Author | Xiao Wang

Edit | Pudding

Produced | Prism Middot; Tencent News Xiaoman Studio

Since starting a business at the age of 33, Lu Zhiqiang has almost never lacked money.

This Shandong man who went to the sea from the position of deputy director of the Office of the Weifang Technology Development Center of Shandong in 1984, advanced from the field of education and training into the real estate industry. The following year, the Shandong Oceanwide Group was established for the registered capital of 730 million yuan.And the flagship of the overpacdering empire in the future.

Lu Zhiqiang is an evergreen tree on the list of major richest people, and has occupied the richest man in Shandong all year round.In the Hurun Rich List in 2020, Lu Zhiqiang ranked 66th with 62 billion yuan. China Oceanwide Holding Group Co., Ltd. (hereinafter referred to as Oceanwide Group) reached 295.736 billion yuan at the end of 2020, and net assets were 59.407 billion yuan.Cross -real estate, financial holding, and strategic investment sector were crowned by the market as the mainland Li Ka -shing.As the earliest giants, Lu Zhiqiang is one of the founding shareholders of Minsheng Bank.

At the same time, as the core member of the Taishan Association of the top private enterprise Furniture Furniture, Lu Zhiqiang has a wide range of connections and is known as the big man behind the big man.

According to the First Financial Daily, when Wanda Commercial Real Estate was listed in 2014, Wang Jianlin especially thanked his elder brother Lu Zhiqiang in his speech.In 2016, Lu Zhiqiang even threw 25 small targets to support the listing of Wanda Film and Television.

According to the southern weekend report, Lu Zhiqiang and Lenovo's founder Liu Chuanzhi also had many years of friends.In 2004, Lu Zhiqiang's excessive funds were in a hurry, and Liu Chuanzhi stretched out a helping hand to help him overwhelm the difficulties. During the Lenovo's stock reform in 2009, Lu Zhiqiang invested in Tao reported Li to take over the state -owned shares to assist the old friends in the seat of the chairman of the stability.

Jack Ma is also a member of the Taishan Association.According to the prism authors, Lu Zhiqiang is one of the few friends who hold the most equity of Ant Group in the circle of friends.If the Ant Group is successfully listed, the market value of Lu Zhiqiang's related shareholding at the issue price has exceeded 5 billion yuan.

Today, Lu Zhiqiang is experiencing a dark moment in the 36 years since its entrepreneurship, and the overthrow wheels created by one hand are on the verge of stranding.Equity is frozen auction.Lu Zhiqiang, who should have enjoyed the year, had to be discharged from the hospital and rushed back to the country, running on the front line of debt repayment.

Boss Lu talked about integrity in the market.It is really difficult now, but I believe he will keep his promise, even if he needs to abandon most assets.However, financial institutions and society are needed to give a certain understanding and time.Zhang Ming, a senior financial market person close to the Oceanic Group, told the author.

On July 29th, the stock price of the most important listing platform of Pan Marine Group's main listing platform reached a record low in history and closed at 1.94 yuan/share, which is more than half of the stock price of about 4.5 yuan/share last year.

60 billion rich people are trapped in debt black holes

If the money can come back this time, I will only deposit banks in the future.Investor Wang Min purchased a private equity product issued by the Minsheng Wealth of the Oceanwide. The threshold for buying was 1 million yuan. Originally, it expired at the end of March this year. Now he can only wait for the Buddhist department.I bought a low -risk rating product.

Like Wang Min, Li Jie is also anxious and helplessly waiting for the various progress of the disposal of Oceanwide debt.The 10 million yuan of people's livelihood trust products he purchased originally expired in February this year, and is now required to be extended for half a year or a year of redemption.

Minsheng Trust and Minsheng Wealth are all institutions of Oceanwide Group.The Oceanic Group and its unanimous actors are the controlling shareholders of the Oceanwide Holdings. In fact, the controller is Lu Zhiqiang.

