On August 29, the State Supervision Commission of the Central Commission for Discipline Inspection published the following articles on the Zheng Shuang incident:

How much is it?

This year, after the artist Zheng Shuang starred in the ghost of the ghost of the Ghost Girl exposed, a new measurement unit was popular on the Internet: a cool.

One cool = 160 million, cool day = 2.08 million.

Netizens used this ridiculous way to express their dissatisfaction with the price of flowers in flow stars.

With a slight smile in front of the camera, you can have a lot of accounts. The artistic accomplishment of some traffic stars and the degree of contribution to society are far from their income.What is even more unbearable is that they also use illegal means to avoid the supervision of the industry's competent department on sky -high pay, and pass the false declaration of tax evasion.

Fragments of law will be severely punished.In April 2021, actor Zheng Shuang was investigated by the signed yin and yang contract.Four months later, on August 27, the State Administration of Taxation reported that Zheng Shuang's tax evasion case was seriously investigated and punished in accordance with the law, recovered and fined a total of 299 million!

299 million, what is the basis?

Related laws and regulations include: Article 32 and 63 of the Taxation Management Law of the People's Republic of China, as well as Article 2, Article 10, 11, and the People's Republic of China on Personal Income Tax Law of the People's Republic of ChinaArticle 1 and 19 of the Provisional Regulations of the Republic of VAT.

Which income should be taxed?Article 2 of the Personal Income Tax Law of the People's Republic of China stipulates: wages, salary income; income from labor remuneration; income from manuscript rewards; income from franchise; business income; interest, dividend, dividend income; property lease income; property transfer income; accidental income, etc.It belongs to personal income and shall pay personal income tax.

In addition, Article 1 of the Provisional Regulations of the People's Republic of China stipulates that the units and individuals and individuals who sell goods or processing services, sales services, intangible assets, real estate, and imported goods in the territory of the People's Republic of China will be taxpayers.VAT shall be paid in accordance with these regulations.Article 19 stipulates that the occurrence time of the VAT deduction obligation is the day when the taxpayer's VAT taxpayer obligations occur.

The First Investigation Bureau of the Shanghai Municipal Taxation Bureau has found that Zheng Shuang did not declare personal income of 191 million yuan in accordance with the law from 2019 to 2020, 45.269 million yuan in tax evasion, and 26.5207 million yuan in other taxes.Even if the capital increase agreement was later lifted, Zheng Shuang did not change the established facts that caused the less tax to pay less taxes, nor did it affect the identification of the nature and amount of the subjective behavior of tax evasion.

The taxation department must be recovered, and it must be collected.Article 32 of the tax collection management law of the People's Republic of China stipulates that if the taxpayer fails to pay taxes in accordance with the prescribed time limit, if the withdrawal obligations fail to unlike taxes in accordance with the prescribed time limit, except for the order of the limited time to pay, the tax will be refuated from the delay tax tax on time.From the date of the payment, the sturgeon of five thousandths of 10,000 yuan will be collected on the day.

There are not only late funds, but also fines.Article 63, paragraph 1 of the tax collection management law of the People's Republic of China, stipulates that the taxation of taxpayers shall be evacuated by the tax authorities, and the tax authority shall be recovered by the taxes that shall not pay or pay less.Fine more than 50 times less than 50 times.

According to these laws and regulations, the tax department has a fine of RMB 71.7903 million in pursuing taxes of 71.7903 million yuan in taxation in accordance with the law; a 4 -fcent of the tax evasion of the income nature is 30.6957 million yuan;Part of the fines were fined 5 times, and 188 million yuan was calculated.This is how 299 million comes.

It is worth noting that Zheng Shuang's fines are strict, and some fines even reached 5 times the top punishment.The relevant person in charge of the First Investigation Bureau of the Shanghai Taxation Bureau explained: In this case, considering that the tax evasion case of Zheng Shuang took place in 2018, after regulating the tax order of the film and television industry in 2018, the subjective and intentional were obvious, and the different illegal acts were distinguished.Punishment strictly.

Time to 2018.The State Administration of Taxation issued a notice on further regulating the work of the tax order of the film and television industry. The notice clearly required: From October 10, 2018, the local tax authorities have notified the film and television production companies, brokerage companies, performing arts companies, and star work in the region.High -income employees such as rooms such as rooms and film and television industries have carried out self -examination and self -correction of taxation taxes since 2016.Film and television companies and practitioners who have seriously checked their own self -correction and actively pay taxes before the end of December 2018 will be exempted from administrative penalties and will not be fined.

This is the opportunity to wash your mind to the entertainment industry, not to mention that there are a certain lesson that a certain artist has had a tax evasion of more than 800 million.To citizens' obligations, make examples of examples.

However, under such a situation, Zheng Shuang's crime committed the crime. In the performing arts project participated in the film and television industry's tax order in 2018, the yin and yang contract evaded taxes, and the typical non -convergence and no hand.

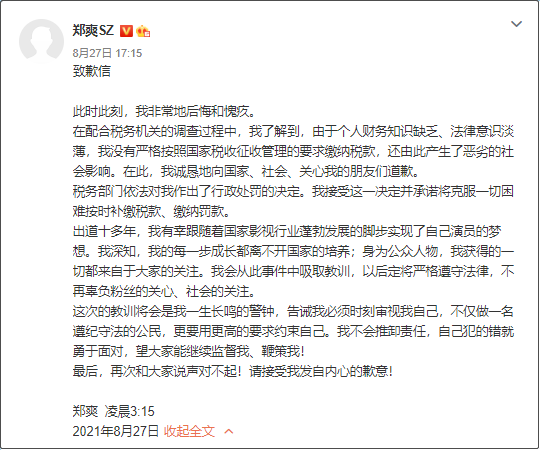

In the apology statement issued in the early morning of August 27, Zheng Shuang said: Due to the lack of personal financial knowledge and weak legal awareness, I did not pay taxes in accordance with the requirements of national tax collection management, which also caused a bad social impact.

Since 2018, the country has three orders and five applications, knowing that it is not necessary to do it. It is not a simple lack of financial knowledge and a weak legal awareness.

Some netizens are concerned, will she be punished by criminal punishment?Article 201 of the Criminal Law of the People's Republic of China stipulates that if the taxpayer has evaded the taxation of taxes, after the tax authority issues a notice of recovery in accordance with the law, the tax should be paid.Responsibilities; however, except for being punished by criminal penalties for evasion of taxes within five years, except for more than two administrative penalties for secondary administrative penalties.

For the first time, Zheng Shuang was punished by tax evasion by tax evasion for the first time and had not previously punished criminal penalties for evading taxes. The corresponding tax and late funds had been paid within the prescribed period.If it can pay a fine within the prescribed time limit, it will not be held criminally responsible according to law; if the fine is not paid within the prescribed period, the tax authority will be transferred to the public security organs for treatment according to law.

One of the reporters in this case, Heng, was also filed for inspection for helping Zheng Shuang's tax evasion.Relevant enterprises are suspected of providing convenience for Zheng Shuang to split contracts and conceal film rewards, helping Zheng Shuang's tax -related violations such as tax evasion, and the tax department has also made separate cases in accordance with the law.

This shows that in the face of the law, everyone is equal.Whether it is a star artist, a corporate owner, a party member and a cadre, or an ordinary people, taxation is the basic obligation to pay taxes in accordance with the law.

Furthermore, taxation is an important means to regulate the gap between the rich and the poor.China is a socialist country. Common prosperity is the essential requirements of socialism. We must never accept the wealthy people who are tired, and the poor people eat the chant.There are an incompetent gap between the rich and the poor.