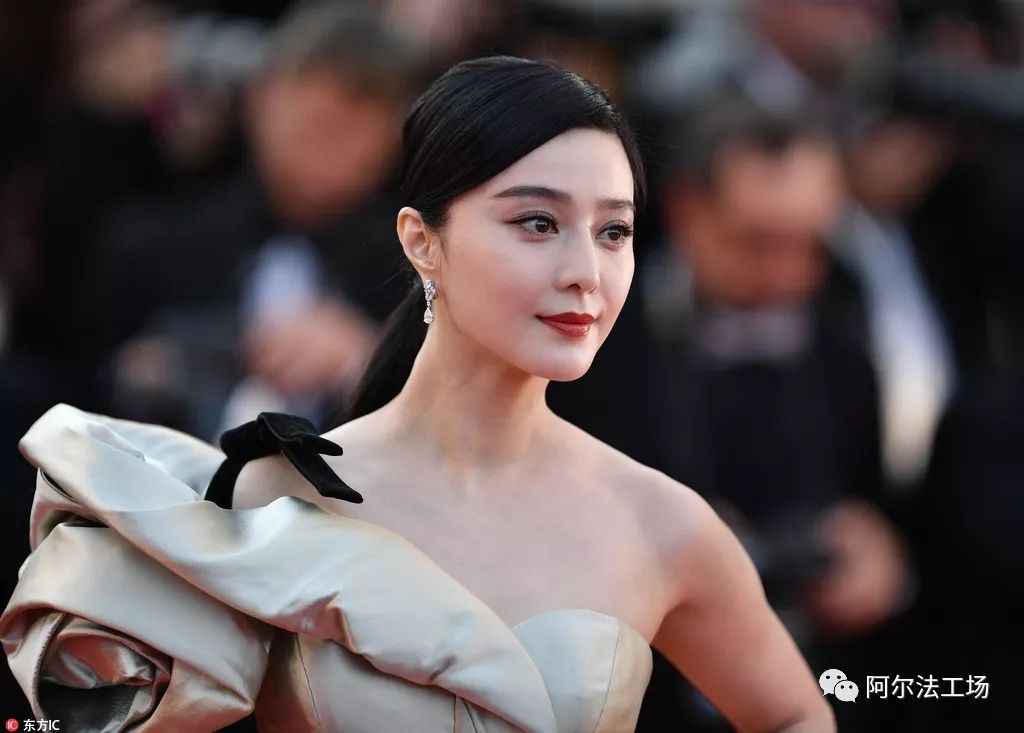

It is rumored in the market that star Fan Bingbing has been investigated by the relevant departments for his suspected yin and yang contracts.

What specific issues Fan Bingbing is involved in requires relevant departments to issue official conclusions after investigation.

However, as far as tax-related issues are concerned, judging from the information disclosed in the financial report of Tangde Film and Television (SZ: 00426), a listed company that is one of the top ten tradable shareholders, whether it is Fan Bingbing or Tangde Film and TelevisionIn itself, it is a fact to find ways to avoid high taxes.

Two rewards

The cooperation between Tang De Film and Television and Fan Bingbing dates back to 2007.

This year, Tang De Film and Television filmed and starred in Fan Bingbing's Rouge Snow, which was broadcast on various local channels, and finally realized an income of 29.47 million yuan, of which Tang De Film and Television received 25.04 million yuan.

Since then, Fan Bingbing has often appeared in Tang De Film and Television's film and television works, until the 2014 release of The Legend of Wu Mei Niang became Tang De Film's first hit with a revenue of over 100 million yuan, and the final income reached nearly 500 million yuan.

The Legend of Wu Meiniang has been in preparation since 2011.Initially, Evergrande's film and television investment ratio was 60%, and Tang De's film and television investment was only 40%.

In 2014, Tangde Film and Television signed an agreement with Evergrande Film and Television. Before the end of March 2015, Tangde Film and Television will transfer the 7.2 million yuan investment fund and 2.88 million yuan fixed income paid by Evergrande Film and Television (40% of the investment fund)One-time payment to Evergrande Film and Television, after which Evergrande Film and Television only enjoys the right of authorship.

Jilin Hongpu Film and Television Culture Co., Ltd. and Guangxi TV Station also enjoy the right of authorship.

