Author | Xiao Wang

Edit | Pudding

Produced | Prism Middot; Tencent Xiaoman Studio

The Shanghai Beach Mysterious Capital Big Big Sanglei has lost its contact for 120 days, and its listed company A listed company A listed company Aihai Medical (*ST Haiyi, 600896.SH), which has cost more than 3 billion yuan, is about to delist.

On May 5th,*ST Haizheng opened a card. On the last day of the company, the company received a pre -notice notice from the Shanghai Stock Exchange on terminating the company's stock listing.The annual report confirmed that since the beginning of 2022, the chairman Michi has not been able to perform his duties normally. The company has repeatedly verified the understanding of the controlling shareholder and the family members of Michuna, but did not learn that any information should be disclosed and did not disclose.

According to Caixin report, Mi Chunlei has been taken away by a certain place before New Year's Day this year. Two weeks later, he was at the helm of Shanghai Life, and his investment director Zhang Xilin was also investigated.

Mi Chunlei is the chairman of Shanghai Life and Listed Companies. In the Hurun Rich List in 2021, Michunlei ranked 647th with a net worth of 11 billion yuan.According to the prism authors, Mi Chunlei's capital map involves insurance, banking, real estate, medical care, car, minerals and other fields, and his more familiar identity is Mdash, the husband of the well -known host Dong Qing; Mdash; before, Caixin, ChinaA number of media such as the operation newspaper have reported related reports.

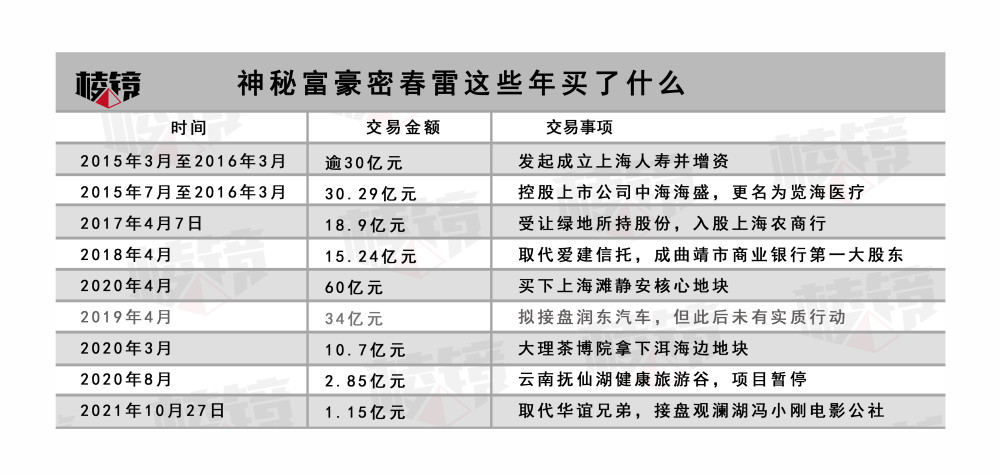

Low -key and mysterious is the label of Mi Chunlei before.However, after 2015, Mi Chunlei began to turn over the clouds and rain in the capital market. First, a group of state -owned shareholders initiated the establishment of Shanghai Life Insurance, and then controlled listed companies, entered the bank, won the core plot of Shanghai Beach, took over Huayi brothers, and all kinds of operations.Make the market unavailable.

With the loss of Michun Thunder, the Capital Empire, which was created by its first -hand, was also at stake.

The listed company bought 3 billion will be delisted

The listed company, which costs more than 3 billion yuan, is on the verge of delisting.

On April 29th,*ST Haizheng reported in 2021. The company's 2021 annual revenue was 119 million yuan, and its net profit loss was 281 million yuan. The net profit loss of net profit after deducting non -recurring profit or loss was 319 million yuan.

The accounting firm issued an audit report on the company's annual report, which cannot ensure that the annual report is true, accurate and complete.

