Sheng Hong: There is evidence that with the increase of tax burden, the asset yield of enterprises has declined year by year, and the increasing increase in tax burden on the corporate has squeezed out the profit space of the enterprise.

To put it simply, the reason for the Chinese miracle is the market -oriented low tax burden.We have understood the principle of marketization. It can inspire our work and greatly improve resource allocation.The price system that guides the allocation of resources is also formed in each other of thousands of people.In the long run, the market system can also promote technological innovation and professionalism, and then it can also promote the change of the system.

So what does low tax burden mean?The tax burden corresponds to public services.Public services that include protection of property rights, maintaining order, and righteous ruling require resource support, so the tax burden is the price of public services.Because the production of any product is inseparable from the conditions for public services, the tax burden is the necessary cost in any product.When the tax burden mdash; MDASH; when the cost of public services is low, the compensation of other production factors is relatively high, and the owners of the factors have greater power to produce and invest in production and investment.

If the tax rate is only determined by the department providing the public service, it will not be low.Because public services have a natural monopoly nature, the government administrative department will set a monopoly high price and can also be enforced.So, how is the low tax burden determined?Theoretically, in a social rule of law, the tax rate is determined by the wishes of the people.The specific form is the representative of the public, representing the tax rate.However, at the beginning of China's reform and opening up, it did not have such institutional conditions. How could a low tax burden formed?

This is because the reference at the beginning of reform and opening up is the planned economy, with extremely low efficiency. Not only the people are poor, but government officials are not rich.

It is said that Wang Zhen, the vice president of the country at the time, visited the UK and found that the wages of the British cleaners were six times that of their own.Therefore, when the effect of the market economy first appeared, the government departments stipulated their own income with revenue in accordance with the planned economy. Although it has changed greatly compared to before, it is still at a level of low tax rate.

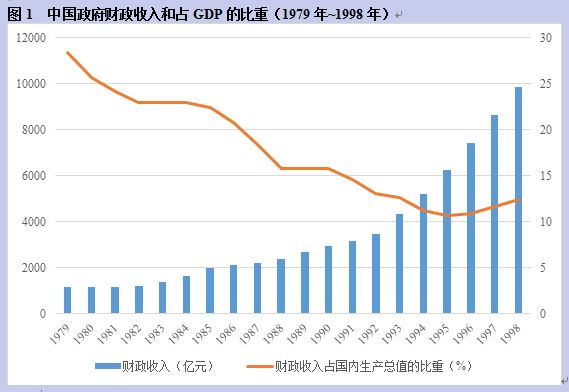

This is confirmed by the statistical figures.From 1978 to 1995, fiscal revenue increased significantly year by year, but the tax rate (fiscal revenue/GDP) fell year by year until 1995 as low as 10.5%.This is of course the concept of tax rates, but it is enough to reflect the decline in tax rates.It is such a low tax rate that cooperate with market -oriented reform that it has created a Chinese miracle.

However, with the advancement of market -oriented reforms, the market economy has rejuvenated higher and higher efficiency, and huge wealth is surging.The reference department of government departments has gradually changed from a planned economy to the market economy itself.At this time, the tax rate is still led by the government administrative department, and there is still no institutional constraint.Even if the government administrative department is not intentional, it is also driven by the nature of the economy to gradually increase the macro tax rate.

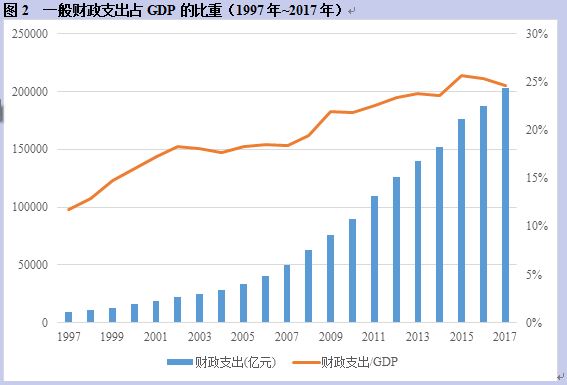

This includes tax -based general fiscal budget revenue, government fund income based on land finance, the opportunity income of resources and assets occupied by state -owned enterprises, and medical pension insurance.From 1997 to 2017, general fiscal expenditure increased from 11.7%of GDP to 24.6%, an increase of 12.9 percentage points.