In December 2013, Tangde Film and Television signed an agreement with Hongpu Film and Television. The latter invested 10 million yuan and paid an additional 20% of the revenue share after 12 months of investment. The latter is controlled by Jilin TV Station.In April 2014, Guangxi TV station invested 10 million yuan, and the income share obtained after 12 months of investment was 15%.

After receiving the share, the two TV stations only retain the authorship of the TV series, which has nothing to do with the distribution revenue.Only the Beijing TV Branch of China Film Co., Ltd. participates in the sharing of TV dramas.

Legend of Wu Meiniang

According to the prospectus of Tang De Film and Television, the total cost of filming the legend of Wu Meiniang was 293 million yuan. In 2014, the drama contributed 268 million yuan to the company's revenue, and in 2015 it was 198 million yuan, reaching a total of 466 million yuan.The partner's share, the total revenue of this TV series should be around 500 million yuan.

With this TV series, Fan Bingbing received nearly 50 million yuan in return.

Fan Bingbing's nearly 50 million yuan was obtained in two years in 2013 and 2014.The prospectus of Tang De Film and Television disclosed that in 2013, Fan Bingbing received 5.66 million yuan through the Meitao Jiayi (Shanghai) Film and Television Culture Studio as the leading actor in the legend of Wu Meiniang, and 13 million yuan in 2014.

Not only that, but in 2014, Fan Bingbing, as the producer of Wu Meiniang Legend, earned 31.1 million yuan through Jiangsu Fuyuan Sihai Media Co., Ltd., and the total income of the two items was 49.76 million yuan.

In a TV series, Fan Bingbing obtained nearly 50 million yuan in return by virtue of two identities, and shared or transferred his personal income to a third-party company——During the production of Wu Mei Niang Legend, Fan Bingbing received remuneration as a producer and actorTwo company accounts are used.

Among them, the 18.66 million yuan remuneration received as an actor was paid to Meitao Jiayi (Shanghai) Film and Television Culture Studio.Industry and commerce information shows that the sole shareholder of the latter is Fan Bingbing.

In addition, Fan Bingbing's income of 31.1 million yuan as a producer was paid to Jiangsu Fuyuan Sihai Media Co., Ltd., and the industrial and commercial information shows that this company has been cancelled.

However, according to historical records, the major shareholder of this company is Yang Xuemin, who holds 99.4% of the shares, and the other shareholder is Li Qin, who holds 0.6% of the shares.From the perspective of shareholder relationship alone, Fan Bingbing seems to have nothing to do with this company, and the income of 31.1 million yuan she received seems to have nothing to do with it.

However, business information shows that the company under the name of Yang Xuemin is either registered in the same place as Fan Bingbing's Aimishen company, or the phone number left is the same.In the reality show Challenger League that Fan Bingbing participated in, the producer also has Yang Xuemin.

Fan Bingbing in the reality show Challenger League

Why does Fan Bingbing put more income in a third-party company that seems to have nothing to do with him, but is closely connected?

Among the various ways in which the media discusses the tax avoidance of performing arts stars, there are many ways such as corporatization of personal income, diversification of income from multiple jobs, and so on.In the filming of this TV series, Fan Bingbing participated in the production with two identities and two different companies, and only she herself knows the motive.

Due to the high income of performing arts stars, how to avoid tax has become the scope of their consideration, but whether the tax avoidance method is reasonable and whether it involves tax evasion, there is no clear definition of the red line.

There are many methods for film and television stars to avoid taxes, such as setting up studios in tax havens, setting up third-party companies, signing large and small contracts, and being a producer, supervisor, etc. to distribute their pay.

Through the total amount of taxes paid to Fan Bingbing by Tangde Film and Television, the market may be able to get a glimpse of the scale of the stars' tax avoidance.

For these two expenditures totaling nearly 50 million yuan, how much tax did Tang De Film and Television pay and withhold?Because Fan Bingbing is also one of the shareholders of Tangde Film and Television, Tangde Film and Television stated in the prospectus that the company paid Fan Bingbing 52.75 million yuan including tax, which was 2.99 million yuan more than Fan Bingbing's income.

