Hong Kong has established the third generation of Internet this week this week this week this week, the third generation of the Internet was established this week this week.(Web3.0) Association, promoting the development of the virtual asset market, compared with mainland China in the ban on virtual currency.

Hong Kong Chief Executive Li Jiachao said at the establishment ceremony of the association on Tuesday (April 11) that Hong Kong should dare to become the leader of this wave of Internet innovation and make Hong Kong the best foothold for virtual asset companies,Attract global talents and enterprises to go to Hong Kong to show their fists to accelerate the development of innovation and financial development.

This association is the president of the Hong Kong HKMA, Chen Delin, as the chairman. Members include multiple industry leaders and legislators, with high specifications.According to the official website of the association, the association responded to the establishment of the State and the Hong Kong Special Administrative Region Government. It is committed to promoting technological changes and industrial upgrading, cooperating with the government to implement relevant policies, and in order to build Hong Kong as the world's leading Web 3.0 smart city and safe and sustainable digital financeThe center contributes.

In addition, the Hong Kong Government also promised to allocate the development of the Web 3.0 ecosystem in the fiscal budget of 2023 to 2024 to promote the development of the Web 3.0 ecosystem.

It can be seen that Hong Kong has great ambitions for soliciting virtual asset companies and becoming a world -class digital financial center.However, on the premise of the core product of Web3.0 blockchain technology -cryptocurrency — is the supervision of the supervision of the web3.0 blockchain technology, can Hong Kong really do so?

One country, two systems, one blockage?

Although it is not the whole of digital finance, as an important part of virtual currency, it has always been the focus of related topics discussions.The virtual currency in the broad sense is a digital expression of value. It can refer to all kinds of currency without physical currency, including various types of online platforms, and digital currencies issued by the officials of various countries.

Cryptocurrencies represented by "Bitcoin" refer to virtual currencies based on blockchain technology and complete decentralization.Its biggest feature is that it is not issued by any centralized agency, and theoretically, it will not be affected by the interference and control of government departments.

Due to its difficulty tracking characteristics, cryptocurrencies can be used in illegal criminal activities such as illegal fundraising, fraud, MLM, and money laundering."Differential" disturbing economic and financial order ".

In view of this, Beijing has always been concerned and jealous of this technology.In 2013, in 2013, the central bank of China issued a notice on preventing Bitcoin risks. It is clear that Bitcoin does not have the legal status as the currency, and it should not be used as currency in the market.However, Bitcoin at that time was considered "virtual commodity", which could be used as assets for collection and transactions.

In 2017, Bitcoin ushered in a fire globally. The relevant Chinese departments also issued an announcement on preventing token issuance of financing risks, which were issued by tokens.The trading platform adopted a tough combat attitude.By 2021, China further targeted virtual currency transactions. The top ten regulatory authorities such as the People's Bank of China jointly issued a notice in September to qualify all virtual currency -related business activities into illegal activities.According to the notice, the overseas virtual currency exchanges provide services to residents in China through the Internet and are also regarded as illegal financial activities.

In short, Beijing's "one -size -fits -all" in 2021 banned the virtual currency transactions in the mainland market. Many virtual currency exchanges and mining companies also withdrew from China during this period.

However, according to the statistics of the blockchain research organization Chainalysis, from July 2021 to July 2022, mainland China is still the fourth largest cryptocurrency trading market in the world.Even under the prohibition of officials, many investors will still trade on overseas platforms through virtual special networks (VPN) and other means.

Although Hong Kong is not as banned from virtual currencies as the mainland, it was originally allowed to only allow professional investors to conduct cryptocurrency transactions under supervision.However, since the end of last year, this special administrative division seems to have begun to "sing against Beijing" and release the signal of more friendly policies for cryptocurrencies.

During the Hong Kong Fintech Week held at the end of October last year, the Hong Kong Government released a policy declaration on the development of virtual assets in Hong Kong and showed the Hong Kong government to the global industry to promote the development of Hong Kong.The vision of the center and the news that it will legalize cryptocurrency retail transactions.

In February this year, the Hong Kong Securities Regulatory Commission took a consultation on the suggestions of the regulatory virtual asset trading platform, and will implement a new virtual asset trading platform to issue a licensing system from June, requiring all those who operate in Hong Kong to operate business in Hong Kong.The trading platform obtains a license and clarifies that retail customers can use trading services provided by operators provided by the licensed virtual asset trading platform operator on the premise of passing appropriate assessment.

In simple terms, although there are certain regulatory restrictions, for trading platforms that can obtain the corresponding licenses, especially the relatively niche cryptocurrency platform, this means that they can develop more differently in Hong Kong for more differences in more differences in Hong Kong.Customers 'trading activities can also be guaranteed by retail investors' transactions.