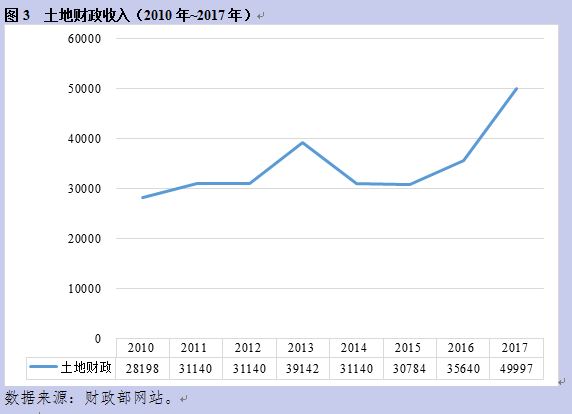

Since 2000, with the Chinese economy and the commercialization of residential, the price of land has risen significantly, and the government administrative department has also opened up the interests of the government, that is, the stage of land finance.China has no effective institutional constraints on this part of the division of national wealth.As a result, the amount of land finances is also increasing, from 2.8 trillion in 2010 to 5 trillion in 2017.

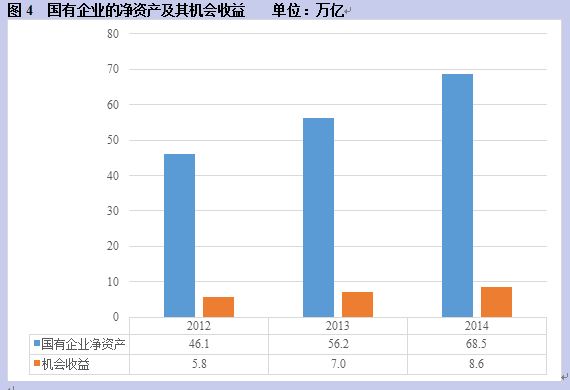

According to Li Yang's research, the net assets of state -owned enterprises have also increased significantly year by year. From 46 trillion in 2012 to 69 trillion in 2014 (China National Assets Liabilities 2015, China Social Science Press, 2015, 43rdPage).

According to a reasonable profit margin, that is, risk -free interest rate plus a reasonable risk premium (Liao Li and Wang Yihui, research on risk premium research in China's stock market, financial research, 2003, No. 4), about 6.15%plus 6.38%equal to 12.53%estimation, The opportunity of such a huge net assets should have trillion yuan.See below.This is also part of the macro tax rate.

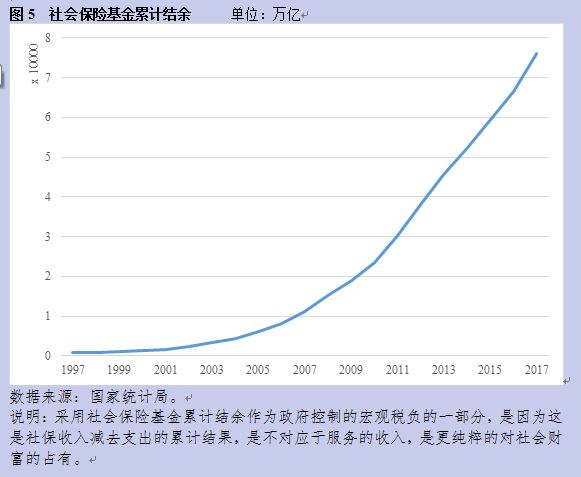

As for the cumulative balance of social insurance funds, since 1997, it has soared, from 83.2 billion to 7.6 trillion in 2017, which is higher than one year's social insurance income.This is a part that has social resources and increasing the burden on enterprises and individuals, but it does not play a role.

