Zhou Maohua: During the National Day, the US economic data was strong, the Fed released the eagle signal, and the overseas market was shocked. Will the central bank implement the direction of the RMB exchange rate at this time?

This round of the Central Bank's fourth targeted reduction during the year, but it did not change the stable and neutral policy tone. The RMB exchange rate did not have a large basis for depreciation of a significant trend. The probability of RMB was balanced to a basket of currencies.From the long -term perspective, the pressure of RMB -saving value is mainly due to the stronger and sustainable fundamental fundamentals and sustainability of China's fundamentals. The financial market is continuously open to the outside world. The demand for the allocation of RMB assets will increase significantly.

On October 7th, the People's Bank of China (hereinafter referred to as the central bank) issued an announcement saying that starting from October 15, 2018, it has lowered large -scale commercial banks, joint -stock commercial banks, urban commercial banks, non -county rural commercial banks, foreign bank RMB deposit reservesThe rate is 1 percentage point.The targeted reduction was released about 1.2 trillion yuan, of which 450 billion yuan hedged for the mid -term loan convenience (MLF) expired on October 15, and the actual new funds were about 750 billion yuan.

During the National Day, the US economic data was strong, the Fed released the hawk signal, and the overseas market was shocked. Does the central bank's implementation of targeted reduction at this time of the time constitute a pressure on the RMB exchange rate?

Impact on the RMB exchange rate on the RMB

The author believes that the targeted reduction rate has limited impact on the RMB exchange rate, and the RMB is expected to maintain a smooth operation of a basket of currencies.After the short -term market risk is cleared, the renminbi will return to the fundamentals again.

The directional reduction is basically in line with market expectations.Since the beginning of the year, the central bank has declined three times in January, April, and July, but affected by factors such as shadow banks' atrophy and frequent credit breach of contracts, the domestic monetary and financial environment is still tight.The problem of difficulty in financing of private enterprises and expensive financing are still prominent. The market has a strong expectation of the central bank again. During the National Day, U.S. stock bonds are double -killed, emerging market anxiety is resurrected.Lobricity helps stabilize market expectations.

The tone of stable and neutral monetary policy has not been changed.Judging from the growth rate of M2 and nominal GDP, the domestic currency credit environment is still tight. In August, M2 M2 was 8.2%year -on -year, which was significantly lower than the nominal GDP (GDP+ CPI) 8.7%.From the beginning, due to poor domestic monetary policy, frequent credit bond defaults, difficulty in financing for small and medium -sized enterprises, and expensive financing.

The central bank's targeted reduction helps commercial banks reduce liabilities and enhance loan capacity.From the perspective of quantity, the release of 750 billion yuan in incremental funds in this directional reduction needs to be taxed in October, and the central bank has not released a lot of liquidity.The central bank clearly stated that it will continue to implement a stable and neutral monetary policy without engaging in large water irrigation.

The fundamental toughness is enhanced.In recent months, economic and financial data have not been ideal. For example, from January to August, fixed investment hit a record low. In August, M2 M2 hit a record low year-on-year, the scale of social financing fell year-on-year, and the PMI manufacturing industry was not expected.Show the economic cold.

However, from a structural point of view, the contribution of consumption and services to the economy is increasing. The retail data of social consumer goods has not covered service consumption expenditure and government consumption expenditure.In the interval, the stability of the economy is significantly enhanced.China's economy's dependence on fixed investment and exports has declined significantly.

Domestic financial leverage has declined, shadow banks shrink, real estate bubble risks have basically been curbed, and macro financial risks have been clearly released.The release of market risks such as domestic stocks has been fully released. Whether it is a longitudinal or horizontal comparison, the overall valuation of the Chinese stock market is in a relatively reasonable area. Since the beginning of the year, overseas funds have continued to inflow.

Emerging market anxiety has limited impact.In the past, the overseas market is turbulent, and some emerging market anxiety is re-ignited.Carefulness and orderly opening can better block the impact of emerging market anxiety.

Since April, Turkish and Argentine currencies have suffered heavy declines, but foreign exchange reserves of the two economies have not fallen, showing the important impact of psychological expectations in the financial market.If the RMB market has a cyclical and obviously deviated from fundamentals, the central bank can strengthen market expectation management through counter -cyclical factors and fine -tuning policies.

Internal and external internal and external of the US dollar.Recently, despite the strong economic data of the United States, the Fed's release of the eagle statement, the US debt yields have soared, but the booster of the US dollar is limited. The US dollar index fluctuates around 95-96.High deficit, the European Central Bank's launch of the policy normally, and Trump has repeatedly criticized factors such as strong dollars.

From the perspective of asset allocation of assets in the United States, the US property market is slowing, the stock market valuation is at a historic high, and the Federal Reserve ’s interest rate hike+US debt still has room for adjustment.The Federal Reserve ’s interest rate hike cycle is difficult to reproduce global large -scale capital return in the short term, and the author's analysis found that in recent years, the explanation of the Sino -US spread on the RMB exchange rate has weakened, especially the short -term exchange rate fluctuation.

