Russian President Putin ordered the invasion of Ukraine and shocked the world. The NATO country headed by the United States was sacrificed for strong sanctions within a week."Russia strives to make Putin feel the real" pain ".

The effect of sanctions is immediate. Not only did the Russian currency ruble have fallen over day, the stock exchange transaction was suspended, and domestic banks were squeezed.The Central Bank of Russia raises interest rates sharply and implements other capital control measures to emergency.Sberbank, the largest local bank, announced on Wednesday that it has withdrawn from almost all European markets.

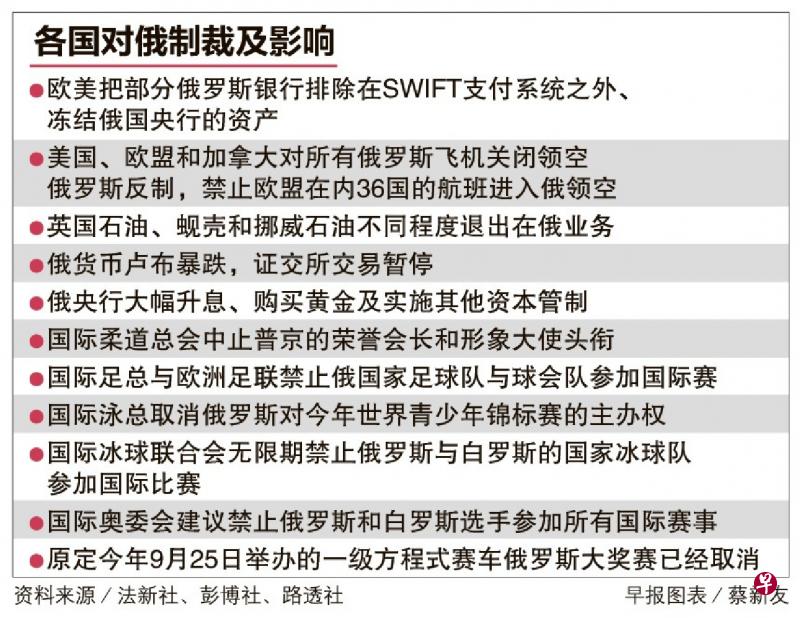

Four days after the Russian army entered the Wudong region on February 24, the United States, Britain, France, and Germany decided to exclude some Russian banks from the Global Bank Financial Telecommunications Association (SWIFT) payment system on Saturday.This is regarded as the "financial nuclear bomb" in the sanctions.

Russia's exporting SWIFT system will cause a major blow to Russia's foreign trade and international settlement, forcing Russia to trade with its own currency or other countries that sign the currency exchange agreement with other countries.It is known that about 300 Russian banks are now members of SWIFT.SWIFT is currently the world's most important international collection and payment telecommunications transmission and exchange processing system. Members cover more than 200 countries and regions around the world. The annual amounts processed by the system are as high as trillions of dollars.

The exports of Russia from oil to food and other commodities are facing serious interruptions.Russia's wealthy class was uneasy. According to the Bloomberg billionaire index, Russia's super rich in the world's richest Russian super rich has shrunk this year, and has lost a total of $ 83 billion (approximately S $ 112.3 billion).Not only that, the European Union announced on Monday that some Russian super -rich people were likely to be the target of being hit next.

A number of European and American multinational companies have also responded to the call of isolated Russia's economy, and has successively announced that it will withdraw from Russia.Russia's largest foreign investment company, British Petroleum Corporation, which has been operating in Russia for 30 years, announced last Sunday that it will leave the shares of Rosneft, which are held in Russia, and other businesses in Russia.The loss of the dollar.

The British Petroleum Corporation announced on Monday that it ended its partnership with the Russian Natural Gas Industry Co., Ltd. (Gazprom).Equinor ASA, the largest energy company in Norway, also began to withdraw about 1.2 billion US dollars in Russia.Other withdrawal of HSBCs and Irish Aircraft Leasing Company Aercap were successively withdrawn.

According to Reuters, the Bayeon government has aimed at the 10 largest financial institutions in Russia, accounting for nearly 80 % of the total bank industry assets.If punishment is increased, Russia's financial injury will be heavier.

Except for Russia's oil and natural gas companies, other minerals, metals and shipping industries may be the targets of US sanctions.

Senior researcher at the Atlantic Council of Washington Think Tank, Outur, said that the United States can impose comprehensive financial sanctions on Russia in the next step, such as issuing a new policy to prohibit Americans from importing and exporting Russian goods, services or technology.He said that the United States can also expand to global to prevent anyone from trading with Russia.He said: "In this way, Russia will become Iran."

Scholars: Sanctions will push high inflation to slow down the global economic epidemic

Zhuang Jiaying, an associate professor of the Department of Political Science, the National University of Singapore, accepted an interview with Lianhe Zaobao. In the short term, these sanctions and international situations are unstable, which will cause energy prices and some mineral prices.Ascend, sea, land and air will be the first.This will push high inflation and slow down the global economy after the crown disease epidemic.

He believes that if the war is maintained in Ukraine, countries around the world should find alternatives in energy, minerals and transportation in energy, minerals and transportation to reduce pressure on the global economy."If the war spreads outside Ukraine, it may lead to long -term instability in Europe and may affect global security. Because there are territorial ambitions or those who are required by other countries, they may take the opportunity to put pressure on other countries and even take armed operations."

As for whether Russia will use nuclear weapons, Zhuang Jiaying believes that Putin should just use nuclear weapons to disburse NATO and the United States and let them stop sanctions on Russia and assistance to Ukraine.

Washington's sanctions on Russia still worry about the final affected the American people

Wu Mu, an associate professor of the School of Public Policy of the National UniversityThe probability is not high.In an interview with the Morning Post, Wu Muyu analyzed that nuclear military powers restricted each other. If Russia broke the existing rules of nuclear deterrence and disturbing international order, there would be the risk of third war out of the outbreak, and the consequences were unimaginable.

However, in terms of energy sanctions, the United States has not been heavy.The outside world believes that Washington still jealous sanctions will further push up the high level of natural gas and energy prices, and ultimately affect the American people.The United States is now positive for the high inflation rate in history.

The former deputy governor of the Central Bank of the United Kingdom, John Geifu, analyzed: "We do not restrict energy exports, because doing so will bring us greater pain, we are unwilling to bear it."

Russia is one of the global oil -producing powers, accounting for about 10 % of global oil supply, and it is also the largest natural gas supply country in Europe.EU statistics show that the amount of natural gas in the EU in 2020 exceeded 40 % of the amount of natural gas from Russia.

Bloomberg economic research believes that Russia's interruption of energy supply to Europe may lead to economic recession in the euro zone, and will reduce the economic growth of the United States.

Morgan Chase chief economist Casman also estimates that continuous cutting off Russian oil exports may quickly increase the price of crude oil to $ 150 per barrel.The inflation rate rose four percentage points.

On the other hand, after the international sports organization invaded Ukraine, the International Sports Organization gradually introduced measures to sanction Russia (see table).The International Judo Federation first announced on the 27th to announce the suspension of Putin's honorary chairman and image ambassador.The Federation of Honorary President Putin was awarded in 2008.