I estimated last year that the macro tax rate in 2013 was as high as 45.6%.Now, according to the data of 2017 (data from the state -owned enterprise in 2014), the general fiscal budget expenditure was 20333 billion yuan, the government fund expenditure was 6070 billion yuan, the opportunity income of state -owned enterprises was 8.6 trillion, and the total balance of social insurance funds was 7.6 trillion yuan.About 42603 billion, accounting for 51.5%of the GDP.Based on 2013, weighing.

We already know that the tax burden is the price of public services, and it must enter the cost of each enterprise and citizen.A product or service is contributed by a variety of elements, most of which are competitive, so the relative price can stabilize at a set level and even decline;

However, some elements with monopoly nature will increase the price to the height of the monopoly price; the price of public services is mandatory monopoly prices, not only need to pay, but also cannot be paid.While the relative price of public services (that is, the proportion of GDP) increases more than a dozen percentage points, the profit margin of enterprises or individuals is reduced by more than ten percentage points.At a moment, their profit margin was squeezed.

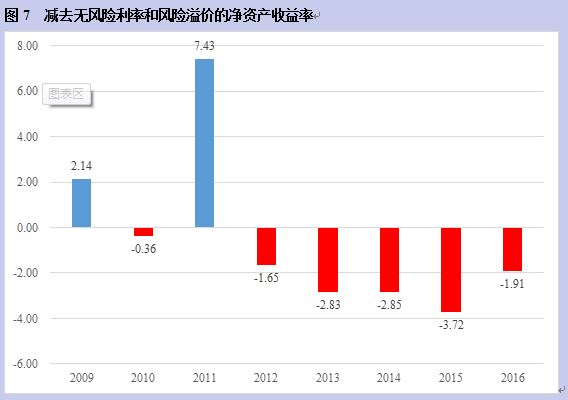

Evidence has shown that with the increase of tax burden, the asset yield of enterprises has decreased year by year.The data given by the tax burden report given by Chinese private enterprises in 2017 in 2017 by the tax burden investigation team of China show that corresponding to the increase in tax burden year by year, the total asset remuneration rate of listed companies in manufacturing companies decreased from 10.68%in 2009 to 20167.12%(2018).See the table below.

Assuming that the asset -liability ratio is 38%(Wang Xian and Wang Kai, analysis of the current status of capital structure, science and technology and economy market, and No. 8 of 2017), the yield of net assets is estimated to minus the business prescribed by the central bankThe one -year loan interest rate of banks can be judged by minusing a reasonable risk premium in the Chinese stock market.

We have seen that since 2012, the net asset yield of the manufacturing industry has reduced risk -free interest rates and reasonable risk premiums.The meaning is that the capital of these enterprises can no longer obtain average market return from the operation of the enterprise, and it is better to conduct a one -year loan business at the interest rate level of commercial banks.This indicatesIn recent years, the increasing increase in tax burdens that have not been restricted have squeezed out the profit margin of the enterprise.

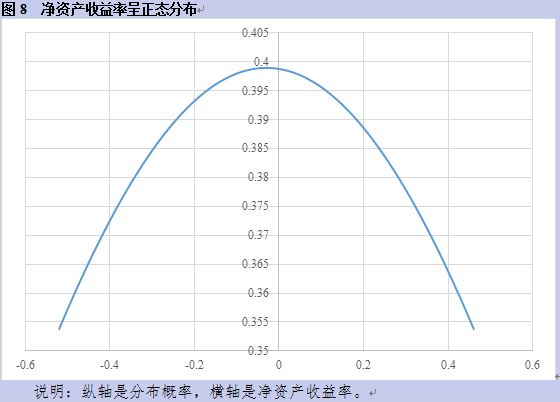

It should be noted that this is just average.If the net asset yield of the enterprise is distributed properly, if the company's net asset yield is reduced, the risk -free interest rate and a reasonable risk premium are zero, the capital income of about half of the enterprise is lower than the reasonable level of the market.With the average value of -2.6%from 2012 to 2016, the proportion of such enterprises will increase significantly.This is because if the net asset yield of the enterprise is distributed normally, most of them are concentrated near the average.