On the whole, the targeted reduction did not change the central bank's steady neutral policy orientation. With the expected guidance of the central bank, the market was largely avoided to a large extent.At the same time, domestic economic toughness, decreased financial risks, and strong US dollars have become important factor in the stability of the RMB exchange rate. The RMB is expected to maintain stability on a basket of currencies.

Mid -term and long -term RMB deposit value pressure

In the middle and long term, with the continuous advancement of supply -side reforms, China's economic efficiency has improved, supply and demand structure tends to be balanced, economic toughness and sustainability are enhanced, and economic efficiency has improved; China's financial market depth and breadth are enhanced, the internationalization of RMB internationalization and the opening of the financial market is all all.It will enhance the appeal of RMB assets.

Generally speaking, the currency exchange rate of one country in the middle and long term will eventually return to the fundamental aspect. The sustainable and efficiency of economic development will affect the stability of the currency.

With the continuous advancement of supply -side reforms, the Chinese economy is facing a more sustainable, more efficient, more balanced supply and demand, and a more global economic model of the financial industry.The motivation for China's economy is mainly due to the people's pursuit of a better life and supply -side reform.There are such impacts and difficulties in the short term, but this trend is still formed and achieved staged results.

With reference to the relevant theories such as industrial social evolution and the level of human needs, China has basically entered the middle and back of industrialized society. The upgrading of people's consumption will provide a strong motivation for the transformation and upgrading of the economic structure.

China has met food and clothing, consumers have grown rapidly for services, health, entertainment and leisure, etc. The domestic supply -side reform is in line with the laws of domestic economic development., Make up the shortcomings of the system and law, give play to the decisive role of the market in the allocation of resource allocation, continuously improve economic efficiency, release the vitality of the micro -subject's innovation to meet the people's pursuit of a better life.With the gradual shift of China's economic engine to consumption and service -driven, the economy will be more sustainable and efficient.

From the middle and long term, China's economic efficiency and influence have improved, the globalization of RMB and financial markets has continued to advance, and the attraction of RMB assets will continue to increase.It is foreseeable that as domestic supply -side reforms are solidly advanced, the domestic economic toughness and efficiency have been further strengthened, the Chinese economy has continued to rise globally, the depth and breadth of the financial market have continued to increase, and the international demand growth in RMB is growing rapidly.

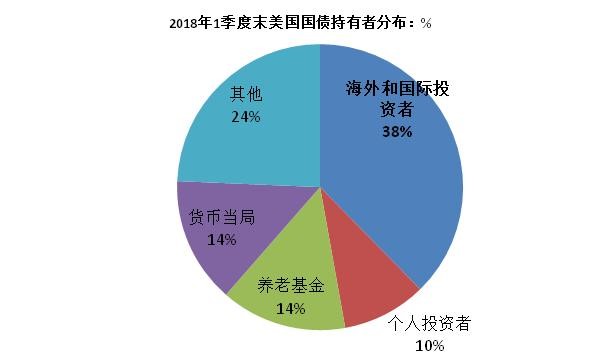

Data show that the proportion of U.S. overseas investors in 2017 isNear 8%, and holding only about 2.0%of Chinese government bonds, Chinese assets have large overseas space.According to statistics from the Global Bank Financial Telecom Association, in July 2018, Swift RMB global transactions rose to 2.04%, and RMB ranked fifth in global payment currency.

Figure: The distribution of U.S. Treasury holders in the first quarter of 2018

Data source: Wind Information, Everbright Bank Financial Marketing Department.

In recent years, China's financial reform and opening up have been accelerated. The continuous maturity of domestic financial markets and the transformation and upgrading of domestic economic transformation has bred a huge market and investment opportunities. With the further integration of China's and global financial markets, the demand for the allocation of RMB assets will rise rapidly quicklyEssenceThe RMB exchange rate will follow the pressure of a certain appreciation.

Generally speaking, trade disputes have a more indirect impact on the exchange rate of the RMB, mainly because of deteriorating fundamentals and capital markets, thereby impacting the demand for RMB and its assets; and trade disputes may also impact some fragile emerging economies, which will cause butterfly effects.

The author believes that the impact of trade disputes on the RMB mainly depends on whether the macro risks in the country are reduced, the high competitiveness and value of corporate corporate, whether micro -subject innovation is active, and whether the economy is more sustainable.Judging from the trend of China's economic dynamic energy transformation and supply -side reforms, the impact of domestic economic disputes in the medium and long -term domestic economy has gradually decreased, and the globalization trend of RMB assets will also be irreversible.

(The author is a macro analyst at the Financial Market Department of China Everbright Bank. This article only represents the author's point of view. Editor -in -chief email: [email protected])