Huang Fan: In the past, the simple and effective method of investing in financial management in China was to buy a house.The above trend is at the turning point of reversal, and investment and financial management is a lifelong practice.

Near the end of the year, it is time to summarize and look forward to investing in wealth management.Looking back, a year ago, the stock market continued to fall, debt frequently breach of contracts, and investors' confidence. At that time, the boldness of the market wrote not to waste a rare bear market article. It is recommended that investors seize the opportunity and actively participate.Now I look back to test. The point of view in the article is indeed reliable. In the first half of 2019, the market did get out of a considerable amount of amplitude.It also confirms that things must be reversed.So, looking forward to 2020 and in the future, what is the main change in the macro background of the market?What is the long -term trend of major domestic investment products?How can investors deal with the goal of wealth preservation and appreciation?

In the past ten years, I personally understand that the domestic macroeconomic goals are mainly to maintain growth.The goal of GDP growth from Eighth, Baoqi, to Hellip; Hellip; .. So, the slowdown of each economic growth will lead to the relaxation of the monetary policy and the decline in interest rate levels. At the same time, the senior management will startStimulation of the real estate market.As a result, the stock market has risen short -term bomb (after a long time to return to its original position), housing prices have reached a new level, and the level of debt levels continuously expands hellip; hellip;

In such a macro background, the simple and effective method of investing in financial management in China is: buying a house, buying a house, and buying a house;In fact, in the past ten years, the stock market has grown slowly, housing prices have risen forever, and the characteristics of financial institutions' wealth management products have continued, and even strengthened their deep beliefs in the minds of many investors.

However, according to things, the market rules must be reversed. Personally, I personally believe that the above trend is at the inflection point of reversal.Why?Because, the macro background has changed:

The National Bureau of Statistics announced in December that the consumer prices of residents in November 2019 rose 4.5%year -on -year, which is far higher than the year -on -year increase of about 4%.The price index has continued to climb to a high level of nearly ten years. In contrast, our one -year deposit interest rate level has been at a low level of 1.5%since October 2015.The state of negative interest rates has been maintained for a long time, and it has continued to expand significantly.

The continuous inflation pressure makes the monetary policy as loose as ever.Since the slowdown of macroeconomic growth and the continuous rise in the price index exist at the same time, and the macro background of monetary policy is difficult to relax, it is expected to repeat the short -term big bull market in the stock market in the future, and then the real estate price is obviously rising again.Obviously very unrealistic.

#8232; From the instructions of the highest leadership room in the early stage, to the statement of the recent capital market to serve the real economy, we should also understand the main line of economic policy in the future.Under such a macroeconomic background and policy offline, I have made the following suggestions on the main parts of domestic investor asset allocation (real estate, fixed income wealth management, domestic stocks and other asset categories):

First, house prices have risen again, and they are not expected.

In fact, it is indisputable for the continuous expansion of house prices in the past ten years, and everyone is worried about the decline in house prices.However, everyone who dares to sing empty house prices is beaten ruthlessly, and the glasses of experts who predict house prices to fall are all over the ground.However, this macro background and high -level attitudes are really different from the past.

As an investment product, domestic real estate has always been with low returns (1%-2%rental rate) plus high leverage (even a lot of down payment is also the characteristics of consumer loans and credit card borrowing). For investors in the property marketThe rate is far lower than the interest rate cost of borrowing loans. If the price does not rise, it cannot be held for a long time. The price will be continuously increased by continuous leverage. Obviously, it cannot continue for a long time.This round of debt deleveraging and backward production capacity were cleared, and in the end it was real estate.Under the macro background of not loose currency, if the property price can get out of the ten -year -on -zero trend like the A -share syndrome index, it is ideal to digest the bubble.

However, it is not a bad thing to not rise in the property market.Although the slowdown of GDP growth is inevitable, the goals that have been advocated for many years can be achieved by excess capacity, economic structure transformation, and debt deleveraging.In addition, it is conducive to guiding the capital to invest in more than the capital industry and invest in technological innovation; if everyone calms down, work with peace of mind and entrepreneurship, the real economy does not worry about the growth rate, and core technology cannot be worried.

Second, fixed income financial management, stable as the foundation

Recently, many friends have reported that various high -yield wealth management invested in the past few years has now encountered a dilemma that cannot be redeemed and asked how to deal with it.How did the author write a few years ago?Waiting for the article can be regarded as a reminder of the front gun.

It is recommended that investors in the future for a long time, and wealth management must not be in order to make investors wealthy, but to allow wealth to realize the principle of premising value premise under security, and accept lower expected returns.At present, the yield of small risks with a small fixed income product is below 5%of the annualization. In addition, it is necessary to choose to deal with formal financial institutions to avoid various types of investment and financial management.

Third, the long bull market of A shares is coming

Over the past ten years, A shares have been short -bears, and they have deviated from the economic face that maintains good growth.The cause, in addition to digesting the bubble of the 2007 super bull market in 2007, is mainly based on IPO control and off -market failure, resulting in the absence of the fittest mechanism, excessive administrative intervention that leads to the distortion of the market resource allocation mechanism, and the hidden rules of rigid payment have caused the rules of rigid payment.The risk -free yield is caused by special factors such as high levels.

Recently, we have seen obvious changes: the entry board of the GEM reduces the IPO threshold; the convenience of the GEM and the science and technology board to improve the re -financing; the New Third Board reduces the threshold of investors and clarifies the rules of the turn of the board;#8232;

We can expect that the regulators will unswervingly promote the substantial registration system and improve the delisting mechanism, and continue to conduct the survival of the fittest: the selected companies are required to come in with the normal IPO, and use the pseudo -shoddy listed company through the delisting company through the delisting company.Exit, such a survival fitness mechanism can also achieve the purpose of improving the profitability of long -term listed companies.At the same time, strict law enforcement, severe punishment of financial fraud and market manipulation, can reduce the price of many virtual high stocks to a certain extent, and the investment value is highlighted.