If the average value moves to the negative aspect, even if it is small, it means that the capital of more than half of the corporate capital will be paid.As shown below.

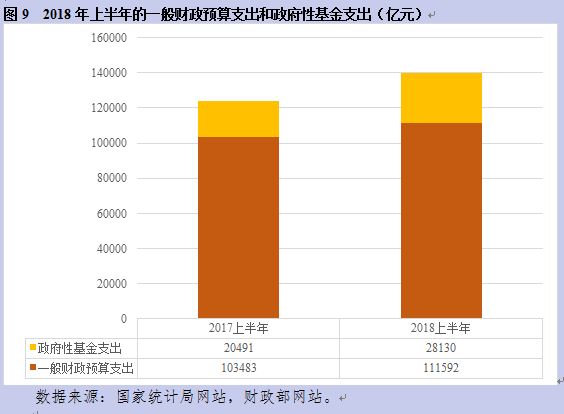

If more than half of the company's capital is in a state of loser, they will stop production, let alone invest.This will lead to recession.The problem is that this is not the worst situation.To make matters worse, such a trend not only did not stop signs, but accelerated.According to the National Bureau of Statistics, the general fiscal budget expenditure in the first half of this year increased by 7.8%, while GDP only increased by 6.8%.According to the Ministry of Finance, the budget expenditure of government funds in the first half of this year was 2813 billion yuan, an increase of 37.3%year -on -year.The two increased by 10.5%year -on -year.

There is also a tax reform plan. While improving the starting point of personal income tax, the collection of social insurance is transferred from the Ministry of Human Resources and Social Security to the State Administration of Taxation, which has led to two important changes.First, the basis for the withdrawal of the amount of social insurance is not the original basic salary, but the entire income. Second, the State Administration of Taxation is mandatory. Enterprises or individuals who were unwilling to join social security had to pay social security premiums.

This will further increase the macro tax rate.The most important thing is that social insurance should not be a compulsory tax burden, but there should be room for corporate and citizens to choose voluntarily.

Many small and medium -sized private enterprises have a way to deal with economic fluctuations is to flexibly hire workers, and they do not pay social premiums (not workers). They can only spend safely during depression.Therefore, this change is not only a positive reform, but an institutional backward.

It should now be a cliff, and it is time to brake immediately.What is even more terrible is that we do not have such a mechanism.If you want to brake, you must first know that the danger has been known, and the vehicle has passed the dangerous boundary.If the windshield in front of the car is not transparent and colorless, it can truly observe the road conditions ahead, but instead filter out the danger. If you can only see the safety and beautiful scenery, it is impossible to find the reason for the brake.

That is to say, for the economic situation, if there is no all -round transparent information expression mechanism, and no discussion and confrontation with different views, it is impossible to have a correct judgment of the situation.Regarding the issue of macro tax rates, the economic theory and corporate circles have long been warned.

At the end of 2016, one of our research reports proposed the problem of too high macro tax rates, and proposed a warning of the death rate, and was immediately suppressed. Some people directly asked the person in charge of the subject to shut up.Articles about tax cuts are often deleted online.The profit margin was exhausted, only because of the room for opinions.

In fact, any report is not necessarily correct. The key is that a healthy society must ensure that everyone expresses freedom.Especially in terms of macro policies, there must be an opinion ecology that can ensure all kinds of voices.This is the transparent windshield of society.

With the real information about road conditions, if there is no sensitive brake system, the car photos cannot be stopped.The braking system of fiscal expenditure is a constraint mechanism for fiscal expenditure.However, in China, this is just a conceptual brake system.In terms of text, the revenue and expenditure of governments at all levels in China must be approved and supervised by the people's congress at the same level, but history has proven that this brake system is failed.

Generally, the annual fiscal revenue final accounts generally exceed the budget, and the expenditure generally exceeds the income. The expenditure final account will definitely exceed the income budget.The following table is the situation in the past 10 years.