On July 28, Longheng Capital, controlled by Oceanwide Group, stipulated that the loan agreement was triggered, and the Minsheng Bank of Minsheng Bank, which was pledged at 142 million H shares, has a market value of about 460 million Hong Kong dollars.On July 14, Minsheng Bank disclosed that 3888.8 million shareholders' bank shares held by Oceanwide Group will be auctioned, with a total market value of about 1.6 billion yuan.

Earlier June, two batches of Oceanwide Holdings stocks held by Oceanwide Group had been hung on the auction table, with a total market value of about 1.3 billion yuan.On July 28, the Oceanic Group reached a settlement with the creditors, and the second batch of nearly 331 million shares was canceled.

Although the unanimous actors such as Lu Zhiqiang and the Oceanwide Group still hold the stocks of Minsheng Bank with a market value of about 10 billion yuan, 99.88%of them have been pledged for financing;Stocks, but more than 90%of them have been pledged, and the cumulative frozen shares have reached 21.38%.

Although Oceanwa Holdings claims that the auction of shares will not cause the company's controlling shareholder and actual controller to change, the constant stock price may detonate the gunpowder barrel of the large proportion of equity pledge.

In order to boost investor confidence, Oceanwa Holdings also threw a stock repurchase plan in January, intending to repurchase some shares for no more than 4.75 yuan/share, totaling 300 million to 500 million yuan.This failed to recover the decline in the stock price of Oceanwide Holdings. As of now, Oceanwide Holdings has not yet performed repurchase.

On July 1, Tianyancha showed that Lu Zhiqiang and Oceanic Holding Group Co., Ltd. became a series of lawsuits, with a total of 4.999 billion yuan.

In the open market, a technical default of 280 million US dollars in bonds of overseas offshore subsidiaries have a technical default.After the issuance of US $ 166 million in private equity notes, the Oceanwide promised to be paid before August 23 on August 23.

Multiple loan litigation is still on the road.According to statistics from prism authors, since March, the domestic appeal amount disclosed by Oceanwa Holdings has exceeded 4.7 billion yuan and US $ 214 million (equivalent to 1.388 billion yuan).Some financial institutions have applied for some of the land assets of Wuhan Company.

On March 28th after the overdue of Minsheng Trust and Minsheng Wealth products, Lu Zhiqiang stated in the letter of investor that he is accelerating the introduction of strategic investors, increasing asset disposal strength, etc., and plans to strive for in July, October, 10, 10Complete the redemption at the time of February 3.

In the report, the rating agency Dongfang Jincheng pointed out that in June to August of 2021, the balance of Pan Sea Holdings expired and returned to the domestic bond principal balance of 3.7 billion yuan, and the bond concentrated redemption pressure was greater.The 2020 report of the Oceanic 2020 shows that the amount of non -current liabilities expired within one year is 29.257 billion yuan.

At the end of May, the main rating of Oceanwood Holdings was lowered in about a week, from AA+to A, and the rating outlook maintained negative.

We rarely reduce the rating of a company in such a short period of time, which shows that the company's condition is not optimistic.Some people from rating agencies analyze the author, and the rating to A to A also means that it will be difficult to pay debt financing in the open market in the future.

There are some hidden payments in the sea that have not been disclosed.The author noticed that the Oceanwide Wuhan Company increased its capital and expand its capital in 2018 and received 7 billion yuan in Hangzhou Lujincing's investment.In 2020, the sea is called the operation of Wuhan Company and further introduced the convenience of strategic investors. It decided to transfer all the equity of all Wuhan subsidiaries held by Hangzhou Lu Jinting.

When responding to the Shenzhen Stock Exchange's inquiry letter in June, the Oceanic said that as of the end of 2020, the company's cumulative payment of equity transfer funds was only 348 million yuan.

According to the data, Hangzhou Lu Jinting's main funding institution is Beijing Zhongcai Longma Capital Investment Co., Ltd., which is a private equity investment platform initiated by the Central University of Finance and Economics.On July 7, Zhongcai Longma Capital disclosed to qualified investors the arrangement of overpackers on the postponement of equity acquisition.

