One of Hong Kong's largest real estate company Deweng (Wu Zongquan, chairman of Wheelock and CO., was reported to buy a thousand -foot mansion in the Minami Wan Bay in the high -end region of Hong Kong for 59.8 million yuan (Hong Kong dollars, the same below, about 10.11 million yuan).

It is reported that this three -bedroom luxury home is located on Minghui Garden, 45 Lamen Bay Road, Hong Kong. It was built in 1973. It was built in 1973. It is 1,583 square feet (about 147 square meters).It is similar to the price of the real estate in 2020.

The rich man buying a house is not a news, but according to the land registration office information reviewed by Hong Kong, Wu Zongquan paid about 2.54 million yuan in print duty, which means that the stamp tax he paid was aimed at4.25%of the first home buyers, rather than 15%of the existing real estate people.According to the price of houses, the difference between the two is about 6.4 million yuan.

The name of the real estate company, which has more than 10,000 real estate in the name, has Wu Zongquan, the head of the real estate company, which is known as the "chartered" of Hong Kong, is the first home buyer?

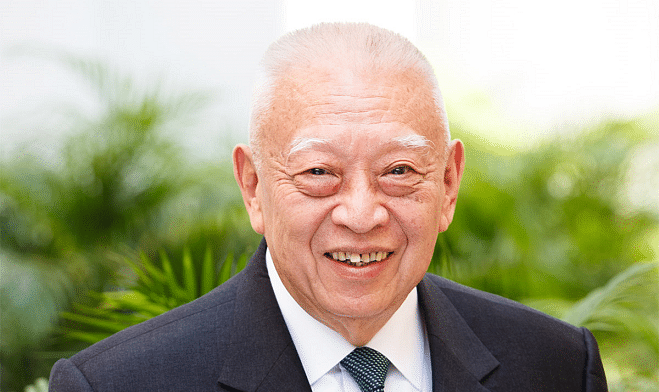

Who is Wu Zongquan?

Although it is better to be famous for Hong Kong's real estate industry led by Li Ka -shing, entering the name of Wu Zongquan into a search engine, it is not difficult to find the accurate summary of mainland Chinese media to him: the age of 45 is only 45 years oldHong Kong's "chartered rental public", more than 15,000 real estate in the name, raised 30 billion yuan (about S $ 6 billion) an annual lease.

Data show that Wu Zongquan's grandfather is Hong Kong's "ship king" and Hong Kong's richest man Bao Yugang in the 1970s and 1980s. His father is the sixth Bloomberg Hong Kong rich list.Light.When he was only 35 years old in 2013, he took over the post of Chairman Defeng from his father's hands and was in charge of the business empire with a market value of more than 300 billion yuan at that time.

The main business of Huidevon is real estate. Auxiliary companies include Jiulong Warehouse Group, Huidefeng Real Estate, and Kowloon Warehouse Real Estate, Haiang City and Times Square of Hong Kong's well -known high -end shopping malls.In addition to collecting leases in Hong Kong, Wu Zongquan also has a lot of investment in the mainland. Chengdu International Financial Center and Changsha International Financial Center have also become the local "Internet celebrity punching point".

Wu Zongquan also selected the representative of the 14th National Committee of the Chinese People's Political Consultative Conference in China, and is a "patriotic entrepreneur" praised by the mainland media.According to reports, during the Wuhan crown disease in 2020, Wu Zongquan allowed all its property companies to reduce the rent and donated 10 million yuan at the same time. He also donated 15 million yuan to Henan for relief in Henan floods in July 2021.

After taking over a huge real estate company 10 years ago, in 2023, they "first ownership" to buy a house to buy a house. People who are not familiar with the situation may feel a bit strange, but the media and spectators in Hong Kong have been.It's not surprising to see.

Celebrity Popular "First Real Estate"

According to the official regulations of Hong Kong, people who can enjoy the first property printing rate, including the following:

- FromNo property, the first home ownership and for self -occupation;

- Once held property, but the original property has been resold before again;It holds property, but has been transferred through close relatives or other ways before the rest of the business, so there is no property on hand during the business.

Under the definition of a relatively broad "first home property", the first qualification is not as literally, and it can only be once in a lifetime.To put it simply, as long as there is no other property in the name when buying a home, or if you take the previous property within the prescribed time after buying a house, you can always enjoy the first qualification.

