The tension in the Middle East continues to be upgraded. Analysts believe that turbulence in the short term will bring risk of increase in oil prices. If Iran also involves it, it will further push up oil prices. It is expected that the average oil price in the fourth quarter of this year is 90 US dollars.

/>

/>

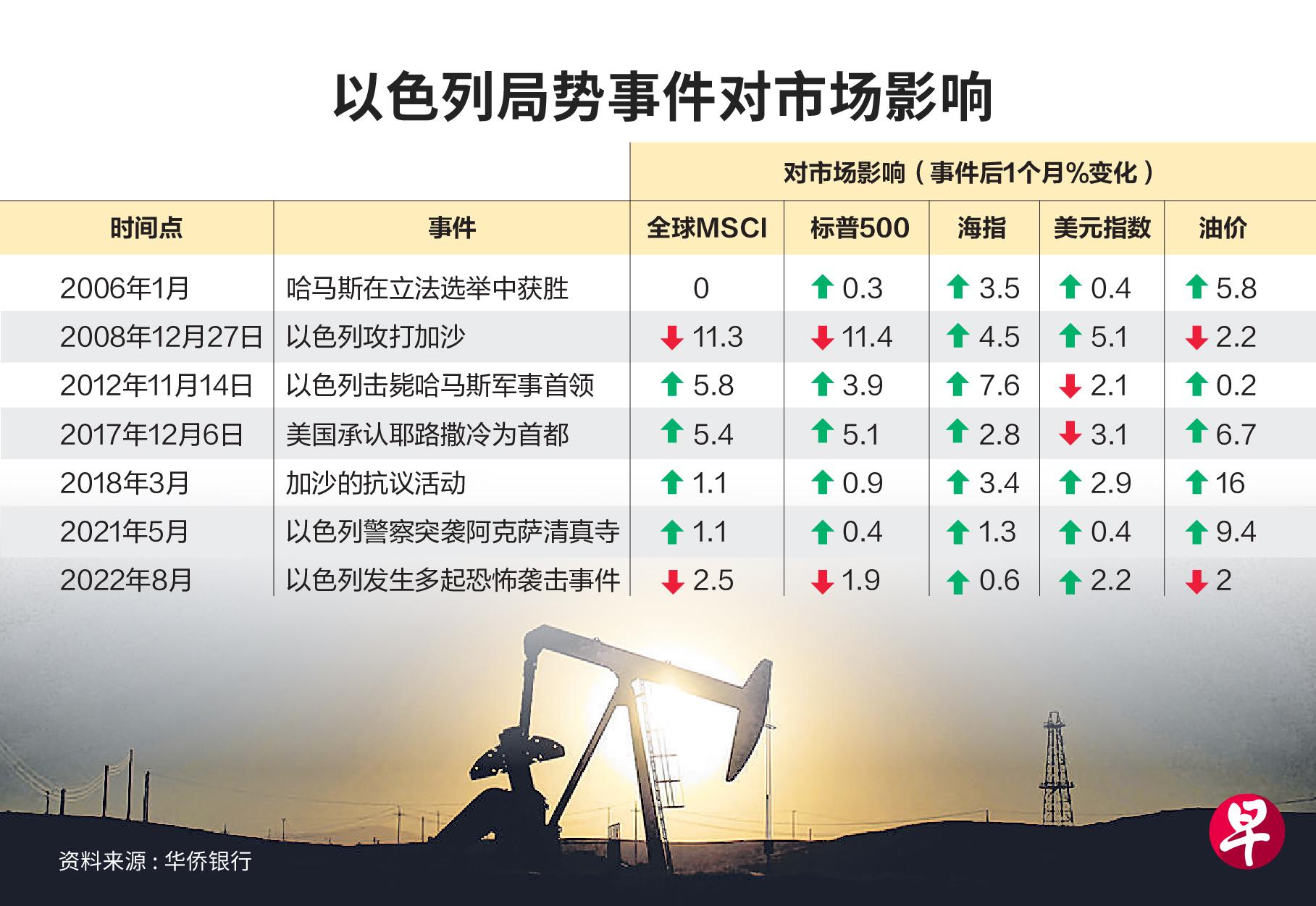

Historical data shows that after many times in the past Israeli and Palestinian conflict, oil prices rose most of the time, the global stock market performance was uneven, and the local stock markets basically increased.

