The New York Times reported earlier that the Chinese female wealthy market was lost in September last year and had been arrested.Caixin Media further disclosed that Duan Weihong was investigated for the corruption case involving the CPC Chongqing Municipal Party Secretary Sun Zhengcai; Sun Zhengcai assisted her to win the Huadu Center of the Golden Area of the Beijing Golden Area during his time as the secretary of the Jilin Provincial Party Committee.The report also disclosed that the trace of the wealthy woman rely on power to complete a series of transactions that cut cakes from state -owned enterprises.

According to Sing Tao Daily today (1st), 49 -year -old Duan Weihong was from Tianjin. In the 1990s, he was in business in Tianjin. In 2002, he moved the headquarters of Taihong Group to Beijing to become a mysterious female rich.

Caixin quoted sources as saying that in around 2010, a number of companies with a strong background wanted to get the project from the Chiefs Group. Duan Weihong passed the then Secretary of the Jilin Provincial Party Committee Sun Zhengcai to say hello to Beijing Huadu.In addition, it has also passed the approval of the Beijing planning department to expand the Huadu Hotel into the center of Huadu.

According to reports, Duan Weihong became rich before Ping An Insurance, which was listed in 2002.Her Taihong Group, which has spent about 50 million yuan (S $ 108 million), purchased a large number of Pingbao shares from Zhongyuan Group and subsidiaries at a low price, accounting for about 3.2 percent of the total shares. Pingbao was listed in Hong Kong.The stock price was tripled on the first day. In 2004, Taihong Group snatched the Capital International Airport Freight Customs Customs Customs Customs Customs Customs Customs from China Foreign Trade and Transportation Group, covering an area of more than 5,000 acres.Caixin quoted people familiar with the matter and said that Duan Weihong's control of the capital aviation city was greeted by Shunyi District. COSCO was investigated by the executive Qianmei, who had sold Ping An shares to Tianjin Taihong

In 2002, on the eve of Ping An Insurance Company listed on Hong Kong, HSBC acquired 10%of Ping An Insurance's equity at a price of 600 million US dollars and about 5 billion yuan.The price of 9.9%of Ping An Insurance is only 1.2 billion yuan (calculated at HSBC at the purchase price of HSBC, and the equity value of this part is about 4.95 billion yuan), and the loss of state -owned assets is about 3.75 billion yuan.

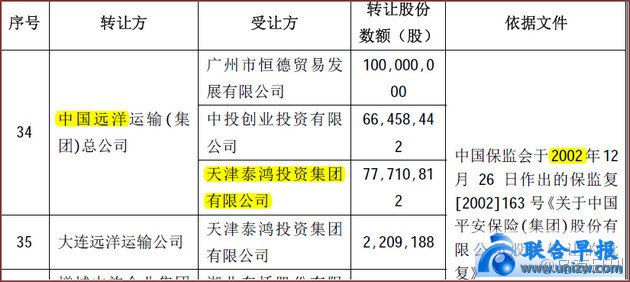

According to a well -known newspaper in the West: According to the documents provided by Ping An's listing in Hong Kong, Taihong first purchased 77.7 million Ping An shares from the hands of the global transportation giant China Ocean Transportation (Group) Corporation (referred to as COSCO), and later from China and YuanThe Dalian branch purchased 2.2 million shares.After the shares were dismantled, Taihong owned the number of shares doubled.Therefore, according to the publicly disclosed documents, in June 2004, on the eve of Ping An's listing in Hong Kong, Taihong held 159.8 million Ping An shares, accounting for about 3.2%of the total shares.In an interview, Duan Weihong said that in order to buy these shares, she spent about 40 cents per share (according to the current exchange rate), totaling $ 65 million.Analysts said that the price seems to enjoy extraordinary discounts, because according to the documents disclosed publicly, in the previous two months, HSBC purchased 10%of Ping An's shares, about $ 1.6 per share.It can be seen that the purchase price of Tianjin Taihong is a quarter of the purchase price of HSBC Holdings two months ago.

Excerpt from Ping An Public Prospectus in China

COSCO Group is not the only involved in selling Ping An Insurance Shares. In addition, there is also an investment in Qin Xiao.In 2002, China Merchants Bureau quietly transferred to the equity of 14.37%of Ping An Insurance (calculated at the acquisition price of HSBC, and the equity value of about 7.2 billion yuan) was quietly transferred to Beijing Yuanxin Xing and Beijing Baohua.Investment companies, the transfer price is only 1.855 billion yuan.Between the transfer, the state -owned assets lost about 5.3 billion yuan, which has not been counted as the value -added income after listing.

