From mid -April to the present, many village and township banks in Henan have been fermented for nearly three months, and the reason why hundreds of thousands of storeders have "cash withdrawal difficulties" have gradually become clear.During the mines, the figure of Henan New Wealth Group can be seen everywhere.

According to the report by the China Banking and Insurance Regulatory Commission officials and the Henan Financial Supervision Bureau, the New Fortune Group colludes internally and outside the internal and external use of third -party platforms and funds to absorb public funds.The online trading system of village banks is also controlled and used by the new wealth group.The Xuchang City Public Security Bureau reported in June that the criminal gang headed by Lu Mou, the actual controller of the new wealth, has been using a series of crimes on the village and township banks since 2011.

2011 was the year of the establishment of Henan New Wealth Group, that is, the group began to implement economic crimes at the beginning of its establishment.Many media reports that the actual controller "Lu Mou" in the report is a businessman named Lu Yi.

Lu Yi's relationship network is very huge.Among the characters associated with him, in addition to many officials in local village banks, there may be Cai Esheng, former vice chairman of the China Financial System Senior CBRC.

The Henan New Fortune Group and many shadow companies controlled by Lu Yi have penetrated into 13 banks. Four Henan Village Banks in addition to mines are also the banks such as Luoyang Bank, Hebei Bank and other regions.

Where does the new wealth group come from so many funds and buy so many bank equity?This will start with Lu Yi's family history.

Lu Yi's president friends

Lu Yi founded a home appliance company in 1997. It has a certain influence in Kaifeng, Henan, but the real origin may sourceYu Lanwei High Speed.Lanwei's highway is invested and constructed by Kaifeng City. The route has a total length of 61 kilometers and a total investment of 2.4 billion yuan (RMB, the same below, about S $ 496 million).The actual controller of the construction company is Lu Yi, and he has obtained the toll right of the road for 30 years.

After winning the construction project of "Lanwei Highway", Lu Yi mortgaged the highway charging right to the bank and borrowed the funds for road construction.The judgment of the referee document network shows that through the mortgage charging right, Lu Yi loan six times from 2004 to 2005, with a total amount of 1.1 billion yuan.After that, he used some funds to participate in financial institutions such as shares, and then borrowed the equity of the financial institution.

In this way, Lu Yi used the money borrowed from the bank to buy bank stocks, and then mortgaged the bank's equity borrowed money from the bank.

In the process, Lu Yi bribed many officials in financial systems.He can easily get hundreds of millions of loans, which is inseparable from the pension of many presidents and friends.

The Zhengzhou Intermediate Court disclosed in a criminal judgment in September 2018 that Lu Yi borrowed more than 9 million from the deputy president of Zhengzhou Bank for a loan.More than 23 million bribes.The two also started a business for eating and interest differences. Qiao Junan was responsible for approval of the loan. After borrowing, Lu Yi leaned to some affiliated companies with a higher interest rate.Qiao Junan was arrested in November 2017 for suspected of accepting bribery, and was sentenced to 14 years in prison.

At present, this judgment has not been retrieved on the referee document network, the Zhengzhou Intermediate People's Court of Henan, and the People's Court announcement network.

Except for Qiao Junan, the chairman of Hengfeng Bank Cai Guohua approved Lu Yi's 3.5 billion loan in 2017. Until Cai Guohua was dismissed due to bribes, the loan did not return.Lu Yi also reported that Wang Jikang, the first president of the Guangzhou Rural Commercial Bank and his later chairman, had a deep relationship with himself.Wang Jikang was investigated in August 2019 and was sued for bribery.

In addition to the banking system, senior officials and Lu Yi of the regulatory system may also be involved.

The former party committee member and vice chairman of the China Banking Industry Supervision and Administration Commission Cai Esheng were arrested in February this year because of the crime of bribery, using influence and bribery, and abuse of power.Many media in China quoted sources reported that Lu Yi had been required to assist the investigation by the Supreme Procuratorate as a related person, and then he was suspected of leaving China to the United States.

Coincidentally, at the same time when Cai Esheng was arrested, Henan New Fortune Group also canceled in February.

It is worth mentioning that Lu Yi involved a criminal case that Qiao Junan was bribery at least in 2018.If he was asked to assist in the investigation of Cai Esheng's case by the highest procuratorial request, then it means that Lu Yi's back to the Heavy Division and lived in China for four years until he fled until he fled.