Due to the loss of non -net profit loss for two consecutive years, the audited main revenue was less than 100 million yuan. While disclosing the annual report, Lanhai Medical received a prior notice from the Shanghai Stock Exchange.

Regarding the loss, the company said that it was mainly due to the long -term profit cycle of the medical industry. During the reporting period, only two comprehensive outpatients were put into operation. The rehabilitation hospital opened at the end of 2021. The overall scale effect has not yet appeared.But the capital market obviously has no patience.

The predecessor of Lanhai Medical is Zhonghai Haisheng, which is mainly shipped.In 2015, the domestic and foreign shipping industry continued to be sluggish, and there were few signs of rebounds. China Haisheng's controlling shareholder China Haipai was retired.

Miyunlei appears in a timely manner.The Lanhai Group and the recently opened Shanghai Life Insurance established a joint venture company to see the Haiki Shou. It was used by the agreement to accept some shares held by China Shipping Institute.The institution won 45.22%of Zhonghaihai Sheng, with a total cost of 3.029 billion yuan.Shanghai Lanhai, a wholly -owned subsidiary of Lanhai Group, became the controlling shareholder of Zhonghai Haisheng, and Michunlei became the actual controller of the listed company.

Since then, Mi Chunlei intends to build a listed company into a capital operation platform for its medical and health service industry.

At the end of 2016, China Sea Hai Sheng was renamed Lanhai Medical and implemented asset reorganization.The shipping assets were all peeled and began strategic transformations. The layout of high -end rehabilitation hospitals, high -end medical clinics, online hospitals, and medical equipment financial leasing and other businesses.

However, reality is sensible.Since Michun Thunder has led the transformation of Lanhai Medical, its annual revenue is only about 50 million, and it has continued to lose money.When facing the risk of delisting for the first time, Luanhai Medical rely on the sale of Donghua Software stocks in 2018 and transferred the equity of the financing leasing company to the affiliates to obtain 334 million yuan in revenue and net profit of 114 million yuan.The shell of listed companies.

However, in the following 2019 and 2020, Lanhai Medical still failed to make profits by the main medical industry.Due to the loss of non -net profit in 2020 and the revenue of less than 100 million yuan, the company was alert to the risk of delisting.

In terms of stock prices, the highest point of Lanhai Medical in recent years has stayed at the time of the Lanhai Group to plan to hold Zhonghaihai Sheng.Since Michun -Lei Holdings in 2016, the stock price of Luanhai has shocked all the way, falling nearly 90%of the cumulative.

It should be pointed out that although the high -end hospitals and clinics of the medical layout of Lanhai, although the current operation is not good and the cash flow is not good, its location is excellent and the early investment is large.Its net assets at the end of 2021 were 1.962 billion yuan.

Due to the fact that the actual controller and chairman Michi could not perform their duties for the time being, Luanhai Medical failed to contact him when herself inspected funds occupation and illegal guarantees, and confirmed the company's self -examination found that the related parties of the controlling shareholders were complicated.

On April 19th,*ST Haizheng disclosed that the company's controlling shareholder Shanghai Lanhai and unanimous actions to visit Haiki Shou will hold all the 45.47%of the company's shares. The use is the external guarantee, and the pledged owner is Shanghai Life.The largest shareholder of Shanghai Life is the Haihai Group.According to the stock price of*ST Haizheng pledged, the total market value of the equity was 1.35 billion yuan (there are usually discounts at the time of pledge).

After the pledge disclosure,*ST Haizheng's stock price took 9 daily limit.As of the close of April 29, it has closed at 1.74 yuan/share, which has fallen by 37%compared to the first day of the stock price.

Aihao car, buying a bank, picking up Huayi Brothers

The current dilemma is in sharp contrast to the pride acquisition of Miyura thunder in previous years.

In April 2020, the C050201 Unit 023-7 commercial land in Jiangning Community, Shanghai Jing'an District, Shanghai, was sold at a reserve price of 6 billion yuan to create the second high price of Shanghai's total price in that year.