Searching for the Internet, you can find the first home property provided by many real estate intermediary websites, including the "borrower" to buy a house (even if you use the name of a person who has never held a property) or a straightforward relativeInternal transfer of "throwing names" and other methods obtained the first qualification.Although the data is not available, I believe that among ordinary people who have the ability to buy a house, there should be not a few people using similar operation tax avoidance.

However, because the public can inquire about the registration information of the land, it is difficult for Hong Kong celebrities to hide the eyes of the media.

According to Hong Kong media reports, Dong Jianhua, the first chief executive of Hong Kong, who has just stepped down as the vice chairman of the Chinese CPPCC, was "first home" at the age of 84 in 2021.He spent about 160 million yuan to buy a 3,335 square foot luxury mansion in the middle and half -mountain Jiahui Garden, and paid a printed duty of 4.25%and about 6.8 million yuan in stamp duty;It will need to pay 24 million yuan of stamp duty.

In addition to Dong Jianhua, there are actually many celebrities who have boarded the media layout because of the "first settled" property in the past five years:

Huang Zhixiang's wife, Yang Suqiong, reportedIn 2021, he purchased the housing of Jiaotu Garden for about 100 million Hong Kong dollars and paid about 4.4 million yuan in the first tax; Hong Kong rich Liu Xiong also bought a building in the first name this year, with a transaction price of HK $ 40 million, with a first tax of about 17 millionYuan; Guan Zhilin, Li Jiaxin, Zhang Jiahui, Zhong Chuhong and other Hong Kong performing arts stars have been exposed to the market in the first name from 2017 to 2018 to buy luxury homes.

Ren Dahua, known as the "King of the Lou" in the entertainment industry, is also reported to sell Prince Keelung Street Panel in 2021 and earn 20 million yuan.37.4 million yuan purchased the Mid -Mid -mountain Royal Garden luxury house.According to media reports, these celebrities and rich people usually buy their business in the name of the company. Therefore, when buying properties in the name of individuals, they can still enjoy their first qualifications.

"Spicy tricks" are not rich?

Many regions collect stamp duties to property transactions, especially in Hong Kong with high property prices and gold -in -money gold.In order to control the soaring housing prices, Hong Kong introduced the concept of "double stamp duty" since 2013. In order to prevent the further deterioration of the property market bubble, it will be uniformly designated at 15%from November 2016.Special circumstances can be exempted, and continue to enjoy the lower ladder tax rates based on the price.

Improving the price stamp duty, coupledSince 2012, buyers' stamp duty levied on non -Hong Kong permanent residents are generally collectively referred to as the "spicy tricks" in Hong Kong controlling the property market.However, property price data shows that although these "spicy tricks" are introduced, although the growth of property prices has slowed in the short term, it will soon recover or even exceed the previous growth rate.

What really caused heavy damage to Hong Kong's property prices is the anti -repair routine in 2019 and the three -year epidemic in the following three years.Under the influence of the epidemic, the economic slowdown and the downturn in the property market have caused many Hong Kong home buyers to call on the government to "withdraw".In October last year, in the first policy report, in order to attract talents, after launching the conditions of meeting the conditions, the policy of stamp duty of non -permanent resident buyers could not be adjusted.

Chen Maobo, the director of the Hong Kong Financial Secretary, also stated in February this year that although Hong Kong's property prices fell more than 15%last year, the current property prices are still in high levels, which is not suitable for canceling any "spicy tricks".

On the other hand, Hong Kong has gradually recovered since last year, and after recovering a full customs clearance with the mainland this year, statistical data show that the sales volume of luxury homes in Hong Kong in January this year has risen sharply, reaching a new high since eight months;In February, ordinary residential transactions also reached a new high in recent years. It shows that the property market has begun to recover after the epidemic. If the property price is intended to continue to control the property price, the Hong Kong government should not choose to further "withdraw" in the short term.

In general, the "spicy tricks" of the Hong Kong property market have limited effects, especially the wealthy class with sufficient resources and methods.

For Dong Jianhua's "first home ownership" in 2021, his 6.8 million yuan "first set" stamp duty paid, at that time, he barely bought a 286 square foot room "Mosquito -type building.Rao is so. For more than 200,000 households with a per capita residence area of more than 40 square feet, this may be the "mansion" in their eyes.

For ordinary people who are desperately working hard in this crowded large city, they are desperate to work hard, and in the face of sky -high real estate, the tax rate is high or higher, and the difference seems to be very large.The wealthy celebrity reported from time to time from time to time, the rich celebrity "first set", more about the talks after meals, or the ultimate "Hong Kong dream" of some people.