Sun Hongbin helped to help nearly 15 billion yuan

With debt, Lu Zhiqiang can only continue to sell assets in the sacked pocket.

There is a tradition of mutual assistance among the members of the Taishan Association. The members helped Shi Yuzhu pay off the debt and the resurrection of Dongshan in 4 years.Although Taishan will be dissolved, as the core of the formerPersons, Lu Zhiqiang showed his powerful resources and circle of friends in the process of disposal assets.

According to the prism authors, Oceanwa sold Shanghai Dongjiadu and the Beijing Oceanwa International Residential Land assets in early 2019 to Sun Hongbin's Sunac Real Estate for Sun Hongbin.And selling Zhejiang Sea Construction Investment Corporation, the United States International Data Group, and some of the assets of Wuhan, the Changjiang Securities purchased the headquarters office building from the Oceanwa's hands, etc. The Oceanwide Holdings has achieved nearly 24 billion yuan of funds.Behind multiple transactions, there are the shadow of Lu Zhiqiang's business friends behind the receiving parties.Among them, Sunac and Greentown were originally real estate industry, and they also said that they had to take over real estate assets, but some of them were very obvious to help friends temporarily cross the difficulty.

For example, on January 21, 13.49%of the equity of Minsheng Securities sold Minsheng Securities was sold to Shanghai Quanquan Enterprise Management Co., Ltd. at 2.364 billion yuan.The villagers also hold positions in the National Federation of Industry and Commerce.

On June 24th, Sunac acquired Zhejiang Oceanic Construction Investment Corporation for 2.2 billion yuan. The acquisition clauses specifically mentioned that the acquisition of assets does not include the owner of the people's livelihood trust equity, the Hangzhou overthrow international center, etc.The company or designated party has the right to repurchase by June 23, 2022.

In addition, the author also noticed that the investor of the CITIC Industry Fund changed, and the Oceanwide Group withdrew, replaced by Shanghai Haixing Asset Management Co., Ltd., and the shareholders behind it were the China Ship Else Mutual Protection Association.Both the Pass Else Mutual Protection Association and the Oceanwide are the initiated shareholders of Minsheng Bank. Song Chunfeng, the general manager of the Bao Else Mutual Protection Association, has long been a director of Minsheng Bank with Lu Zhiqiang.In media reports, they often advance and retreat on many voting voting matters.

In the disposal of the San Francisco project transaction, the Lenovo Investment of Lenovo, the old friend Liu Chuanzhi, also appeared.Hongyi's authorized representative John Huan Zhao is the English name of Zhao Linghuan, chairman of Hongyi Investment.At the end of March 2020, Hongyi replaced the quotation of US $ 1.02 billion in previous private equity funds with a quotation of US $ 1.2 billion. It was intended to acquire the San Francisco project of the overtime.

Ma Yun's figure has not yet appeared in a list of assisted assets to disposal assets. Its Ali system representative Ali Mom Software Service Co., Ltd. appeared in the recent aid of Suning. Suning Tesco was also deeply trapped in debt crisis.

Some are too busy, and some can avoid it.Li Jiang, a senior financial market observer, told the author.The Oceanwide Group, with a total asset of nearly 300 billion yuan, is already a behemoth, and it is difficult for general private enterprises to be able to rescue the predicament.

As of the end of 2020, the total assets of Oceanwide Holdings were 181 billion yuan, net assets were 16.6 billion yuan, and the asset -liability ratio was 80.67%.Zhang Ming, a senior market person close to the sea, told the author that the sea of sea is not debt, and the financial assets and real estate resources held are relatively high quality.However, in the process of disposal, finding good sellers, disposal progress, and whether buyers will take advantage of the opportunity to complicate prices.It has been time to sell assets to improve liquidity, but which assets are prioritized and which assets are the capitals that Dongshan will come back in the future.It also requires the marketing parties to give understanding and time.