The Shihai Group and Shanghai Lan You Enterprise Management Partnership (Limited Partnership) of the land of the land are all controlled by Michun Lei.Real estate is one of the old banks of the secret home.

According to the industrial and commercial registration information, the father of Mi Chunlei, Mi Boyuan, established Shanghai Foreign Investment Real Estate Co., Ltd. as early as 1997.In 2005, 2008, and 2010, the secret family has established Shanghai Zhongying Jiande Real Estate Development Co., Ltd., Shanghai Baoyuan Real Estate Co., Ltd. and Shanghai Yinggu Real Estate Co., Ltd.

In addition to real estate, Mi Chunlei is also fond of banks.On April 7, 2017, the Shanghai Rural Commercial Bank's shares held by the Greenland Holdings of Greenland Holdings became the tenth largest shareholder of the Shanghai Rural Commercial Bank, which cost 1.89 billion yuan in transactions.

Shanghai Rural Commercial Bank's 2021 report showed that 336 million shares held by Lanhai Group accounted for 3.87%, but all shares held have been pledged.

The small shareholders of a big bank may not be addicted. In April 2018, the Luanhai Group participated in the Qujing Commercial Bank (hereinafter referred to as the Qu Commercial Bank) to increase its capital and expand it.Become its largest shareholder and hold 19.5%.According to Hexun.com, Wang Jianping, chairman of Qu Commercial Bank, was nominated by Lanhai Group. Wang Jianping had previously served as Deputy Governor of Shanghai Huarui Bank;Shi Fuliang, President of Life and Secretary of the Party Committee of Lianhai Group, serves as a director of shareholders and non -executive directors.

It should be pointed out that what originally intended to win the largest shareholder of Qu Commercial Bank was Shanghai Aijian Group's Aijian Trust.However, in April 2018, Aijian Trust was informed that it did not meet the relevant provisions of the temporary method of the new Banking Regulatory Commission's newly introduced banks' equity management.According to the announcement of Aijian Group, 19.5%of the shares of Queshang Bank cost 1.524 billion yuan.

As a result, the capital's capital tentacles extended to Yunnan.

From the end of 2019 to August 2020, the Lanhai Group continued to shot in Dali and Chengjiang Fuxian Lake, with a total of 1.515 billion yuan in a residential land in Dali Manchiang District and supporting the maternity hospital, Dali Town Shangkamura Village, somewhere.Block and a land on the east bank of Fuxian Lake.In particular, the cost of land acquisition of the Dali Tea Expo project reached 1.07 billion yuan, setting the largest existing area and the highest total price in Dali in recent years.The land is located at the foot of Cangshan, the shore of Erhai Lake, and the scenery is excellent.Lanhai Group has since introduced Hengda Life to participate in development and construction.

But Yunnan may not be the blessing of Mi Chunlei.

According to public information, the above -mentioned Dali Manjiang District Residential and Maternity Hospital Projects, due to the planning and adjustment of the Manchu area, the construction of the two sides in July 2020 suspended construction.

In June 2021, Fuxian Lake opened the lake revolution, and the approval of some plots around Fuxian Lake in Chengjiang City, Yunnan Province, included in the Fuxian Lake Middot; International Health Tourism Valley project created by Lanhai Group.

According to the information of Tianyancha, the Qujing City Public Security Bureau frozen the 492 million yuan of the equity of Qujing City Commercial Bank held by the Shihai Group on March 28 this year.Equity of Haizhu Nursing Industry Development Co., Ltd..

In October 2021, Michri also took over 35%of the shares of Hainan Guanhuili Huayi Feng Xiaogang Culture Tourism Industry Co., Ltd.The author checked the audit report of Huayi's subsidiaries and found that the capital contribution was about 115 million yuan.

