HNA Group is facing a new challenge as a default on its high-interest peer-to-peer product sparked protests from investors and attention from the government.

Updated at 13:32, September 3, 2018. Reported by Han Biru, Zhang Qi, and Ju Fei from Beijing, Financial Times

Conglomerate HNA Group (HNA, hereinafter referred to as HNA), once a model for Chinese companies' overseas expansion, faces a new challenge at home: middle-aged investors in China who worry that the money they lent to HNA may be wasted, are expressing their views on social media.anxiety.

While HNA has raised $18 billion this year through asset sales, signs of tight liquidity have reemerged.That has sparked concern among investors in HNA's peer-to-peer financing products that they fear they may lose their money, with some complaining they hadn't seen any early warning signs that HNA was in danger.

I haven’t seen any reports of HNA’s problems before, according to a worried investor who works as a real estate broker and put about 1 million yuan of his savings into an 8% interest product sold on HNA’s platform.I certainly would not have invested in these products if I had seen them before.

Two of the products she purchased have expired, but redemption has been delayed; the rest expire this fall.

In late July, HNA shut down one of its peer-to-peer platforms, prompting angry investors to protest at its headquarters on Hainan Island.In August, the company failed to make principal and interest payments to numerous individual investors -- including current and former employees --.

At the same time, the 1 billion yuan bond issued by HNA companies at the height of HNA's liquidity crisis last year nearly defaulted.Zhang Xu, an analyst at Everbright Securities, said that the postponement of bond redemption may be due to short-term debt repayment pressure and the shortage of capital chain caused by the mismatch between current assets and current liabilities.

A former HNA employee put 300,000 yuan ($44,000) from a friend into a 15-day product that pays 16 percent a year.HNA just informed me that the principal and interest of this product had to be deferred and asked me to sign a confirmation letter.When I refused to sign, they ignored me and offered no resolution, the former employee said.

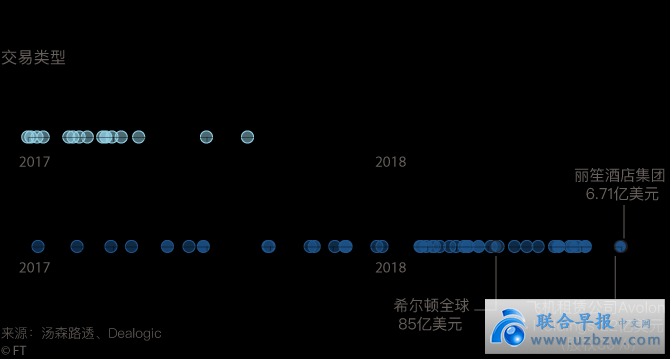

HNA's latest liquidity crunch comes as it has sold assets.HNA has raised nearly $3 billion in funding over the past two months, according to HNA's statement and Thomson Reuters data.That includes selling a $2.2 billion stake in its aircraft leasing unit Avolon and a $671 million stake in its Radisson Hospitality unit, in addition to HNA's roughly $15 billion in sales in the first half of the year.Some of the company's efforts to cut debt have also proven effective.In the first half of this year, HNA's total debt fell to 542 billion yuan, down nearly 10 percent from the end of 2017.

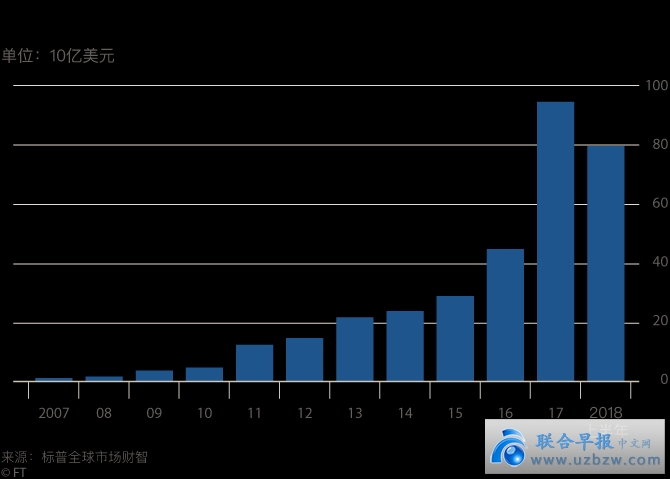

The sudden turn in the company's fortunes has been startling.After a two-year, $40 billion acquisition spree, HNA hit a cash crunch in the fourth quarter of 2017 as China cracked down on corporate overseas acquisitions.Regulators also prohibited an HNA subsidiary from raising funds for HNA through the sale of life insurance products.

A new danger looms as peer-to-peer investors band together to coordinate and organize protests via social media.Although HNA is now subject to a committee of bank creditors, its fundraising from individual Chinese investors has yet to be put under a magnifying glass - as the Chinese government becomes concerned about the social impact of China's shadow lending market.This could prove to be a politically thorny issue.

An analysis of HNA's P2P platforms shows that HNA may have raised more than US$1 billion in non-bank financing in recent years.HNA declined to disclose the size of its P2P exposure, but said it would meet its repayment obligations fully responsibly.

With lending resources from domestic banks drying up, HNA has turned to China's peer-to-peer platforms to raise funds using high-interest retail products.Many other Chinese private companies also rely on this shadow financing.

The Financial Times found last year that HNA raised funds through 11 P2P platforms for purposes such as staff training and the purchase of IT equipment.By this spring, most of those platforms were no longer offering new HNA-related products.

On July 30, the Qianhai Air Shipping Exchange, the former P2P platform of HNA Group, was closed.The incident sparked protests.HNA said it would extend the repayment period and develop specific repayment plans for each product, many of which are not yet due.

According to data from the website of Qianhai Aviation Exchange, in more than three years of operation, Qianhai Aviation Exchange has served more than 1.3 million individual users and more than 1,000 institutional users, raising a total of more than 160 billion yuan (US$23 billion).A FT study of its prospectus showed that many of the platform's products were either financed by HNA subsidiaries or guaranteed by HNA Logistics.

In addition, according to calculations by the British Financial Times based on public data, Jubaohui owned by HNA—the investor working as a real estate broker at the beginning—used this P2P platform—which raised at least 40 billion yuan for the company.RMB funds.Jubaohui has 2.9 billion yuan in outstanding current or future debts, according to P2P network data service platform Wangdaijia.

Jubaohui investors who complained about overdue principal and interest payments were told by HNA employees that they would be paid in about 20 weeks, but did not receive any written confirmation.

Less than a week after the closure of the former HNA exchange, Beijing police cordoned off the city’s financial district to contain protests by disgruntled peer-to-peer product investors, including some who bought products issued by HNA-based platforms.

The Chinese government nationalized Anbang Insurance last year in large part because the company relied on insurance products sold to retail investors.

But reports of a meeting of HNA’s creditors hosted by the vice-governor of the People’s Bank of China show that authorities assured HNA’s co-founder Chen Feng in June that HNA was different from Anbang.

Translator/He Li