Swedish technology startup Klarna is looking to take on big U.S. tech giants with its own artificial intelligence-powered image recognition tool to help people find products they want to buy.

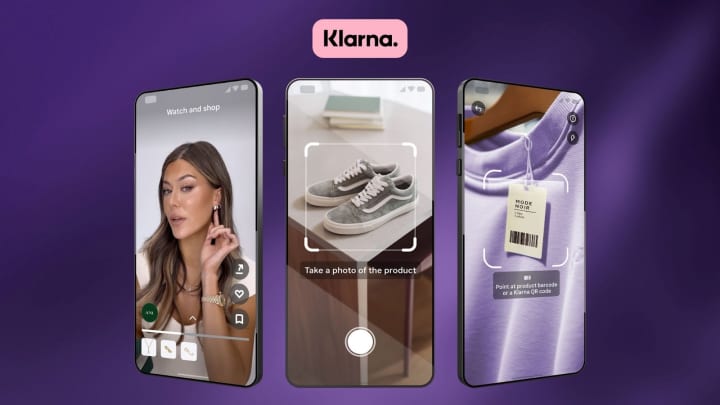

The feature, which Klarna rolled out Wednesday, will enable users to point their phone at an item of clothing or an electronics product and find results for similar items directly within the Klarna app.

It's similar to how Lens directs users to suggestions based on items captured by their camera.

The tool is trained on data from PriceRunner, a price comparison service Klarna acquired for close to $1 billion.

PriceRunner competes with the likes of , Google's shopping comparison service Google Shopping, and French-founded firm Kelkoo.

" We see AI as a huge opportunity for Klarna and the way we are approaching it is to provide everyone at Klarna with the tools and support to use AI in their day-to-day jobs," David Sandstrom, Klarna's chief marketing officer, told CNBC.

"Our unique operating model gives us the agility to take advantage of emerging opportunities that deliver superior consumer benefits, such as AI, faster than sprawling traditional banks and credit card companies."

Sandstrom said the appeal of Klarna's image recognition tech over Google is that Klarna is focusing more specifically on a shopping experience rather than pointing users toward more general search results on the web.

Klarna, which was founded in Stockholm in 2005, exploded in popularity over the Covid-19 pandemic as more and more people turned to online shopping to fill up their wardrobes.

The company's zero-interest credit model proved particularly popular for younger, less affluent consumers lacking the credit history to successfully apply for a credit card.

The company's market value at the peak of the low interest rate-fueled tech stock frenzy.

Since then, Klarna has had a tougher time in the market, with its to $6.7 billion. The company also laid off 10% of its global workforce last year.

This year, Klarna has been looking to AI to help it become a leaner business as it, like plenty of other fintech firms, pushes aggressively toward profitability.

In August, Klarna in the first half of 2023, marking a return to profitability for the firm for the first time since it slipped into the red in 2020.

Klarna says that more than 2,500 of its total 5,000 employees have access to the OpenAI API, which allows them to integrate the -backed company's technology directly into their own tools and services.

Still, regulators, not least the European Union, have become wary about the rapid advancement of generative AI technology, which generates new material in response to human inputs.

Sandstrom urged Europe not to risk falling behind in the global race toward AI.

"I still have my hopes up when it comes to Europe," he told CNBC. "I think we take a lot of inspiration on what is coming out of China. They have their benefits when it comes to progress there."

"A lot is obviously happening in Silicon Valley as well, but there is no rational reason why Europe should be behind."

"I also think the world in general needs to lean into AI and start working with it and see where it can go right and where it can go wrong before passing judgment," Sandstrom added. "Currently, I think it's way too premature."

Klarna has for years offered users the ability to pay for items over installments using a model known as "buy now, pay later." But it has been increasingly trying to build out its offering to include more features specific to shopping.

The company in April this year with new features for personalizing users' feeds to help them find the items they want with more advanced AI recommendation algorithms, inspired in no small part by TikTok's addictive discovery algorithm.

Klarna is also rolling out a few other updates Wednesday. One big one is the expansion of shoppable videos in Europe. It's a feature Klarna first brought out in the U.S.

With it, shoppers in Europe will now be able to view unboxing videos, tutorials, reviews and other clips from Klarna merchants and the firm's own network of content creators.

Klarna is seeking to tap into the growing creator economy, tapping social media influencers with sway over consumer purchasing decisions to make its mark in the e-commerce world.

Klarna also launched its own cashback rewards program, Klarna Cash. Starting with the U.K., but rolling out to other markets in the future, Klarna Cash will allow shoppers to earn up to 10% of their purchase amount back when they pick pay now, pay in three, or pay later at the checkout of retailers with active offers.

Participating retailers will include Farfetch, River Island, The North Face and Hotels.com.