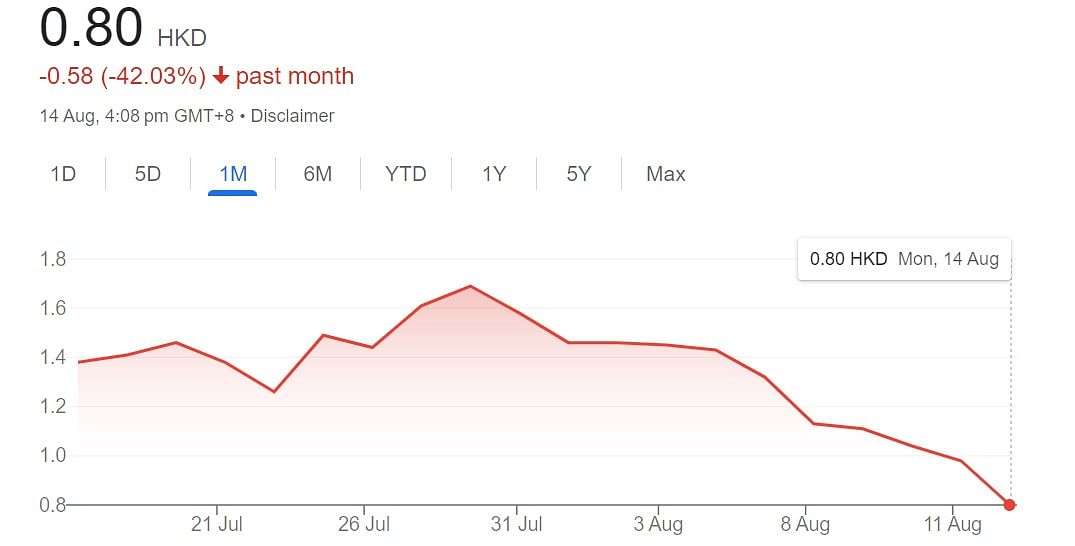

China Real Estate Giant Country Garden is getting deeper and deeper in the financial crisis.On Monday (August 14), the market in the Hong Kong stock market fell more than 16%to HK $ 0.82 (about S $ 0.14), a record low.

Since the failure to pay two US dollars bond tickets on August 7, Country Garden crisis has emerged rapidly.The company admits that it has encountered difficulties in staged liquidity and said that due to sales and other reasons, it is expected to have a loss of up to 55 billion yuan (RMB, the same below, about S $ 10.3 billion) in the first half of the year.

Subsequently, the company, which sold the first in China for six consecutive years, issued an apology letter on Friday (August 11), saying that it faced the biggest difficulty since its establishment. Although it has been rescued by themselves, its operating pressure has continued.That night, the company announced that 11 bonds involved in over 16 billion yuan were suspended on Monday, seeking reorganization and further exacerbating market concerns.

Analysts believe that with the current situation of Country Garden and the weakness of China's economic recovery today, if the financial crisis cannot be lifted, the shock to the Chinese economy will exceed the previous Evergrande.

The crisis emerges

The market is not expected that Country Garden will be in crisis.In 2021, the Chinese government restricted the financing scale of housing enterprises. Evergrande, Sunac and other real estate companies were in a debt crisis, but Country Garden persisted as a "three good students".The 100 billion -level private housing companies that have been the first for the sales list for six consecutive years have been strictly reducing the scale of sales assets and operating business leverage, and Longhu and Midea Real Estate have been listed as "demonstration real estate companies".

But it cannot be denied that despite the government's requirements, Country Garden, like other real estate companies, has been undergoing liquidity pressure since 2021.The decline in house sales since this year further dragged down its cash flow.According to Kerry data, in July, the sales of the Top 100 real estate companies in China decreased by 33%year -on -year, and the sales sales of Country Garden in July decreased by 60%year -on -year.

On the other hand, since China ’s regulatory tightening of housing and enterprise financing policies, the issuance of US dollar bonds has become one of the few financing methods for housing companies.However, since last year, due to the surge in U.S. debt interest rates and the outbreak of China's real estate credit risk, the US dollar debt financing volume of Chinese housing companies has decreased by 90 % year -on -year, exacerbating the liquidity of housing companies.

chain reaction

The crisis of Country Garden affects not only the company's employees, suppliers, buyers, and creditors, but also bring a chain response to the Chinese real estate industry and financial system.

First of all, the closest employees and partners from Country Garden.Country Garden has 33,207 cooperative suppliers and 70,000 employees. If Country Garden falls, more than 30,000 companies will be affected, and more than 70,000 people will face unemployment crisis.

