A entrepreneurial investment fund with a management scale of about $ 700 million in Shanghai opened an office in Singapore last year.Half a year later, the two partners watched all the early Southeast Asian entrepreneurial projects that could be exposed to, but did not shot any.

This fund has been focusing on China for more than nine years, and the investment portfolio is mainly consumption.A partner of the fund told the United Zard that he met about 50 startup teams in half a year, distributed in Indonesia, Singapore and Vietnam. The industry involved electric vehicle manufacturing, beauty products, e -commerce and consumer finance.In his opinion, the number of "50" projects is very small for venture capital companies."In China, I often see two or three different projects a day, but in Southeast Asia, the number of entrepreneurial projects is much less."

But he also pointed out that the founder of the company's appointment is mainly based on Chinese entrepreneurs.

This fund is one of many funds from China that swarmed south of Southeast Asia since 2022.Affected by factors such as the closure control of the crown disease, the tight geopolitical relations between China and the United States, and the Chinese government's crackdown on technology companies, a group of US dollar venture capital funds operating in China for a long time opened a office in Singapore.They look forward to investing in the next Alibaba and bytes in Southeast Asia, continue to write high returns in the Chinese market, and also look forward to the existing investment portfolio companies that are difficult to grow in China can show a grand view overseas.

But soon, they found the gap between reality and imagination.On the one hand, these funds have not shot new projects in Southeast Asia, but they dare not conclude to the development of the Southeast Asian market in a short time.On the other hand, most funds have failed to use the opportunity to set up the Singapore office to become an international fund, telling a new story that moved China to Southeast Asia to solve the dilemma of fundraising.

Obviously, when Chinese venture investors are still looking forward to copying the past growth rate in Southeast Asia, Southeast Asia and even global investors have decided to reduce investment in China, including Chinese funds in the investment portfolio.

from hot fry to Yixing Langshan

Since last year, the Chinese US dollar venture capital fund manager met with colleagues or media and will mention Singapore and Southeast Asia.One of the world's largest private equity summits, the staff of the organizer of Super Return, told the United Zard that more than 100 Chinese venture capital institutions in Singapore in September 2022 participated in the number of Chinese investors since 2019.once.During the meeting, China Venture Capital Media reported that "Singapore has no hotel in September."

The glory of the China Venture Capital Fund, which is depicted by these reports: Investors flocked to Singapore, register a company, open a public account, open a bank account, apply for a work visa, go to Southeast Asian countries on a business trip ... In Singapore for seven years in Singapore, the seven years in SingaporeJapanese investor Lu Ziming told Lianhe Morning Post that after October last year, he frequently received the invitation from Chinese investors on social networking sites."After simple greetings, I will ask, what good items? Can you recommend it?"

The aforementioned fund partners from Shanghai said to the United Morning Post: "At that time, everyone's emotions were a bit pushed up by the external situation. China has been in the event for three years, and everyone has not gone abroad for a long time.I thought of Southeast Asia. "

The popularity of the Southeast Asian market reached a small peak.Singapore's early venture capital company Jungle Ventures partners pointed out to Forbes Magazine in 2021 that the total amount of Venture Capital in Southeast Asia increased by 5.2 times from 2015 to 2020.Bain Company data shows that the total transaction volume of private equity in Southeast Asia reached a new high of US $ 25 billion (S $ 34.7 billion) in 2022.

