The deputy director of the Institute of Economic Policy of Peking University said that China's economic growth rate has reached more than 5.5%this year.If the repair in all aspects is better, it is expected to reach 6%; even considering the uncertainty that may face this year's economic recovery, the setting goal of about 5%is "not too great".

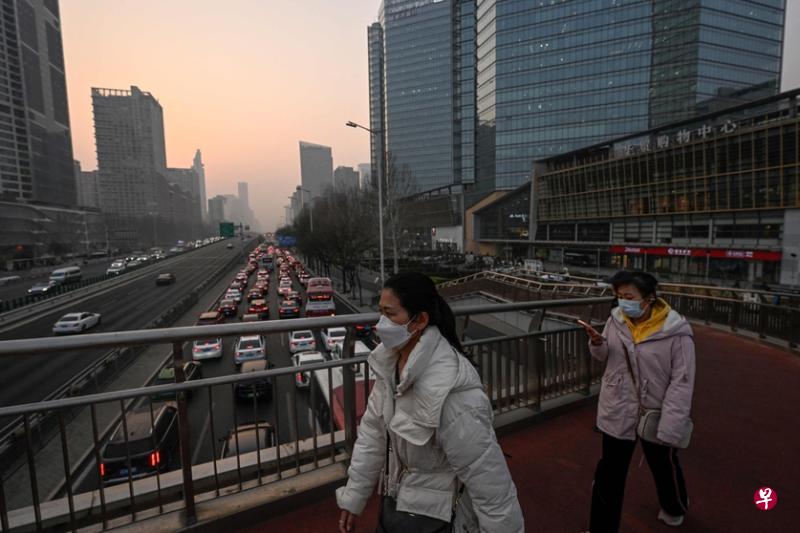

The Chinese government set a cautious goal of about 5%of economic growth this year, while Chinese economists predict that under the low base effect last year, coupled with the repairs of economic recovery confidence and policy support, local governments' efforts, this year, this yearThe economic growth rate will reach 5.5%or even higher.

北京大学经济政策研究所副所长颜色,周一(20日)在北大光华管理学院举办的“两会后经济形势和政策分析会”上表示,中国今年经济增速达到5.5%以上“完全possible".If the repair in all aspects is better, it is expected to reach 6%; even considering the uncertainty that may face this year's economic recovery, the setting goal of about 5%is "not too great".

Colors point out that the economic growth goals set by China except Beijing and Tianjin have higher economic growth goals this year higher than or equal to national growth goals.If weighted average of GDPs in various places, the national economic growth rate is 5.6%, and the median number is 6.0%.

In addition, China's economic growth last year was only 3%, "low bases may increase economic growth by about 1.5 percentage points."He said that the low base effect in the second quarter of this year will be clearer, and the growth rate in the second quarter of last year was only 0.4%.

China's economic activities have recovered from the downturn in the first two months of this year, but consumers have insufficient confidence and still invest a lot of money into savings.Color said that excess savings of residents are issues that need to be followed, and the confidence of the enterprise is expected to wait in the second half of the year to gradually repair.

For the trend of foreign trade this year, he expects that China's overall trade volume will only be 1%this year, and "the price may be compressed."

Scholars: The international financial crisis will not be transmitted to the Chinese financial system

Recently, Silicon Valley Bank and Credit Suisse have triggered an international financial crisis, and the outside world is concerned that China's financial security will be affected.Liu Xiaolei, director of the Department of Finance of the Guanghua School of Management of Peking University, stated at the analysis meeting on Monday that he did not think it would be transmitted to China's financial system.She said: "China's capital market has not been released yet ... Faced with the crisis, it feels more cautious under capital."

In the past two years, exports are the key pillars of China's economic growth.With the soaring inflation and the rise in interest rates in other parts of the world to suppress the demand for Chinese goods, China's export amount decreased by 9.9%year -on -year in December 2022.

However, in the view of Tang Yao, an associate professor at the Guanghua School of Management of Peking University, the Chinese economy was influenced by foreign trade in the short term that it was not as frustrating as data.But he also warned that if the upper and middle reaches of the industrial chain was transferred, it would cause the substantial industrial chain to decompose.

He said that the important carrier in the industrial transfer is direct investment. China has attracted foreign investment to account for a significant proportion of GDP.The indicators of foreign -funded attraction capabilities are more stable.

He suggested that local governments provide enterprises with an institutional open and stable policy environment, and the central level is coordinated at industrial policy, market access, financial support, and cross -border payment.

In the context of exports this year, exports are not optimistic, and the real estate market is still weak, the Chinese government expects consumer expenditure to help achieve the goal of steady economic recovery this year.

It is recommended to stabilize house prices to promote consumption

Zhang Ye, a professor of the Department of Finance at the Guanghua School of Management of Peking University, suggested that it has stabilized expectations through stabilizing house prices, thereby promoting consumption.Real estate is the main component of Chinese household assets. Zhang Ye said that the overall housing prices in China have fallen to a certain degree in the past three years. Although the total amount of Chinese households' assets is only a book loss, the impact on consumption cannot be ignored.