In the process, whether Fan Bingbing has avoided tax and what method to avoid tax, perhaps only he knows.Obviously, if ordinary people get a labor remuneration of nearly 50 million yuan, the tax they need to pay will be dozens of times more.

In the prospectus, Tang De Film and Television clearly stated that Fan Bingbing received more than 30 million yuan as the producer of Wu Mei Niang Legend, but among the final cast and crew, there was no Fan Bingbing among the nearly 20 producers of the TV series.name.

According to the broadcast information of Legend of Wu Meiniang, there are 7 directors and 11 supervisors in the TV series, and Fan Bingbing's name is not included in it.

If Fan Bingbing can get more than 30 million yuan in return just by being a producer, how much should the 7 directors and 11 producers get paid?Fan Bingbing's compensation of nearly 50 million yuan has already accounted for nearly 20% of the total cost of the TV series. The 18 supervisors obviously did not get such a generous return like Fan Bingbing, otherwise the cost of the TV series would be far more than 300 million yuan.

Although Fan Bingbing is not included in the 18-person list of producers, there is one in the list of producers.Fan Bingbing.In the broadcast information of Wu Meiniang Legend, Fan Bingbing is one of the three chief producers, and his manager Mu Xiaoguang is one of the four producers.

Similarly, if Fan Bingbing was paid 31.1 million yuan as the chief producer, did the other two chief producers with the same status also receive such generous remuneration?How much should the 4 producers be paid?

In addition, what is even more puzzling is that before the listing, Tang De Film and Television gave Fan Bingbing nearly 50 million yuan in income, but after the listing, Fan Bingbing transferred all the income back. What kind of transaction is this?

Strange accounts receivable

In 2015, among the accounts receivable of Tangde Film and Television, the coefficients of Sichuan, Hunan and Henan TV stations were listed.The Legend of Wu Mei Niang produced by the company has been shown on Hunan and Henan satellite TVs successively, and the other two TV series The Moon Embracing the Stars and Left-handed Chopper are also broadcast on Sichuan Satellite TV, so it is not surprising.

However, in the list of accounts receivable, Fan Bingbing's Wuxi Aimeishen Film and Television Culture Co., Ltd. (hereinafter referred to as Aimeishen) also appeared in it. The amount of accounts receivable was 48.49 million yuan, and the term was within one year.

Amy God was established at the end of July 2015. At that time, the company's shareholders were only Fan Bingbing and his mother Zhang Chuanmei.According to industry and commerce information, in 2015, Amy God achieved a revenue of 34.68 million yuan, a net profit of 530,000 yuan, and zero tax payments.

Tangde Film and Television received 48.49 million yuan from Amy God, that is, Amy God contributed nearly 50 million yuan to Tang De Film and Television.In less than half a year, Amy God, who has an income of only 30 million yuan, purchased from Tang De Film and Television, which film and television drama, and needs to pay nearly 50 million yuan?

In other words, Amy God is only one of many registered companies under Fan Bingbing, with a registered capital of only 3 million yuan.What about the income of nearly 50 million yuan?

In order to find the answer, the author had to continue to read the 2015 annual report of Tang De Film and Television.

According to the annual report, among the TV series mainly sold by the company, Legend of Wu Mei Niang contributed 198 million yuan, and Left-Handed Knife and Moon Embracing the Stars achieved revenues of 61.82 million yuan and 58.98 million yuan respectively. The latter two TV series have nothing to do with Fan Bingbing.

In addition, Fan Bingbing is related to the Challenger Alliance invested by Tangde Film and Television. Fan Bingbing is one of the guests of this variety show. In 2015, the program contributed 45.75 million yuan to Tangde Film and Television.

Therefore, the TV dramas starring Fan Bingbing and the reality show variety shows he participated in have brought more than 200 million yuan in revenue to Tang De Film and Television.

This means that in 2015, Tangde Film and Television needs to confirm the corresponding costs and continue to pay remuneration to Fan Bingbing's company. Fan Bingbing and his company are suppliers of Tangde Film and Television, not customers.

In the main source of income of Tangde Film and Television, Fan Bingbing and his company seem to have no reason to purchase Tangde Film and Television's works and contribute income to it.