Qin Xiao and Wei Jiafu chose to sell Ping An Insurance shares at the same time in 2002, causing huge amount of state -owned assets to lose, which is puzzling.Who has benefited from this low -selling capital case has not yet been made public.The Central Commission for Discipline Inspection continued to investigate the China Merchants and COSCO Group, and expelled the Wei family's Fuzhi sac, the successor Xu Minjie, and transferred to the judicial organs to handle it.However, after the retirement of Wei Jiafu, who was sold at Ping An and Sales, was currently in the United States and did not return to China to cooperate with the investigation, which is doubtful.

With the China Discipline Inspection Commission's filed investigation, the two major crimes of sale at the time: the truth about the China Merchants and COSCO Group, the truth of the safe and cheap case may be in the world. Deputy President Zhongyuan Yuan was expelled from the party, Wei Jiafu, in the United States quot; many old quot;

The Central Commission for Discipline Inspection today reported that Xu Minjie, a member of the former party group and deputy general manager of the COSCO Group, was expelled from the party for serious disciplinary violations and was transferred to the judicial organs for processing.Analysts said that the fixed nature of illegal reimbursement is rare, or it also shows that its behavior is a personal problem and will no longer involve other problems.

The Central Commission for Discipline Inspection today reported that the Discipline Inspection Commission of the SASAC recently conducted a case investigation on Xu Minjie. After investigation, Xu Minjie used his duties to reimburse personal expenses in violation of regulations. His behavior has constituted serious violations of disciplinary violations.Then in accordance with relevant regulations, Xu Minjie was expelled from the party.Its suspected criminal issues and clues have been transferred to the judicial organs to deal with it in accordance with the law.

COSCO Group has not responded to the matter.In early November 2013, when Xu Minjie was investigated, COSCO Group issued a statement saying that our company resolutely implemented the deployment of the party and the country's anti -corruption and integrity, and sincerely accept the supervision of news media and all sectors of society.

Some analysts close to COSCO Group said to NetEase Finance that the disciplinary commission department's expression of Xu Minjie's violations of discipline and law is more specific, and only one illegal reimbursement of personal costs.Its behavior is just that individuals are falsifying, and they are limited to the scope of personal problems and will no longer involve other problems.

Earlier analysis in the industry, Xu Minjie's outstanding problem should be the main time as the post of executive director and general manager of the COSCO Pacific.The above -mentioned analysts said that the report of the Central Commission for Discipline Inspection did not indicate that it had a problem after he arrived at the group, and it was obviously difficult to take the reimbursement procedure at the group headquarters, so the foregoing speculation should be more accurate.

It is worth noting that when Xu Minjie was investigated, the above analysts had revealed to NetEase Finance that this matter is very complicated. It doesWait and see.Facing the official qualitative qualitative of Xu Minjie's behavior, the above analysts said that the current results are a bit unclear.

According to the Times Weekly report last year, Xu Minjie, as a cadre trained by COSCO, was deeply appreciated by Wei Jiafu.People in the industry also generally believe that Xu is Wei Jiafu's lsquo; think tank RSQUO;, even once considered to be Wei Jiafu's successor.

In July 2013, Wei Jiafu, chairman of COSCO Group, officially retired. After Xu Minjie was investigated last year, the industry was also rumored that Wei Jiafu, former chairman of COSCO Group, was restricted to leave the country.In this regard, COSCO Group has rumored that regarding the rumors of lsquo; former chairman Wei Jiafu has been restricted by the relevant departments, there is no basis for the rumors of RSQuo; there is no basis.

The analysts close to the COSCO Group revealed to NetEase Finance that a few months ago, due to the need to leave the audit, this was a normal working process. COSCO Group and Wei Jiafu had a video phone connection.At that time, Wei was in the United States, and in the connection, he found that he was obviously older than when he retired.

After winning Huadu Center, investing in Ping An Insurance and Beijing Jinyu, and controlling Capital Aviation City, Caixin described this that in the past 15 years, Duan Weihong successfully completed a series of transactions that cut cakes from state -owned enterprises.