The original cunning rabbit three caves

Lu Yi acted cunning and cautious, and committed crimes through a large number of shadow companies.In the list of bank shareholders infiltrated by Henan New Fortune Group, Lu Yi has never appeared.His clues appear only in some court judgments and official announcements.Therefore, although Lu Yi's governor and friends were in prison, he fled himself.

Henan financial industry who had had business with Lu Yi revealed that Lu Yi was born in 1974 and moved his nationality to Cyprus of the Mediterranean Island.He claims to be the chairman of Liberia's business investment representative and chairman of Cyprus Afroceda Investment Group.

At present, Lu Yi is suspected to be publicly publicly launched outside China.In March of this year, Lu Yi, entitled by the United Nations New Media Jiu'an TV International Media on the Internet, told the "Chinese Story" to the world. The article stated that "in 2021, Mr. Lu Yi was elected as a new director of Jiu'an Television International Media Group.long".

Introduction, the PEACEEVER TV InternationalMedia Group Inc. is a non -profit new media institution headquartered in New York and managed by the council. It is also approved by the United Nations Council, andNon -governmental organizations with a special consultation status have many years of cooperative relationships with the United Nations.

The official website of Jiu'an Television International Media Group also has a similar introduction, but there is no address and contact information.The company's web page design is rough and simple, and it only reproduces some news about the United Nations and charity.Click the donation icon to show that the page has been damaged.

Hundreds of thousands of reserved households with anxiety

Lawyer Zhang Gongdian, a senior partner of Chongqing and Zhi Law FirmPeople can escort the criminal judicial assistance agreement signed by China and the United States.

However, it is still unknown how to fill in how Lu Yi is, how to fill in the huge book of 40 billion.

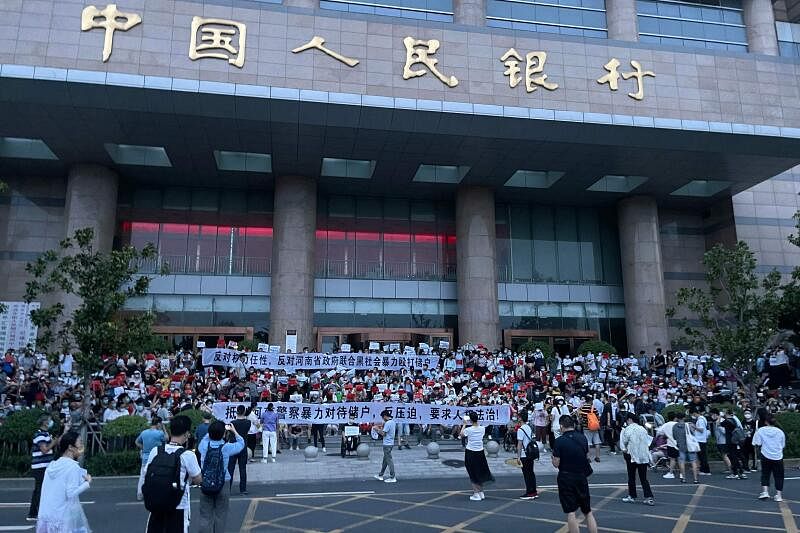

After the large -scale protest of the storeders, Henan started a small cushion from July 15th, but most of the reserved households still complained, especially large households with a deposit of more than 50,000 yuan were anxious and watched, worried about the savings of their lives, and they were worried about the savings of their lives.Clear zero.

The government announced that the funds were paid by the Henan Rural Credit Cooperative (Agricultural Credit News Agency).Chinese financial scholar He Jiangbing believes that 40 billion funds should not be paid by local governments in the end, and in the future, it should be the stolen money from recovered.

However, the road to recovering stolen money is difficult, and most of the fundraising platforms are canceled after completing the transfer of funds.Xuchang City Public Security Bureau said in a notice on June 18 that the case was suspected of a long duration of criminal behavior, many participants, and the case was very complicated.

How to determine the nature of the money is also a huge concern for the store.At present, the government only pays for the "deposit" deposit deposit, but in terms of the current method of attracting the banks involved, the funds are afraid that the funds are afraid of "picking up and marketing financial products" from most reserves.If the "financial product" is investment, not deposit, the reserve households only wait for the court to dispose of the property of the new wealth group.How much to get back depends on how much assets that have been sealed, seized, and frozen, and the remaining losses may be absorbed by themselves.

Village and township banks are small financial institutions that are positioned in the three, rural areas, and farmers. They are in the end of the financial system. However, the crisis is silently moved from the county to the whole of China, showing that the local financial systems are chaotic.How to deal with follow -up questions is a problem to prevent people from resentment further.