Lu Zhiqiang's Dream of Gold Control and Internationalization

Regarding the current liquidity problem, the overall interpretation, the company is affected by the macroeconomic environment, the policy regulation and control of the real estate industry, the regulatory environment of the financial industry, and the superposition of the multi -round epidemic at home and abroad. In particular, the company's main assets are located in Wuhan.Models and development have caused significant negative effects.

Back to this crisis, the dangerous seeds may have been buried 5-6 years ago, but Lu Zhiqiang did not notice it at the time, but was regarded as a major opportunity.

In 2014, the growth rate of the real estate industry slowed down, and the real estate -owned pan -sea holding decided to start a strategic transformation.As one of the founding shareholders of Minsheng Bank, Lu Zhiqiang tasted the sweetness in the financial business. The Oceanwide Group has already deployed financial licenses such as Minsheng Securities, Minsheng Trust, and Minsheng Futures.

At that time, Oceanwa Holdings proposed that the financial control group that created a full -scale financial license was the core goal of the company's transformation. It is necessary to build the company into a comprehensive holding company for real estate+financial+strategic investment.In order to support the company's strategic transformation, Lu Zhiqiang returned to the board of directors of the Oceanwide Holdings in May 2015.

Subsequently, through the operation of acquisition and capital capital increase, the Oceanic Holdings successively included financial assets such as securities, trusts, and insurance held by the controlling shareholders into the platform platform.

In 2013 in 2013, Oceanwa announced the opening of the first year of internationalization.This year, Oceanic has established a development platform in Hong Kong, China to acquire the Los Angeles project in the United States.In the future, the company will make full use of the relatively loose financing and market environment in Hong Kong, China, and launch an overseas financing plan in a timely manner.Pan -sea mentioned in the business plan of that year.

In 2014, Oceanwa acquired the FIRST MISSION project in San Francisco, and plans to build a second highest landmark building in San Francisco.The following year, the tentacles of Oceanwa extended to New York, Hawaii, etc., and acquired Indonesian power plant projects.In March 2017, China ’s Oceanic completed the acquisition of the US International Data Group (IDG), and said it was an important milestone in its asset diversification and internationalization process.

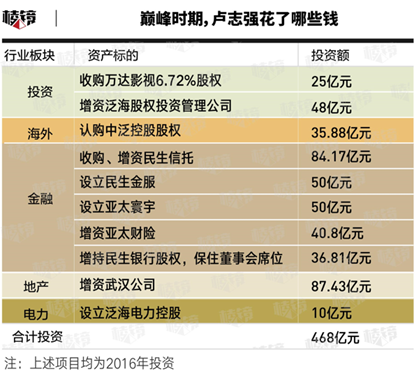

Pan -sea investment reached crazy in 2016, and its annual investment was as high as 46.8 billion yuan.

This year, in order to keep the board seat at the board of directors of Minsheng Bank, Lu Zhiqiang spent 3.681 billion yuan to increase his holdings of Minsheng Bank.In addition, it also contributed a 6.72%stake in Wanda Film and Television, which was acquired by 2.5 billion yuan.

In terms of real estate business, overturning has increased capital of 8.7 billion yuan for Wuhan companies; in the financial business sector, acquisition and capital increase of people's livelihood trusts cost 8.4 billion yuan, capital increase equity companies 4.8 billion yuan, invest in establishing 5 billion yuan of Minsheng Financial Services Holdings, increase capital of Asia Pacific FortuneIn addition, the investment of 1 billion yuan was established to set up an overall power holding of 1 billion yuan, the investment of 5 billion yuan to set up Asia -Pacific Union, and subscribed for 3.6 billion yuan in the equity of Pan -Holdings.Among them, the Asia -Pacific Union signed a merger and ordering agreement with the US Genworth Financial Group (Global Long -term Nursing Insurance Giants) in 2016, and plans to acquire the latter all shares for $ 2.7 billion.