This means that although the National People's Congress approves the budget of fiscal revenue on the surface, it is unable to correct the results that exceeds this budget, and can only recognize the final accounts; it is impossible to restrict the situation of the expenditure exceeding income, and can only recognize expenditure final accounts.So this is a failed brake system.

However, this cars that cannot be brake have sufficient motivation, which is the impulse of the interests of taxpayers.We asked some officials' views on taxation many years ago. They believe that taxation is used to spend them. If it is not finished, it will be assaulting the flower, and the tax burden is not considered to provide public services.Keep it to the people and society.

This view has not changed now, because this group has neither Erhulu, the traditional concept of the people, and the concept of the taxpayer.

They also have a habit of view, that is, the macro tax rates have been raised by them in recent years, but it seems that there is no consequences of economists predicted. They even questioned that if there is a death rate, why has China's high -speed growth in recent years?This is obviously the cause of the inverted fruit.The economic miracle that has appeared in China so far is the result of the original lower tax rate.

The tax rate has not maintained at the original level in these years, but has continued to improve, and there is still a certain profit space for a period of time, but this space will definitely disappear with the increase in macro tax rates.

I believe that macro decision makers know the truth explained by the Lava curve, knowing that tax cuts will eventually bring tax increases; more the opposite result will be that if the tax rate is too high will lead to economic recession, taxation will decrease.However, under the existing political structure, if they want to reduce taxes, they have to encounter huge obstacles. First of all, in the process of the rapid rise in fiscal expenditure of taxpayers, the interest group not only formed the rigidity of interests, but also formed.The rigidity of interests, that is, they are used to growing income every year.

They must stubbornly fight any attempts to stop government share.

What's more, once the economy slows down or declines due to the overweight tax burden, the first thing they think of is that their own income cannot be reduced, and the income of others is soft.This signs have appeared.The tax bureaus of many places have levied taxes in advance. Even in Beijing, some local tax bureaus levied the annual tax of the year at the beginning of the year.

Furthermore, the result of increasing tax reduction is that in the overall scope of society and the government, it will take a long time to achieve it.Unwilling to endure the current suspension of tax increase or tax reduction for a long time;

On the other hand, they are partial. They are unwilling to restrict the expansion of local interests for the overall interests, and think that they have unrelated the overall situation.From the perspective of the entire government structure, there is no effective punishment for increasing taxation, which cannot change their behavior.

So, is it not solved?no.If the macro decision maker recognizes that the problem is serious, urgent, painfulDetermined to prevent the occurrence of evil results, there is still a way to make the thunderbolt.The brakes are broken, and you can also brake.This includes two aspects.First, in the short term, in the moment, it is emergency; the first is that in the long run, we must reform the system structure and truly establish a mechanism to restrict fiscal expenditure.

The so -called emergency, first, is to use the effective means of current government administrative departments to restrict the administrative person in charge of governments at all levels.Speed, free of charge.

This method has been adopted in many occasions, such as adopted during the SARS period, and very effective; second, at the national level, the State Council can directly review the various taxes and fees that have not been agreed by the legislature and abolish them; third third; third; thirdAt the level of legislation, direct tax cuts are required, including reducing tax types and reducing tax rates. For example, the corporate income tax rate is reduced by more than 5 percentage points and the value -added tax rate is reduced by more than 3 percentage points.

In the long run, it is to establish the transparent windshield and sensitive brake device of society.This means that it is necessary to truly implement Article 35 of the Constitution to ensure the freedom of the people; to build the legislative and supervision agencies of the People's Congress into a strong institution that effectively constrains the expansion of the financial expenditure of the administrative department, which means simplifying administration.Of course, the so -called long -term does not mean to do it later, but start from now.

For example, expressing freedom.See the road in front of the car to avoid falling into the cliff.If not, for example, this article cannot be issued, or it is disappeared, and the future may be fierce.

(Note: This article only represents the author's personal point of view. Responsible for the mailbox [email protected])