Followed by ordinary home buyers.According to Caixin.com, without considering debt, if Country Garden will complete the "insurance delivery building" of each project this year, the average monthly sales will be at least 22 billion yuan.The sales of only January to April this year meet this number.In July, Country Garden's sales amount was only 12.1 billion yuan.

According to the statistics of the First Financial Economics, Country Garden's current unpacking houses are about 900,000 units.If Country Garden cannot operate normally, it means that the assets of more than 900,000 owners' families will be affected.At the same time, because Country Garden's projects are mostly in third- and fourth -tier cities, the main impacts are the third and fourth -tier cities families with less income and more real estate.

Creditors are also facing huge risks.According to Bloomberg, Country Garden as of the end of last year, the cumulative debt was 1.4 trillion yuan.Such a high debt will affect a large number of funds and banks once a default.11 bonds involving 16 billion yuan in Country Garden's territory began to suspend trading from Monday (August 14), and this is usually the company's approach to extend the repayment period.

In the open market, Country Garden should pay $ 225 billion in interest on August 7. If it still cannot be paid in September, it will be considered a formal breach of contract.However, the prospect is not very optimistic. Reuters reported that September coincided with another debt repayment peak of Country Garden -the month of the Country Garden may need to repay the shore bonds with more than 9 billion yuan.

Zhang Dawei, chief analyst of Central Plains Real Estate, analyzed the Radio of Hong Kong that the chances of debt defaults in Country Garden were high, and thunder was only a matter of time.

Drag the economy

Moody's rating of Country Garden's rating twice within one month pointed out in a report that Country Garden's credit dilemma is likely to spread to China's real estate and financial markets, resulting in a higher cost of financing in housing enterprises, or even more even more.Multi -cash crisis of housing companies.

In fact, the current performance of Country Garden has affected the market's confidence in Chinese housing companies.On Monday, Country Garden's stock price plummeted, dragging down the real estate index of Hang Seng China, a real estate index fell 4.6%.The rest of the Chinese real estate stocks listed in Hong Kong also fell sharply. Among them, R & F Real Estate and China Jinmao fell more than 8%, and Jiazhaoye Group fell more than 6%.

Yan Yuejin, research director of the Shanghai Yiju Research Institute, China, said: "The current market can no longer bear the danger of a trillion -level head housing company." He pointedReal Estate companies, because Country Garden's problem is not limited to a company in Country Garden.

Reuters reports that Country Garden's dilemma will have a chilling effect on buyers and financial institutions. If financial support cannot be fulfilled quickly, more private real estate companies will be close to the critical point.

In addition to impacting the investment market, the Wall Street Journal pointed out that potential buyers will continue to wait and see, which will delay the recovery of the real estate market and delay the recovery of the Chinese economy.

With the surrounding industries, the real estate industry accounts for about one -fifth of China's GDP, which is an important support for the Chinese economy.Jonathan Garner, a strategic analyst of Morgan Stanley, pointed out the analysis of Nikkei that although the Chinese government wants to reduce the dependence of economy on real estate, it is difficult for China to have the economic development model of land finance and real estate for many years.Change.

Who will pay for it?

There are various signs that Country Garden has come to a critical moment and calls for more and more voices to rescue the market.Chinese economist Ren Zeping called on Friday (August 11) to help Country Garden not only big but not to fall, but to keep the needs of financial risks and people's livelihood.

However, compared to economists, many netizens believe that these real estate companies should be destroyed by themselves, saying that they want to save them, and they should not give them friends.Essence

When the Country Garden crisis was fermented in the public opinion field, the most controversial was a donation of Country Garden in the case of cash tense.Country Garden disclosed that the chairman of the board of directors Yang Huiyan donated a shares worth HK $ 6.4 billion on July 30 to the main body of Hong Kong, the Guoqiang Public Welfare Foundation, for charity purposes.Netizens checked and found that the fund was registered in Hong Kong on June 13 this year, and the founding member was Yang Huiying's sister Yang Ziying.Netizens commented: "This is the capital's left hand pouring and right -handed", "It is recommended to recover all the money."

So some people also proposed that Country Garden should follow the practice of Evergrande's founder Xu Jiayin.

But the injection of funds, both from the government and the enterprise, are just short -term solutions.To resume development for a long time, it is still necessary to restore market confidence, which still requires government participation.

As the well -known media person Qin Shuo said, the problem of really solving the problem of a attractive company can more boost the confidence of the industry than sending a lot of documents.However, how to help, which step is related to people's livelihood, public opinion, and also related to the future fate of the Chinese economy in the second half of the year.