A number of international financial institutions have recently lowered China's economic growth forecast, and even believed that it may not be able to achieve about 5%of the annual growth goals set by the official setting.As of now, the economic stimulus policies launched by Beijing only target specific fields and specific issues, and more media describes these measures to be "small and small."What economic difficulties do China currently face?Why did you not introduce a large -scale stimulus plan?

What are the difficulties in the economy?

The real estate market is sluggish.Since 2021, due to the regulation of the property market and the tightening of credit, the real estate industry has fallen into a downturn and impacted the Chinese economy.According to Goldman Sachs, this will lead to a decrease of 1.5 percentage points of China's GDP (GDP) this year.

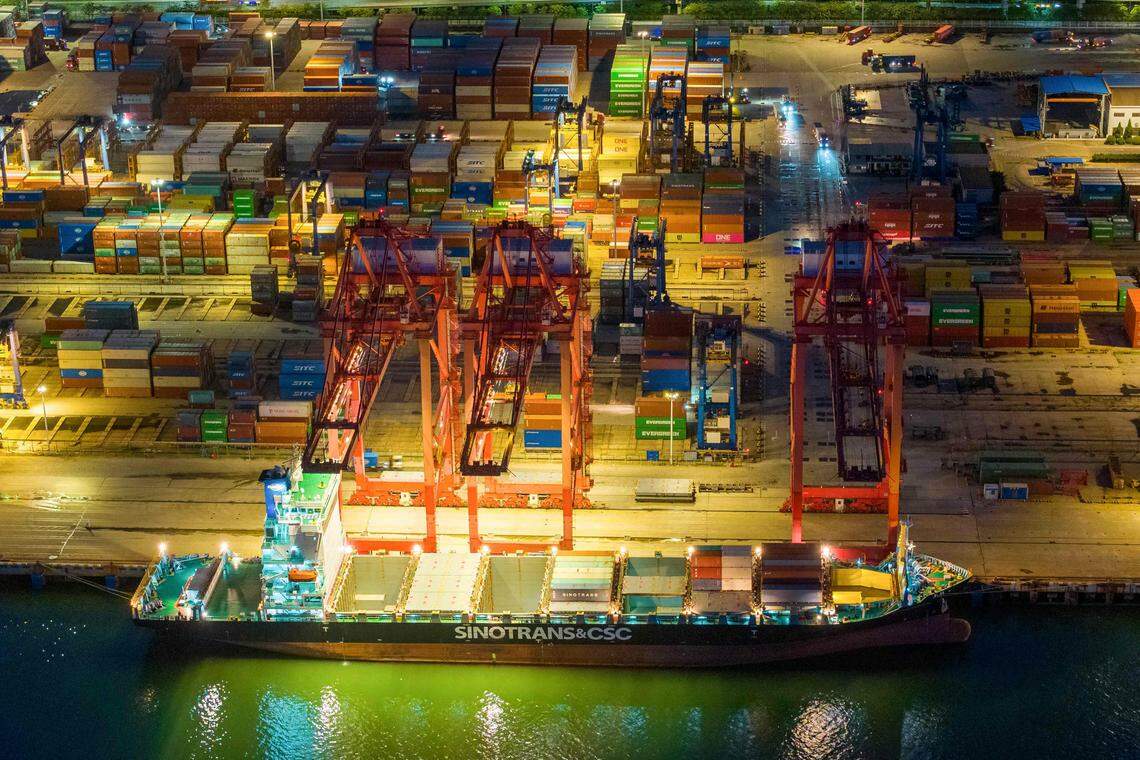

Export and consumption are frustrated.Affected by the weak global demand, China's exports have decreased by more than 10%; after the epidemic, residents' income shrinks, and the employment market is weak, especially for young people's unemployment rates, leading to small consumption.

Private enterprise confidence is frustrated.The three -year -old crown disease impacts the economy. During the period, the official sacrificing strong regulatory measures to the Internet, teaching and training and other industries made private enterprises confident in frustration and affect private investment.

What measures have been launched?

In terms of real estate, first -tier cities such as Beijing, Shanghai, Guangzhou and Shenzhen have implemented the measures of "non -recognition of housing". The official also reduces the proportion of down payment rates of mortgages and requires banks to reduce the interest rate of stock loan.

In terms of private economy, the official rectification of Internet platform companies has come to an end, and the official also promises to support private enterprises. In addition, local governments allow local governments to reinstate financing at low interest rates and boost the stock market by reducing printing duty.

In terms of monetary policy, the People's Bank of China has cut interest rates twice this year, and has adopted stronger measures to support RMB.

What is a large -scale economic stimulus?

The market has been looking forward to stimulating the economy with greater efforts from mid -mid -this year.The large -scale stimulus plan usually contains a series of measures and has huge amounts of capital support. The most typical is in 2008. In the face of the global economic crisis, Beijing launched the "National Ten Articles" expanded by domestic demand, including a series of financial and monetary policies. The total scale contract4 trillion yuan (S $ 745.6 billion).

Why don't you do this time?

First of all, in the official perspective, China's economy is not so bad, the economic fundamentals have not changed, and about 5%of the growth goals are expected to achieve; and there are highlights in the economy, such as the new energy vehicle industry.

Secondly, the large -scale stimulus plan is subject to fiscal tension and local debt restrictions.The three -year epidemic consumes a large amount of government resources. The downturn in the property market also means that the land revenue of local governments has decreased, and the financial stimulus is difficult to make "rice without rice".China's local debt is high, and it cannot be added up.

In addition, the US dollar is in the interest rate hike cycle. If China releases large -scale water, it will lead to continuous flow of funds.Chinese senior management also opposes the issuance of cash to consumers, thinking that this is Western -style welfareism, which can only lead to laziness.

More importantly, the consequences that the large -scale stimulus policy may bring, which is contrary to the goals such as "high -quality development" and "housing and living" pursued by China; the consequences of the 2008 4 trillion stimulus plan areHouse prices and high local debt are nearly doubled.

A series of official statements show that China will not put economic growth in the first place.On Wednesday (September 6), the Party School of the Party School of the Communist Party of China also published a document that China "no longer has the objective conditions of high -speed growth."Next, Beijing is expected to continue the rhythm of targeted stimulation, and will not introduce a large -scale stimulus plan for "large water irrigation".