Hong Kong's ambitions and Beijing's support

Hong Kong's gradual shift to the friendly policy of cryptocurrency friendship, in addition to revealing the ambitions who want to further consolidate their international financial center status, have also made many companies that make many companiesSeeing Beijing's willingness to "pilot" in Hong Kong to relax control.After all, although there is a framework of "one country, two systems", it is impossible for Hong Kong to do a good job with Beijing.

Bloomberg quoted the news that anonymous insiders broke the news in February this year that in the few months of promoting the friendly policy of cryptocurrencies in Hong Kong, the Hong Kong Sino -China Office (the Central People's Government in Hong Kong specially specially in Hong Kong specially specializes in specializing in Hong Kong.Representatives and some other mainland officials of the Administrative Region Liaison Office have always been regulars of local cryptocurrency activities.

People familiar with the matter said that the officials who went to the conference would exchange business cards and WeChat with the participants.They believe that this contact is very friendly, and officials are actually "chasing the degree" and provided reports to Beijing officials.

The Hong Kong cryptocurrency companies interviewed at the time believed that although it was only silently supported, such a statement still represented that Beijing intends to use Hong Kong as an experimental market for cryptocurrencies to release a good signal.

One is JiaThe legal community who provides consultations with secret assets also pointed out that Beijing's default support attitude means that as long as it does not violate the bottom line and does not threaten financial stability, Hong Kong can freely explore and pursue the Asian encrypted financial center under the "one country, two systems".

Is the company returning?

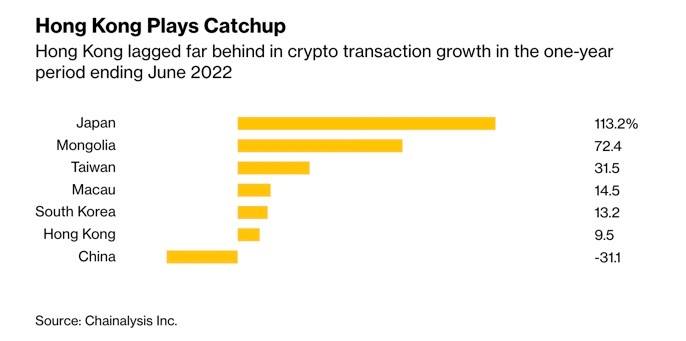

However, Beijing's support for Hong Kong seems to have come a little late.Many cryptocurrency companies and investors initially believed that Hong Kong would follow up the ban on Beijing, so they chose to turn to other regions for development.This also led to the growth of virtual currency transactions from June 2021 to June 2022, far lower than that of Japan, Taiwan, and even other economies of the same region.

Hong Kong undoubtedly wants to recall these evacuated virtual currency companies and recruit some new customers.For enterprises, the potential of China's huge market also allows them to try to settle in Hong Kong with the support of existing policies.

Comprehensive reports from the British Financial Times and Reuters recently, at least a dozen cryptocurrency companies created by the Chinese and have developed in the Chinese market have submitted a license application to the Hong Kong regulatory authorities.For these companies, Hong Kong is the most suitable base for preparing for the Chinese mainland market again.

According to reports, companies planned to establish or expand their business in Hong Kong include BTSE, KUCOIN, Gate.io, OKX, ByBit, Huobi (former "Huobi, Original" Firecoin "), etc.;Binance (Binance), France after 2021, also began to recruit Chinese positions in Hong Kong.

Fire Consultant Sun Yuchen said in an interview with Bloomberg in February that fire must choose to expand the business in Hong Kong.Monetary ban.

Sun Yuchen also said in a event in Hong Kong on Tuesday that the activities related to cryptocurrency -related activities on "China Land" made him incredible.He also said that he hopes that one day, similar activities can be held in Shanghai and Beijing.

Even if the ban on mainland China is not so loosening so quickly, transactions in Hong Kong are still attractive.A Hong Kong web3 investor pointed out that although mainland traders can bypass Beijing's supervision through VPN, they still have difficulty converting cryptocurrencies to legal currencies in China, and if Hong Kong can provide legal transactions, they will notThere is this problem.

However, there are also skepticisms of companies and investors' friendly commitments in Hong Kong.These people believe that since Hong Kong can suddenly be friendly to cryptocurrency, once the situation changes, it may suddenly tighten the policy and even take the initiative or forced to follow Beijing's ban.It should be said that this is the brand left by the three -year crown disease.

The reason why Hong Kong's International Digital Financial Center plans can attract so many companies and investors is not just to see the market of more than 7 million people in Hong Kong: what they see is that Hong Kong can use it to useIts unique geographical and political advantages have become their bridge to enter the huge mainland market.

For Hong Kong, as the "test field" of both parties, whether it can formulate regulatory measures to attract and stabilize enterprises and investors, but also let Beijing seeThe advantages and values of virtual currency transactions have become the top priority.