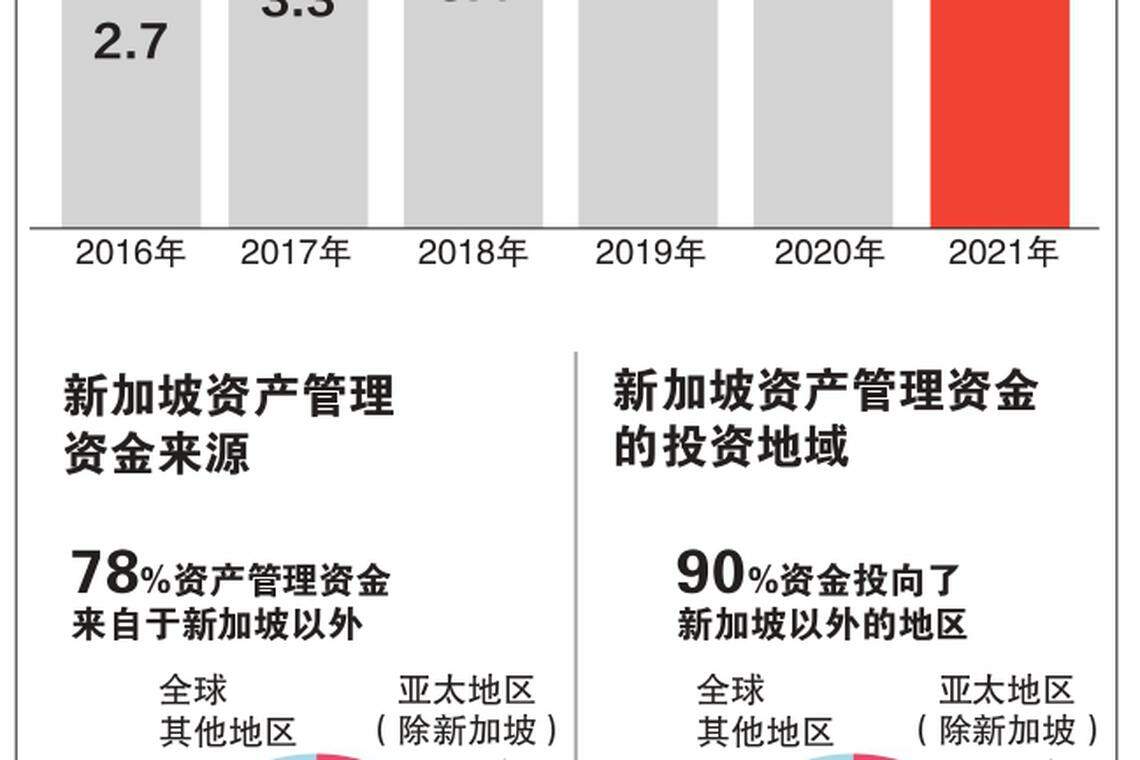

Singapore Deputy Prime Minister Wang Ruijie said at the Caixin Summit in June this year that Singapore supports venture capital and private equity investment to promote the development of innovation and technology.A spokesman for the Singapore Financial Administration responded to the United Morning Post inquiring that the HKMA supports the asset management company to develop business at the base, develop business, and seize the opportunities of Asia and even the world.

Investors who participated in the Super Return Investment Conference last year recalled that the consensus of many Chinese investors at that time was that the next big opportunity was not in the United States or in China.Southeast Asian business.Many people are in a state of "FOMO" (Fear of Missing Out), for fear of missing Alibaba and byte beating that appears near the equator.FOMO is often used to describe the state of being afraid of missing without time.

But at the investment decision -making meeting, when he saw the figures, investors came over again.The aforementioned Shanghai Fund's partner responded that the project he had almost wanted to make money was a company doing electric vehicles in Indonesia.He said that the two founders, a Chinese, and one Indonesian, both returnees and products are good, but "the market is not big enough.""Although Indonesia is already the largest market in Southeast Asia, the GDP (GDP) is equivalent to a Zhejiang Province, and the founder has no plans to open up the Vietnamese and the Thai market."

He also understands that every country in Southeast Asia has its own policies, and the language and culture are different. During the start -up stage of the enterprise, he dare not embrace too much ambition."But the risk fund is still pursuing high -risk and high returns. If the market is not large enough, it means that the future corporate valuation and capital exit channels are not strong enough." In the end, he gave up the project.

Wang Hao, a partner of Yuehai Capital, headquarters in Singapore, told Lianhe Zaobao that according to their statistics, in the first half of this year, only 25 were made by Chinese investors in the 350 Southeast Asian market."These projects in transactions may have seen many Chinese funds, but they don't have much actual investment."

Wang Hao analyzes that the market is decentralized and the valuation of the valuation is low, which may be the cause of Chinese investors."They are not coming for a long time, and they have not adapted to this market yet."