We also saw that after the regulators restored the comprehensive function of stock index futures, they also approved the pilot to expand the options of the stock index.In fact, the improvement of the market mechanism containing short -term mechanisms is to adhere to the direction of marketization.Moreover, the short -term mechanism that everyone hates is precisely the guarantee of long -term slow bulls.

If there is a comprehensive short-term shortcoming mechanism, it is likely to avoid the huge price bubbles of small and medium-sized innovation, poor performance, concepts, subject matter, and shell resource stocks accumulated from 2013-2015.It should be noted that the stock market is sluggish, which is exactly that we have always paid for this.

The registration system of the science and technology board has been more than half a year. The issue has adhered to normalization, prices and marketization. The phenomenon of long -lost new shares below the issue price has become the norm. This has also been proved that the registration system is indeed not a big deal.It is estimated that the issuance price will fall from the level of the virtual height in the future. In the end, it will realize the market -oriented adjustment of the issuance price to achieve the paidable market and supply and demand balance of the issuance of new shares.

In fact, the normalization of IPO and re -financing provides convenient capital support for the real economy, solving long -term direct financing difficulties, which is conducive to reducing leverage throughout the society. At the same timeIt will stand out due to the effective support of the capital market, making the prospects of scientific and technological innovation worth looking forward to.#8232;

In the short term, the normalization of IPO and retraining, plus strict beatingsThe original clearing source of financial fraud and market manipulation does make the stock market under pressure.I am optimistic that these measures will consolidate the foundation for a long -term slow cow.

When the market is abnormally dull today, please allow me to remind: Personally, I personally think that patience and waiting are compulsory courses for the success of investment and financial management.

Investors have encountered very common problems when they invest in stocks and invest in stock -type funds. Most people pay close attention to the daily performance of the stock market, especially when the market is turbulent.In this way, the market will be low because the market rises when the market rises, so it should be entered when it should not enter and give up when it should not be given up.

In fact, the decline in the stock market will affect the value of investors' existing investment, but if you continue to inject new funds into your investment portfolio, in fact, it will also benefit from the stock market decline, because the next investment product will be cheaper cheaper as cheaper.Purchase stocks.In fact, if investors are now in their twenties or thirties, the value of the existing investment portfolio may not be high than the amount that will invest in the next decades.

In addition, even though the stock market plunge caused investors to lose 20%or 30%of the value of stock investment portfolios, total assets are unlikely to have such a violent decline.After all, there are funds in fixed income investment and bank accounts, and the houses, future social security, belong to their own pensions, and mdash; mdash; maybe the most important mdash; mdash; your own human capital, your own human capital, your ownAll these values are the same as before.

In the end, the most important point is, please remember that the stock is basic value.In the case of market turbulence, stocks seem to be the number on the account report, and these numbers have been shrinking.But behind the decline in the stock price is the real economy enterprise, which produces products and services that people buy every day.In the end, investors will eventually realize the value that is hidden in this, and the stock price of the company with good value will eventually rise to its due level.

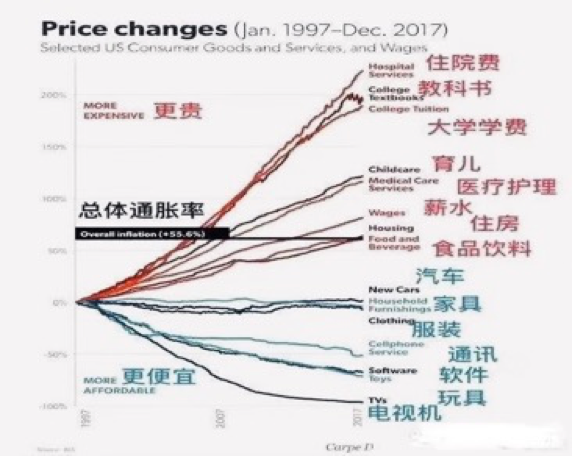

I personally think that the long -term effective strategy is very simple, that is, to invest in a good company, do not speculate in stocks. Investment companies refer to the excellent company in the Chaoyang industry, buy it when the price is reasonable, and then adhere to it for a long time.That is, the three -character scripture selected, waiting, and guarding.As for what industries are the hotbed of birth and cultivating companies?The following pictures about the price changes in different industries in the US market have the reference value of other mountains that can attack jade.

Why can medical and health, parenting teaching, makeup care, alcoholic beverages, etc. become a good industry that is constantly rising?Because these industries can meet the rigid needs of various groups in society: let the elderly prolong life, give children smart, help women, and make men tremble and shake the hero.

The method of value investment is not only proven to be valid for a long time in the past. In the future, this will also allow investors to stand up to the undefeated investment. The principle of value investment is very simple.Long -term plan.If the three -character scriptures that are not easy to choose, wait, and wait for the restrictions of ability, experience, and time, then, for a certain amount of risk investors, regular investment in the CSI 300 and other core indexes also follow the market through long -term sharing through long -term sharing my country's economic growth achievements and effective ways to maintain wealth and increase value.

Investment and financial management is a lifelong career and a lifelong practice.To achieve the long -term success of investment and wealth management, we must take the right path with a calm attitude and persist in endless patience and waiting.

Now that we are now in an era of wealthy wealth overnight, we should choose to be stable, adhere to the right path of investment and financial management, and realize wealth preservation and value, so as to gradually become rich.

Note: This article only represents the author's personal point of view. The author is senior assets and wealth management business executives of foreign banks.Editor of this article Xu Jin [email protected]