The flowers are brocade, cooking oil.The big mergers and acquisitions brought about the expansion of the scale of overthrow -controlled assets, and the capital market was better. In 2015 and 2016, Lu Zhiqiang's wealth increased significantly, reaching the best level on the Hurun Rich List MDASH; MDASH; the body reached 85 billion yuan,Squeeze into the top ten in the top of the wealth.

During this period, Chinese companies including HNA, Fosun, Wanda, and Anbang were generous overseas.In the United States Legendary Courtyard, HNA acquired Virgin Airlines, Hilton Global, Deutsche Bank, and so on.

As everyone knows, the risk of overseas mergers and acquisitions has been alert by the regulatory authorities, and a regulatory storm is about to attack.

He doesn't know the taste of lack of money

In June 2017, the financial regulatory authorities demanded that large banking institutions investigated the credit risks of Overseas M & A companies such as Anbang, Fosun, and Wanda, and cross -border mergers and acquisitions financing policies began to turn.

Li Jiang told the author that the well -known domestic private enterprises entering overseas do not have an advantage when financing overseas. It is mainly used in domestic insurance and foreign loans, that is, domestic asset mortgage is provided, and foreign branches of Chinese financial institutions or international banksProvide financing.This is not only to leave risks to domestic financial institutions, but also worry about capital escape and transfer assets.

Oceanic also slowed down the pace of overseas investment, indicating that resources are concentrated on optimizing stock projects.However, at this time, the US real estate development project has invested US $ 2.722 billion, the Indonesian Mianlan coal -fired power generation project has invested US $ 375 million.Expect.

On the other hand, the old home real estate of the OceanwaFinancial and new direction are all capital -intensive industries, and real estate financing is constantly tightening. The financial business has also opened strict supervision and deleveraging. Overwater overtowing foreign investment has increased significantly, the overturn liability ratio is high, and the capital chain has begun to be tight.

Real estate transformation of finance, when it comes to leverage, is double killing.Zhang Ming said.

The annual report of the Oceanwide years shows that since 2015, in addition to bank loans and trust financing, Oceanwa has raised funds through multiple channels such as non -public issuance of stocks, issuing corporate bonds, medium -term bills, and US dollar bonds.

In order to cooperate with real estate regulation, the financing channels of real estate companies are constantly restricted. In 2019, the financial regulatory authorities interviewed some trust companies to require the control of the business growth and strictly implement the total requirements for housing and housing.

The author noticed that from the end of 2018 to the end of 2019, the end -of -the -end financing balance of the Oceanwide Holdings dropped sharply by 34.8 billion yuan, of which the trust financing balance fell by 40.867 billion yuan, bank loans fell 7.644 billion yuan, and bond financing balance fell 2.809 billion yuan, not banks, not banks.The loan increased by 13.873 billion yuan, with an average financing cost of 11.28%.

In 2015, after the sweetness of non -public offering of 5.75 billion yuan, Oceanic Holdings planned to promote a non -public offering stock financing of up to 15 billion yuan in early 2016 for it for the development of key real estate projects and increased capital to Asia PacificProperty insurance.The matter was approved by the CSRC issued by the Securities Regulatory Commission in July 2016, and it has not been able to get the final approval.In fact, at the end of the month of the examination and approval, according to the People's Daily Online, the CSRC has not allowed real estate companies to supplement mobile funds through reinforcement.loan.

Four years after the extension, the Oceanic Holdings eventually announced in November 2020 that the above -mentioned non -public offering of shares was terminated.Compared with the initial issue price of the plan, the issue price of not less than 9.36 yuan/share. At this time, the stock price of Pan Sea Holdings has been cut over half and hovering at 4 yuan/share.

The bad news of the pan -sea sea is more than that.

As its crazy expansion, real estate sales, as a traditional advantageous business, provided stable cash flow for the company's transformation.In 2016, its real estate business revenue reached 18.545 billion yuan, which was doubled from 2015.However, since 2017, due to the continued influence of rigorous regulation, the key real estate projects of Oceanwide failed to obtain pre -sale permits as scheduled, late entry to the market than expected, etc. The cash flow contributed by the real estate business has fallen sharply.From 8.255 billion yuan in 2017 fell to 2.806 billion yuan in 2019. The operating revenue affected by the epidemic was only 2.135 billion yuan in 2020, and the operating profit loss was 3.921 billion yuan.

