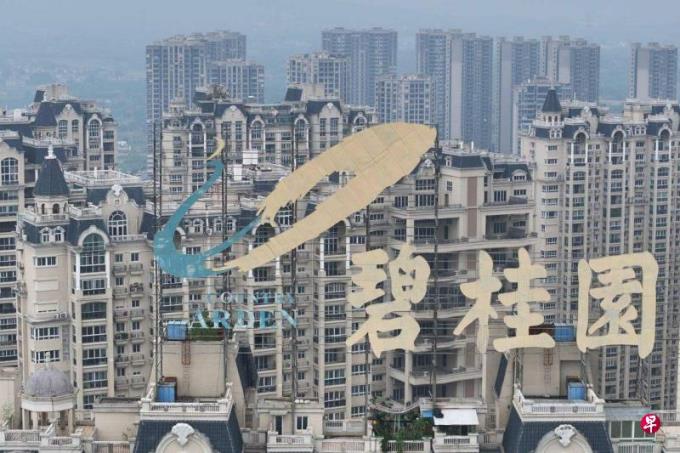

(Beijing Comprehensive News) China Real Estate Giant Country Garden issued an announcement on Tuesday. It is expected that all overseas debt payments are not as good as scheduled or within the relevant width period.Solution to comprehensively solve the current overseas debt risk.

Many Chinese real estate leaders are facing increasing financial pressure. Astronomical digital debt has exacerbated the industry's concerns about their bankruptcy. The International Monetary Fund (IMF) has lowered its predictions on China's economic growth in this year and next.

Country Garden issued an announcement on the Hong Kong Stock Exchange on Tuesday (October 10) that the indexed data showed that the Group's equity sales amount fell by 43.9%year -on -year from January to September 2023, a year -on -year decrease of 65.4%from 2021.Among them, in September 2023, the monthly equity sales amount fell for the sixth consecutive month, a decrease of 80.7%year -on -year, and a decrease of 86.5%from 2021.The group is facing the major uncertainty of asset disposal sale, and it is expected that liquidity will continue to be nervous in the short period of time.

Country Garden said that as of the announcement of the announcement, the principal amount under the debt item has not yet paid the amount of HK $ 470 million (S $ 8.206 million).The company also expects that it is impossible to fulfill the payment obligations of all its overseas debt payments as scheduled or within the relevant width period, which may lead to the obligation of relevant creditors to accelerate the performance of the relevant debt or take mandatory action.

Reuters reports that Country Garden will also face two overseas US dollar bond interests in total of $ 66.8 million (S $ 91.42 million) in a total of $ 66.8 million (91.42 million yuan), and the payment width period is 30 days.If Country Garden cannot pay $ 15 million in September ticket by October 17, all offshore debt may be regarded as breach of contract.

Country Garden said in the announcement that the creditors asked the creditors to give the time to evaluate the status quo, and promised to find a pragmatic and feasible best solution for all the holders.

A reporter from the Cailai News Agency learned on Monday (October 9) that Country Garden is considering the recent announcement of the overseas debt restructuring plan.According to the latest announcement, Country Garden has hired CICC and Hualieno as a consultant to assist in evaluating the capital structure and liquidity status and formulating plans.

As of the end of 2022, the total liabilities of Country Garden reached 1.43 trillion yuan (S $ 270.2 billion).It has 33,207 cooperative suppliers and about 70,000 employees.French New Society pointed out that Country Garden's construction project is four times that of its competitors Evergrande. Any collapse of Country Garden will have a catastrophic impact on China's financial system and the overall economy.

Country Garden pointed out that The exhibition plan for a total of nine domestic corporate bonds has obtained the necessary consent of relevant bond holders For the group's time and space.Country Garden also said that they would go all out to ensure the smooth progress of delivery.

The stock price of Country Garden fell 10.7%on Tuesday (October 10), and its cumulative decline has been nearly 70%since the beginning of the year.

The International Monetary Fund announced on Tuesday that the global economic forecast is expected to increase the GDP of the world's second largest economy in the world this year, which will increase by 5%, which is reduced by 5.2%predicted in July this year.The organization predicts that the Chinese economy will increase by 4.2%in 2024, and it will also be 0.3 percentage points from July forecast.

The IMF believes that the Chinese economy that is out of the epidemic is losing its motivation, especially the obstacles caused by the crisis of the real estate industry. This situation has weakened the buyer's confidence and extended the crisis of the real estate industry.