Mi Chunlei is also interested in the rich toy MDASH; MDASH; luxury cars are also quite interested. In 2016, it was registered for the establishment of Shanghai Lanhai Automobile Development Co., Ltd., and there were many 4S stores in Hubei, Jiangsu, Shandong, and Shanghai.

The author sorted out industry and commerce information and found that during the period of 2019, Lanhai Automobile won the distribution rights of high -end brands such as Lamborghini, Rolls -Royce, Porsche, Mercedes, and BMW by taking over Wuhan Kangshun Automobile Service Co., Ltd.Lanhai also established Shanghai Lanhai Junjie Racing Club Co., Ltd., but no public business information was not available.

In April 2019, Rundong Automobile, a luxury car brand dealer, once plans to sell the equity of its 56 -storey stores to the company under the Haihai Group at 3.4 billion yuan, but in the end, it has not progressed.Since then, Rundong Automobile has signed a memorandum of understanding with Luanhai International, and Luanhai International intends to participate in Rundong Automobile's reorganization and assist its stock to resume trading.But until the end of the memorandum of understanding, Rundong Automobile is still on potential transactions and international consultations.

But at the moment, the Lanhai Group is already the mud Bodhisattva crossing the river, and it is difficult to protect itself.

The insurance license is a critical jump

In 2015, Shanghai Life became a key turning point for the cause of Michun Thunder.It is from the beginning of winning this life insurance license with a high gold content that Mi Chunlei has become a capital leader from the famous real estate merchants.

Shanghai Life was approved for construction in September 2014, and was approved in February 2015.This is the first insurance company established by the Shanghai Free Trade Zone, and the first national insurance company to be approved by Article 10 of the New State of the insurance industry.

Shanghai Life Stock Spectacle has a luxurious lineup, Zhonghai Group Investment Co., Ltd., Shanghai Electric (Group) Corporation, Shanghai City Investment Production and Management Co., Ltd., Shanghai Waigaoqiao (Group) Co., Ltd., Shanghai Lujiazui Financial Development Co., Ltd., Shanghai International Group asset managementA group of Shanghai state -owned shareholders such as Co., Ltd. and Shanghai International Trust Co., Ltd. participated.At the establishment of Shanghai Life Insurance, the registered capital was 2 billion yuan, and the 400 million yuan holding 20%of the 400 million yuan to the Haihai Group became the biggest shareholder.

According to the China Real Estate Daily, when Shanghai Life opened, Xiang Junbo, the former chairman of the Insurance Regulatory Commission, went to the scene.

In April 2017, the Central Commission for Discipline Inspection disclosed that Xiang Junbo was suspected of serious disciplinary violations and accepted organizational review.According to the Huaxia Times, in the past five years of Xiang Junbo's main administration of the Insurance Regulatory Commission, the Insurance Regulatory Commission approved as high as 51 new insurance companies.The principle of loose access is to open the door to the insurance industry into the insurance industry.

In March 2016, the registered capital of Shanghai Life Insurance increased from 2 billion yuan to 6 billion yuan. The new shareholders introduced by capital increase were Shanghai Yangning Industrial Co., Ltd. (hereinafter referred to as Yangning Industrial), Shanghai He Cui Industrial Co., Ltd. (hereinafter referred to as and andCui Industrial) and Shanghai Xinglian Trading Co., Ltd..

According to the Financial Association, a regulatory material in 2018 shows that in the application for capital increase in Shanghai Life in 2016, Yangning Industrial and Cuishe Industrial, such as Yangning Industry and Cuishaye, provide false materials and provide false materials.The shareholding ratio of the Lahai Group and the affiliated parties reached 50.5%, which is far from the 1/3 of the shareholders' shareholding ratio of the regulatory regulations.

All shareholders of financial institutions need to be paid.This means that the Lanhai Group and its affiliated parties have contributed more than 3 billion yuan.