Lu Zhiqiang's high hopes of financial business contributed 9.629 billion yuan and 11.881 billion yuan in operating income in 2019 and 2020.However, in 2020, due to the risk incidents such as the Minsheng Trust stepping on Lei Wuhan Golden Phoenix Jewelery, the preparation for impairment of the Ocean Sea Holdings in 2020 reached 2.253 billion yuan, and the profit was significantly narrowed to 1.019 billion yuan.

Minsheng Bank once brought huge investment income and dividend returns to Lu Zhiqiang. As one of the major shareholders, Lu Zhiqiang had obtained a large number of related loans from Minsheng Bank, which once caused Zhang Hongwei and other shareholders of Dongfang Group to turn his face.Lu Zhiqiang also pledged a large proportion of Minsheng Bank's equity in the large proportion of Minsheng Bank to financing.

This is different from the past.Regulating the requirements for strengthening related loans, banks will no longer become a withdrawal machine for major shareholders.Yuan Guijun, deputy governor of Minsheng Bank, said at the 2020 shareholders' meeting that the bank has implemented strict group credit management of major shareholders since 2018.

On the other hand, Minsheng Bank has not developed in recent years. Compared with Lu Zhiqiang, the stock price has fallen by 20%-30%.In addition, Minsheng Bank was severely fined 108 million yuan by the CBRC last year. The case of violations of laws and regulations included: multiple shareholders exercised voting rights at the shareholders' conference under the proportion of equity pledge.

Boss Lu had almost no money in the past, and did not know what the lack of money was.When investing and acquisition of assets, they did not carefully consider the problems of cash flow and return cycle.You see that at that time, many assets acquired at that time did not make money for a long time.Li Jiang told the author that when the development direction of enterprises and the country's industrial guidance are deviated, and the external financing environment suddenly tighten, it is almost possible to enterprises. It tests the entrepreneur's grasp of the trend and the courage of the trend.

Miss the best time to miss the broken arm

As the financing wind direction mutations, Wang Jianlin began to sell assets crazy.In July 2017, Wanda sold 13 cultural tourism projects and 77 hotel assets to Sunac Real Estate and R & F Real Estate, respectively.

According to media reports, the above -mentioned hotel assets are equivalent to 40 % off.According to the data of the Hurun Rich List, in 2017, the wealth of the Wang Jianlin family shrinking by 28%decreased by 60 billion yuan, and the richest man once became a laughingstock at the street.

At the time of the lack of liquidity crisis in the liquidity crisis in the past two years, the above -mentioned transactions were repeatedly mentioned.

Some Chinese investment executives once told the author that he admired Wang Jianlin's decisiveness and execution of his arms.At that time, the market thought that Wang Jianlin had lost, but looking back, it won valuable vitality for Wanda.

Lu Zhiqiang, a brother of Wang Jianlin, did not notice the change of wind direction.Lu Zhiqiang may think that with his resources and abilities, the sea can be used to make the financing environment better.

It's just that this expectation has fallen.

Until January 2019, the sea of sea began to sell some assets, and the Beijing project and Shanghai Dongjiadu assets were sold to Sunac.Because of the epidemic, the San Francisco project has not been sold as scheduled.

The best profit and performanceMinsheng Securities began to increase its capital and expansion and introduce strategic investors in 2020. From this, Minsheng Securities shareholders have increased from 6 to 46.After a series of equity transfer, the shareholding ratio of Pan Marine Holdings fell sharply from 87.65%by April 2020 to 31.03%, with a repayment of nearly 9.4 billion yuan.

Li Jiang told the author that financial licenses are still very attractive to capital, but like the above zero crushing ground and selling, it is difficult to attract the capital consortium that intends to lay out securities licenses.This may be because the Oceanic still wants to retain a controlling stake in Minsheng Securities.