Behind "Looking for more investment"

On the surface, Chinese companies went to Southeast Asia 10 years ago. Chinese capital also participated in Southeast Asian companies such as GRAB, Shein and Donghai Group (SEA), but in fact, the active of Chinese institutions in Southeast AsiaDegree, it has always been worse than investors in Japan and South Korea.

According to statistics from Alibaba Cloud and China's first -level market investment database IT oranges, China's largest market for overseas investment is the development of more mature in the economy and the market that is more uniform in the market.From 2015 to 2021, in the market with the largest number of overseas equity investment in China, the Southeast Asian market has been behind the North American market.Looking at the Southeast Asian market alone, the statistics of Yuehai Capital also show that from 2013 to 2022, China Capital only invested 273.

From last year, the funds that flooded to Southeast Asia were moved south to profit, but it was not simply profit -seeking, and it also meant to avoid risk.In the past three years, in the case of the Chinese government's continuous relations with technology companies, Sino -US relations, and two countries have increased the review of Chinese companies to go public in the United States, relying on the listing of technology companies to withdraw from investing and profitable, the Chinese US dollar fund has fallen into trouble.Coupled with the interference of China's crown disease and control policies for economic development, and many investment restrictions on international geopolitical pressure, many US dollar funds have thought of Southeast Asia.

In the view of Wang Hao of Yuehai Capital, there are many Chinese in Southeast Asia.Two options.

So why did the result "look more and invest less"?There are many objective reasons, but the core is not to adapt to the rhythm of Southeast Asia. Everything is measured by "Chinese standards".Essence

Wang Hao said that what caused this kind of discomfort, one is that Chinese investors have a short market in Southeast Asia and have no deep cultivation. "Some managers just come to see a business trip." The second is to just look at the project of Chinese founders,There are limitations; the third is because the market always feels that the market is too small.

Copy in China Growth Story is unrealistic

Ding Xinyan, the founder of the Singapore Science and Technology Enterprise Incubator Yunu Sega, told Lianhe Zaobao that today's Chinese investors are used to the "big water fish" in the Chinese market.It's bad ".

She mentioned that the rhythm of some Chinese institutions was required to expand the market in half a year. In 12 months, they were required to see growth figures. Three or five years will be promoted to go public.Chinese investors think they are normal, but they are not actually difficult to satisfy any market.Ding Xinyan believes that in such an unrealistic attitude, it is really difficult to make investment decisions.

Exit difficult

Another deep -seated reasons for China Fund to invest in Southeast Asia are not active, which is related to the complex motivation of the Chinese US dollar fund to go to sea.A four -year investment in Singapore, a founder of a Chinese private enterprise, was judged during the interview with Lianhe Zaobao. Most of the US dollar funds from Singapore last year did not think about investing first, but fundraising first."But basically they can't get money in Southeast Asia, most of them fail."

Since 2021, the funds distributed by the North American market to Chinese assets have declined sharply, and the Southeast Asian market seems to be an ideal land fundraising place.On the one hand, Southeast Asian countries, such as Indonesia, have "old money" (commonly known as "Old Money"); on the other hand, Singapore is one of the largest places for high net worth of people in the world, and it is also each of them.Where the family wealth management office and sovereign funds are located.These are an important object of China's dollar funds seeking fundraising.

However, the actual situation is that the capital of Southeast Asian enterprises is more willing to put on its own industrial expansion, and the money of people's money and high net worth individuals is more about the capital market with higher income, such as US debt.

Singapore's sovereign funds are also shrinking investment in China.According to the Financial Times, the Singapore Government Investment Corporation (GIC) has reduced investment in China's private equity and venture capital funds and enterprises last year.IT Orange Database only recorded GIC's two direct investment in Chinese companies in 2022, less than 16 in 2021.

Zhou Xiaoyuan, who was running a local operation co -operating in Singapore, told the United Zard that from the second year of the epidemic, many Chinese have come to Singapore to set up a household office or invest in joint home office.When asked about the main purpose of the family's money, she did not hesitate to say "preservation" when she was profitable or preserved.

She said: "Homeheets will also consider venture capital institutions, but most of them will be more inclined to invest more local (Southeast Asia) institutions, and they are more familiar with the exit mechanism here."