Analysts say that the market is paying close attention to the development of the situation to evaluate the impact on the stock market. High -energy prices are generally not good for the stock market, but oil and gas stocks may rise.

Lavanya Venkateswaran, a Ya'an Economist of Overseas Chinese Bank, released a report on Tuesday (October 10) to analyze the impact of major conflicts in Israel in the past.History shows that the upgrade of tensions may last for several days to several years.

There are different responses in the asset market

The main asset markets have different responses to the Pakistani conflict in the past. Other events that occur around the world at the same time make it difficult to identify the cause and effect of the market trend.However, Wenswaran said: "One month in the main conflict incident, global oil prices based on Brent crude oil (Brent) generally rose."

The most obvious example ofwas the month after the Arab countries attacked Israel in the early 1970s, and oil prices soared by more than 50%.In May 2021, the Israeli police raid the Ax Mosque incident, and also pushed Brent crude oil prices.

As for the stock market, one month after the conflict in history, the global and US stock market rose more than falling, and the local stock market has basically increased since the record.

Li Cailian, general manager of the Overseas Chinese Investment Research Company, pointed out that the initial response of the stock market was different, and the MSCI World Index was slightly higher on Monday (9th). It may be that the market is expected to allow the Federal Federal Reserve to suspend interest rates.Recovery lost the ground.

Marketing observers pay attention to the development of the situation. The key is the impact of oil prices in the next few weeks.In the past, high -energy prices were unfavorable to the stock market and affecting companies and consumers, but oil and gas stocks that high oil prices may rise.

Thilan Wickramasinghe, the research director of the Bank of Malayan Securities Company, said that the situation in the Middle East was tight, the price of oil may be higher, the risk aversion funds flowed to the US dollar, or caused inflation pressure to Singapore.

He pointed out that rising energy costs may lead to the increasing operating costs in industries such as transportation and public utilities.Industries such as agricultural stocks and dependence on commodities such as food and beverages may be indirectly affected by rising fertilizer costs and increasing increased expenditures of other raw material.However, the coastal and maritime industries, oil and natural gas industries, and companies that formulate alternative energy strategies may be beneficial.

How to develop the situation of the Baza situation, the influence of the oil price

The scale, tension, maintenance period, and scope of the situation of the Baza situation are an important factor in determining the influence on oil prices.

Considering the scale of Hamas's offensive and Israel publicly declared war, Vencatswaran believes that this means that the tension may be lasting. The United States expressed that it is unlikely to cool Israel to cool down in the short term.

If the tension between Iran and the United States is upgraded, the United States may impose more strict sanctions on Iran and squeeze the crude oil market.Iranian crude oil production increased to 3 million barrels per day in August this year, accounting for about 11%of the Organization of the Petroleum Exporting Countries (OPEC, referred to as the Oil Alliance).

Wenswaran said that the risk lies in this conflict upgrade to the regional level, challenging the diplomatic efforts of Saudi Arabia and Israeli relations, so Saudi Arabia may not have much to reduce previous production measures.

The basic prediction ofOverseas Chinese Bank is that the tension situation is limited to the Gaza region and Israel, even if it lasts for a long time, the oil price will return to normalization after the initial conditions of reflection.

Therefore, overseas Chinese predicts the average price of Brent crude oil in the fourth quarter, and the next few weeks fluctuate greatly.

Priyanka Sachdeva, an analyst at Huili NOVA market, said that if the fire of the Middle East continued, the world may return to the origin, just like when Russia invaded Ukraine last year."This means greater inflation pressure, higher oil prices, stronger dollars and higher yields. The combination of these three will cause severe damage."