According to the official information of Shanghai Life, its current asset scale has reached 115 billion yuan, which has achieved profitability for six consecutive years, breaking the tradition of seven -profit in the life insurance industry.In 2020, Shanghai Life Insurance realized the original premium income of 16.851 billion yuan, and the annual billing premium in 2021 was 16.355 billion yuan.The 2020 report showed that bank channels contributed 95%of their premium revenue, while universal insurance product premium revenue accounted for nearly half.

Under the scale and profits, the comprehensive rating of the regulatory risk has continued to decline. In the third quarter of 2021, it fell to Class C.Of the 148 insurance companies disclosed by the Insurance Association, only 8 rated C or D was rated.

In October 2017, Shanghai Life received a supervisory letter, pointing out that the company had problems in the operation of the three meetings, related transactions, internal audit, and assessment incentives, and proposed the regulatory requirements:Within a month, the Shanghai Life Insurance and Lanhai Group and its affiliated parties are prohibited from conducting related related related related related related related related related related related related related related related related related related related related affiliated transactions.

Today, what is the relationship between Shanghai Life Investment Director of Investment and the use of funds from Shanghai Life and the expansion of the Lanhai Group in recent years?It still needs to be confirmed more official information disclosure.However, some people in the Shanghai insurance industry said that the company has professional managers who are managed and do not have to worry about its operation.

The young Hurun rich has become history?

Born in December 1978, Mi Chunlei came out of the rural family in Chongming Island, Shanghai. At the age of 44, he became the top ten billionaire on the Hurun Rich List. His wealth growth rate was amazing.

According to Shanghai Life Insurance, Michri graduated from Tongji University's civil engineering major and EMBA major in the Changjiang Business School.China Business News and other deep lines reported that Mi Chunlei did not go to college and started doing business when he was young.The old family said that Michun's mines are gentle, and they have had a good temper since they were young. They never quarreled with others.

Comprehensive media reports and registered information on industrial and commercial registered information, the earliest family began to do highway construction, material transportation and highway engineering maintenance business in Chongming Island.Perhaps it was to catch up with the development opportunities of Chongming Island in the 1990s and achieved the first bucket of gold in the secret family.The deep line quoted people familiar with the matter and said that he later said to the people in his hometown that he made a fortune.

Mi Chunlei and his father Mi Boyuan registered the establishment of Shanghai Zhongying Enterprise (Group) Co., Ltd. in 2003. This is the predecessor of the Lahai Group.

After the establishment of Shanghai Life in 2015, the Luanhai Group indirectly continued to increase capital from July 2015 to November 2016, and the registered capital was 2The 100 million yuan increased to 6 billion yuan, the value -added rate was amazing, and the dazzling capital operation was opened since then.

Compared with the various pride of Miya Lei, it is a mess in the company's operations and governance.

For example, in 2021, Luanhai Medical plans to purchase an office building that has not obtained a pre -sale license in Kunming, which has not obtained a pre -sale license, and the original shareholders of the office assets are Shanghai Life Life, the affiliated company of Lanhai Group.The Shanghai Stock Exchange issued a inquiry letter on the medical care of the Hai, demanding that the sales of real estate sales eventually flowed to Shanghai Life and other issues.After the two extension responses to the inquiry of the Shanghai Stock Exchange, the acquisition of the acquisition of Hai Hai Medical was terminated.

Some borrowing disputes have also exposed the dilemma of the tight cash flow of the Hai Group.The equity pledge information shows that the Luanhai Group pledged the equity of Luanhai Real Estate, Luanhai Automobile Development Co., Ltd., and Lanhai Medical to Shanghai Life Life, which constitutes a large number of related transactions.

According to Caixin reports, Mi Chunlei has a lot of funds with a number of urban commercial banks in Liaoning.But as of now, the specific reasons for their loss are unknown.

The upcoming delisting Luanhai Medical will not wait for Mi Chunlei, and Dong Qing's fans are still looking forward to the update of his show.On April 23, the reader who had stopped broadcasting for three months originally planned to restore the broadcast, but eventually appointment.