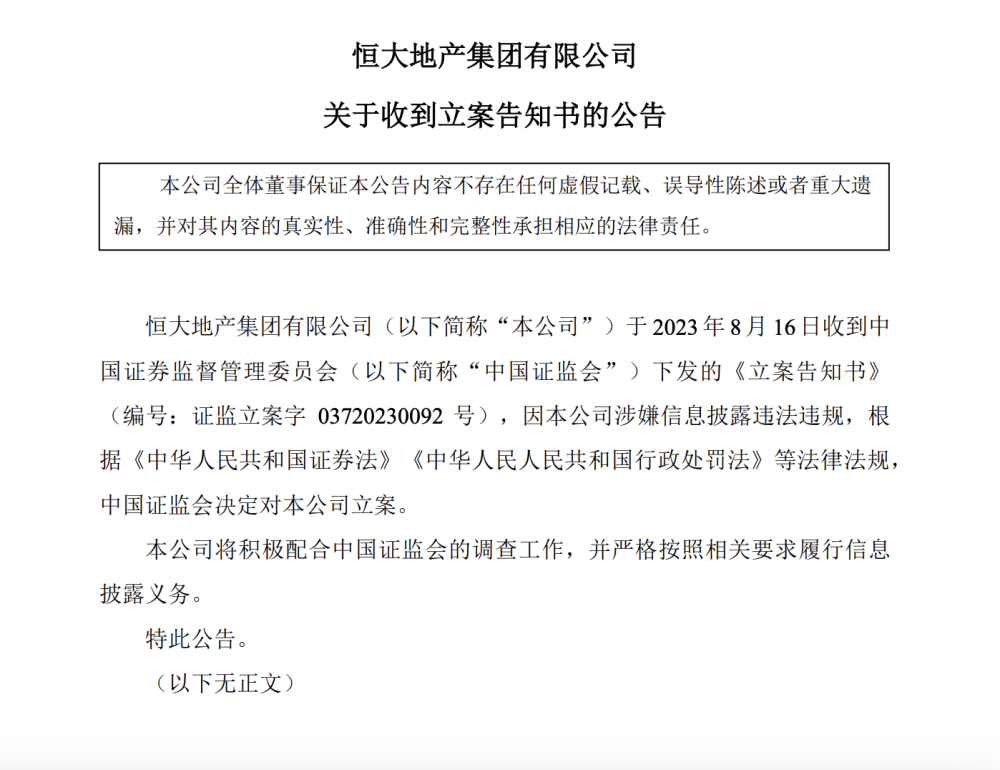

On the evening of August 16th, Evergrande Real Estate Group Co., Ltd. (hereinafter referred to as "Evergrande Real Estate") received a notification of the case issued by the China Securities Regulatory Commission today (number: Securities Regulatory Case 03720230092)The company's suspected information disclosure illegal and violations. According to laws and regulations such as the People's Republic of China, the People's Republic of China, the People's Republic of China, and other laws and regulations, the China Securities Regulatory Commission decided to file a case against the company.

Evergrande Real Estate said that it will actively cooperate with the China Securities Regulatory Commission's investigation and strictly perform information disclosure obligations in accordance with relevant requirements.

Evergrande Real Estate is the domestic main body of Evergrande (03333.HK) listed in Hong Kong. It was established in Guangzhou in 1997 and is also the main body of Evergrande Real Estate business.Public information shows that Evergrande Real Estate has nearly 300 major real estate projects in 139 major cities including Guangzhou, Beijing, Shanghai, Tianjin, Chongqing, Shenzhen, Hefei, Jinan, and Shenyang, which have nearly 300 real estate projects.

As an important subsidiary of China Evergrande, which has a huge loss of 800 billion yuan in two years, the loss of Evergrande Real Estate cannot be underestimated.According to Wind data, from 2021 to 2022, Evergrande Real Estate's net profit was about -576.9 billion yuan.

Evergrande Real Estate's above announcement has not disclosed the specific matters involved in non -compliance.

According to the annual report of China Evergrande, as of the end of 2021, its contract liabilities (pre -collection) were 974.3 billion yuan, which rose 185.7 billion from the same period last year. At the end of 2022, the book contract liabilities were still 721 billion.This huge change stems from changes in the turnover point.

According to the Hong Kong accounting standards, after the sales of real estate companies were sold in their early years, the resources were included in the pre -collection of accounts. It was necessary to wait until the project was completed and delivered before they could be transferred to revenue.In 2017, Hong Kong's accounting standards were adjusted to give enterprises a greater autonomy to confirm that the project could not be delivered to revenue without delivery.

China Evergrande has adopted a radical transfer method since 2017, and has confirmed a large number of pre -sale resources as current revenue and profits, and has achieved three consecutive years of profit surge in 2017, 2018 and 2019.It was also in 2017, China Evergrande's contract liabilities entered the downward channel.

China Evergrande also re -changed its accounting time to the income confirmation time in 2021, saying that "before 2021, the Group believes that customers accept property or are regarded as the property that the property has been accepted by the property.The income is confirmed at the time of confirmation. However, since 2021, due to the Group's increasing difficulty in flowing funds, the Group believes that the additional conditions for incorporating the project completion certificate or the owner occupation as the income will be better reflected in the group's condition, and more and more"It is practical".

Through this accounting processing change, China Evergrande has re -appointed the income confirmed in the past few years into contract liabilities, and the amount involved is about 664.3 billion yuan (excluding tax).After the adjustment, the contract liabilities suddenly skyrocketed at the end of 2021. Correspondingly, the shareholders' equity suddenly dropped from 350.4 billion yuan at the end of 2020 to -473.1 billion yuan, and there was a situation of incomparable debt.

After this adjustment was exposed, the industry questioned China Evergrande's previous confirmation of sales revenue.The person in charge of a listed real estate investor relationship commented that Evergrande's previous income confirmation may have the problem of "early confirmation and more confirmation", which formed a profit that year, but the cost has not been fully generated, and it is desperate after profit.However, after the thunderbolt in 2021, this method of eating food was unsustainable.Some people in the industry believe that there are many problems such as illegal accounting treatment, decoration performance, and financial fraud in China.

However, China Evergrande seems to be struggling, facing huge debt. While negotiating debt exhibitions in China, it gave an overseas debt plan in March this year.cast.

The actions of warfare also have a certain impact on the debt restructuring plan. On the evening of August 16, China Evergrande issued an announcement on the Hong Kong Stock Exchange saying that it was decided to extend and re -hold the Evergrande Agreement arrangement meeting, and at the same time extended the scene of Scenicine to hold the sceneryAgreement arrangements and the heavenly foundation agreement arrangement meeting.The creditor meeting will be postponed until August 28.Prior to the meeting, overseas creditors will weigh whether they accept the reorganization plan proposed by Evergrande.This is also very important for Evergrande's fate.