Today, this persistence has become futile.On July 19, Oceanic Holdings signed an agreement with Wuhan Financial Holdings (Group) Co., Ltd., which plans to sell not less than 20%of Minsheng Securities.Based on the transaction price calculation in January this year, Oceanwa Holdings is expected to return at least 3.5 billion yuan through the transaction.Once the transaction is completed, the Oceanic Holdings will lose a controlling equity to Minsheng Securities.

However, the author noticed that during the addition and transfer of the above -mentioned equity, there were Luoyang Lier and Zhuhai Longmen Zhonghong Equity Investment Company initiated a lawsuit or arbitration to the sea.Share delivery.On July 27th, due to disputes in the 1.4 billion lease price, 3.5 billion shareholders' student student student students held by Oceanwide Holdings were frozen.This may affect the above equity transfer process.

In the inquiry letter of the Shenzhen Stock Exchange at the end of June, Oceanwa stated that the specific measures to deal with short -term debt due this year include increasing the entry of residential projects, actively recovering various receivables, and accelerating the treatment of domestic and overseas assets, while accelerating at the same time to acceleratePromote the completion of the subsidiary's equity leadership work.

Dongfang Jincheng pointed out in the latest follow -up rating report that the current real estate projects of Oceanwa are mainly located in Wuhan and overseas.The company's land reserves are mainly based on commercial properties. There are fewer residential projects, and the cost of land is relatively low. In 2021, the available projects are mainly located in Wuhan, with an available area of 817,700 square meters.However, at present, the project of Wuhan Central Business District is basically in a loan mortgage. The limited book value at the end of 2020 was 17.846 billion yuan, with a limitedity ratio of 86.55%.Overseas, as of the end of 2020, the total investment of the United States U.S. Real Estate was 19.47 billion yuan. At present, there is basically no sales return.

Large -scale asset management companies who acquired real estate projects told the author that the current residential land is more popular in the market, and the land reserves of overpackers are mainly commercial in business. The proportion is high and it is difficult to handle.

In 2020, the revenue of the financial business sector of Oceanwa Holdings was 11.881 billion yuan, contributing 84.52%of revenue.However, the financial subsidiary continued to lead the war.

Dongfang Jincheng pointed out that the current Hercho Holdings currently holds about 5.1 billion shares of Minsheng Securities, of which 5.081 billion shares are pledged and involved in equity transfer disputes and contract disputes.The people's livelihood trust stepped on the risk incidents such as Lei Wuhan Jinhuang in 2020, and provided a credit impairment loss of 2.114 billion yuan. At the same time, due to the new rules and market fluctuations of capital management, net profit loss was 449 million yuan, and the company's non -performing asset rate was higher.

The shopping mall has been galloping for 36 years, and Lu Zhiqiang has experienced several rounds of economic cycle fluctuations safely before. Why is it now in a crisis of liquidity?

The response was slow when the policy changed.Perhaps we overestimate their sensitivity to policy changes, and their past experience judgments are not enough.It may also be that the understanding of policies cannot keep up with the times, and the transformation is slow.Zhang Ming said.Some people are cruel, but they are also very realistic.

On July 5th, the consortiums consisting of Jiangsu State -owned Assets and Ali, Xiaomi, and Midea invested in Suning Tesco for 8.8 billion yuan.After the transaction was completed, Zhang Jindong lost his control over Suning Tesco. Suning Tesco will not have the controlling shareholder and actual controller.

On the list of rich people, the industry of super rich has also changed from clear real estate to today's Internet, new energy batteries, e -commerce, express delivery, drinks and pigs.

After three months, Lu Zhiqiang is about to usher in 70th birthday.Can the pan -sea empire he created in one hand, can he still go to the sea to follow the waves?

(Requirements to the interview objects, Zhang Ming, Li Jiang, investor Wang Min and Li Jie are all pseudonyms)