Zhou Xiaoyuan admits that many Chinese ventilations mentioned last year that they would like to invest in "Chinese entrepreneurs who have entrepreneurially entrepreneurs overseas, Chinese entrepreneurs" to decentralize the risks brought about by the Police Politics and implement the "de -risk" investment strategy."The investment logic of most venture capital institutions is that Chinese entrepreneurs have succeeded and experienced in China, so they can copy such success when they come overseas.It is unrealistic; another Chinese company that goes to the sea still has a large proportion of China. Where will it be exited in the future, it is still unknown. "

Investing in assets with Chinese elements, the uncertainty of subsequent exit channels is the most headache for investors.Zhou Xiaoyuan mentioned the example of Shein.This clothing e -commerce giant is registered in Singapore. The main market is in the United States, but the supply chain is in China. Now I hope to be listed in the United States, but it is still blocked by Chinese identity.

She said that the success of many Internet projects in China has a specific historical background and window."The so -called risk is to put too much assets in China, and now you can no longer put all eggs in China's basket."

Local investors: Southeast Asia enjoys regional globalization dividends and is worthy of deep cultivation

However, although some Chinese fund companies "only do not invest" in the Southeast Asian market, this does not mean that the Southeast Asian market has no potential.Practitioners believe that the focus of Asia is no longer only China, and all money and strategies are around China.

Organization forecast, the average GDP growth rate of the 10 countries in the Aya An will reach 4.6%and 4.8%in the next two years, respectively, showing strong economic toughness in the global uncertain environment.Among them, Indonesia, which investors are most concerned about, reached 5%in 2022, and Vietnam reached 8%of high -speed growth.

SEGA founder Ding Xinyan analyzed the United Morning Post. For the Southeast Asian market, someone could only see it in a short period of time, but it was not a bad thing in the long run."In the past, the market will sieve people and companies that can really take root in Southeast Asia like funnel. In addition, there are Chinese overflow effects, such as talent overflow, overflowing of technology and supply chain, and the rich supply side of products and services.This is a good thing for the local development of Southeast Asia. "She said certain that the number of companies developing in Southeast Asia above the funnel must be getting bigger and bigger.

Wang Hao, a partner of Yuehai Capital, said that any market needs to be deeply cultivated."Japan and South Korea have been paying attention to the Southeast Asian market five or six years ago, earlier than most of China. Therefore, Chinese funds are actually learning the Southeast Asian market gameplay. It is difficult to make decisions quickly in the initial stage, and it is normal."

Several local and Chinese investors who have invested in Southeast Asia have inaccessible and Chinese investors pointed out to Lianhe Zaobao that consumers in the Southeast Asian market are not complicated. They are pursuing cost -effectiveness, willing to consume, and are very pragmatic. In the consumer field, there are investment in the consumer field.Good opportunity.

Wu Yunlong, the founder of Zero 1 Venture Capital of the China dollar fund, pointed out that they have invested in multiple projects in Southeast Asia, mainly consumer goods."Consumer products can make full use of the advantages of Chinese manufacturing, because China has a mature industrial chain. Consumers only care about whether the product is good enough and whether the cost -effectiveness is high enough, and investors will not specially care about the (political) label of Chinese companies."He also said that the founders of Chinese founders used the mature supply chain to make consumer goods entrepreneurially decoupled from politics. The US dollar funds can rest assured to invest, and the founders are also willing to accept it.

The Southeast Asian market in "adolescence" is another advantage. Another advantage is "new" and many possibilities.Hu Boyu, the founding partner of the Venture Capital Fund XVC in Beijing, said that there are still many companies that have grown rapidly, especially financial projects."The per capita sales of financial business are relatively large and have a wide adaptation, such as credit cards." He also said that the credit card business has no chance to do it in China, but Southeast Asia still has many opportunities."XVC will invest in one or two companies in Southeast Asia each year.

Wilson Cuaca, founding partner of East Ventures, the founding partner of Southeast Asia, headquarters in Indonesia, told the United Zard that companies in Southeast Asia can choose different markets in the world, including Singapore, Japan, the United Kingdom, etc.Growth Fund has also deployed Southeast Asia in recent years, and mergers and acquisitions are also a common way of exit."In fact, Southeast Asian companies still enjoy regional and global dividends."