Whether such strange accounts receivable involves Fan Bingbing's tax avoidance behavior is still difficult to determine before there is an official confirmation result; however, as far as Tang De Film and Television is concerned, it is actually a tax avoidance method:

Unlike Khorgos, a tax haven where many of its peers gather together, Tangde Film and Television chose Kashgar, Xinjiang as a tax haven, but the effect of tax avoidance is equally obvious.

Profit Shifting

In 2017, the revenue of Tangde Film and Television was 1.18 billion yuan, and the net profit reached 192 million yuan.Among the subsidiaries that affect more than 10% of the company's net profit, there is only one Xinjiang Chengyu Culture Media Co., Ltd. (hereinafter referred to as Xinjiang Chengyu). Xinjiang Chengyu achieved a revenue of 544 million yuan and a net profit of 238 million yuan that year.

That is to say, in 2017, the income of Xinjiang Chengyu only accounted for 46.1% of Tangde Film and Television, but the contribution of net profit accounted for 123.96%.need more.

This situation also exists in 2016.In 2016, Tangde Film and Television achieved a revenue of 788 million yuan and a net profit of 174 million yuan. Among them, Xinjiang Chengyu achieved a revenue of 329 million yuan and a net profit of 189 million yuan.

The latter's revenue only accounts for 41.75% of Tang De Film and Television's, but its net profit contribution accounts for 108.62%, which is also more than 100%.

In 2015 when it went public and the three years before that, Tangde Film and Television did not have such a profitable subsidiary.

On February 17, 2015, Fan Bingbing and Zhao Wei appeared at the IPO ceremony of Tang De Film and Television

The prospectus disclosed by Tangde Film and Television shows that before its listing, its most profitable subsidiary was Beijing Tangde International Film Culture Co., Ltd. (hereinafter referred to as Tangde Film).

From 2012 to 2014, Tangde Films achieved revenues of 24.98 million yuan, 79.79 million yuan and 26.81 million yuan respectively, with net profits of 11.54 million yuan, 7.41 million yuan and 10 million yuan respectively;191 million yuan, 319 million yuan and 408 million yuan, with net profits of 56.11 million yuan, 63.65 million yuan and 85.71 million yuan respectively.

In other words, whether it is operating income or net profit, the proportion of Tang De's movies is not high.

This means that before 2015, the net profit of Tangde Film and Television was mainly realized by the parent company, and after 2015, Xinjiang Chengyu became the source of profit.

The reason why Xinjiang Chengyu can become the source of all net profits of Tangde Film and Television is closely related to the tax benefits it enjoys.

Xinjiang Chengyu was registered and established in Kashgar, Xinjiang in July 2015, and Tangde Film and Television owns 100% of its ownership.

According to the relevant regulations of the Ministry of Finance and other ministries and commissions, from 2010 to 2020, for enterprises newly established in difficult areas in Xinjiang that fall within the scope of key encouraged development, starting from the tax year in which the first production and operation income is obtained, the first year to theIn the second year, corporate income tax is exempted, and in the third to fifth years, corporate income tax is halved.

Xinjiang Chengyu enjoys the preferential policy of enterprise income tax for key industries encouraged to develop in Xinjiang's difficult areas. Since 2015, it has been exempted from enterprise income tax for 5 years.Therefore, Tangde Film and Television transferred all profits to Xinjiang Chengyu, and its purpose of tax avoidance is obvious.

The effect of tax avoidance is immediate.

From 2011 to 2015, the income tax of Tangde Film and Television was 14.06 million yuan, 19.25 million yuan, 21.28 million yuan, 30.38 million yuan and 33.57 million yuan respectively, and the income tax rate was basically around 25%.

In 2016-2017, the income tax amount of Tangde Film and Television was only 4.65 million yuan and 5.98 million yuan, and the income tax rate was only about 3%.

In 2016 and 2017, the total profits of Tangde Film and Television were 179 million yuan and 198 million yuan respectively. According to the 25% income tax rate of general enterprises, the income tax of Tangde Film and Television was 44.77 million yuan and 49.46 million yuan respectively.After-tax net profit fell to 134 million yuan and 148 million yuan respectively.

20In 6 years and 2017, the total income tax calculated by Tangde Film and Television based on the 25% tax rate was about 94 million yuan, but the actual payment was only 10.63 million yuan. The extra nearly 84 million yuan became the profit of Tangde Film and Television.