China's national security department recently publicly enforced the office of Capvision, Capvision, in Shanghai, Beijing, Suzhou, and Shenzhen.

China CCTV reported that Kaisheng was accepted by overseas companies' consultation with sensitive industries. Some companies were closely related to foreign governments, military, and intelligence agencies, and some experts leaked sensitive content, state secrets and intelligence in foreign consultation.Essence

The investigation of Kaisheng has caused some observer to expand the anti -spy operation to the business field, and some people re -examine the "conventional operations" of the consulting industry.

How does the consulting company operate in this industry?Simply put, most consulting companies' products are "solutions."It is too small to solve a unsmooth internal process for an enterprise. As large as entering an emerging market, companies can seek the help of consulting companies.

But a consulting company cannot have professional talents in various industries. Therefore, the consulting company should assist in completing the research and investigation by forming an external industry expert library.

Therefore, the business model of consulting the company basically involves the two parties.One is an investor or other customers, and the other is an expert in Chinese information. They are those who have professional knowledge in a specific field or the industry or company that works for the interest of customers.The consulting company is similar to the middleman to bridge the two parties for customers and experts.

The business model with rich profits

Customers pay for money, experts pay, and consult the company to draw commissions. This simple business model is rich in profits.

Taking Kaisheng as an example, its prospectus shows that expert interviews ranged from 1,000 to 4,000 yuan (RMB, about S $ 192.4 to S $ 769.5).The Wall Street Journal reports that experts can also rely on industry intelligence and can get up to $ 10,000 per hour.Kaisheng Rongying took the commission from it, and his income was considerable.According to the Kaisheng prospectus, the company's revenue was nearly $ 100 million in the first nine months in 2021.

Expert consultation is the main service of Kaisheng, which has contributed 80 % of business revenue.According to the Kaisheng prospectus, as of 2021, the company's network has nearly 400,000 experts from the company, academia and other fields.

Kaisheng Rongying was founded in 2008 and made 15 years of "knowledge payment" money in the Chinese market.Recently, the reason why he kicked the iron plate was because some experts were accused of providing information involving national secrets to customers.

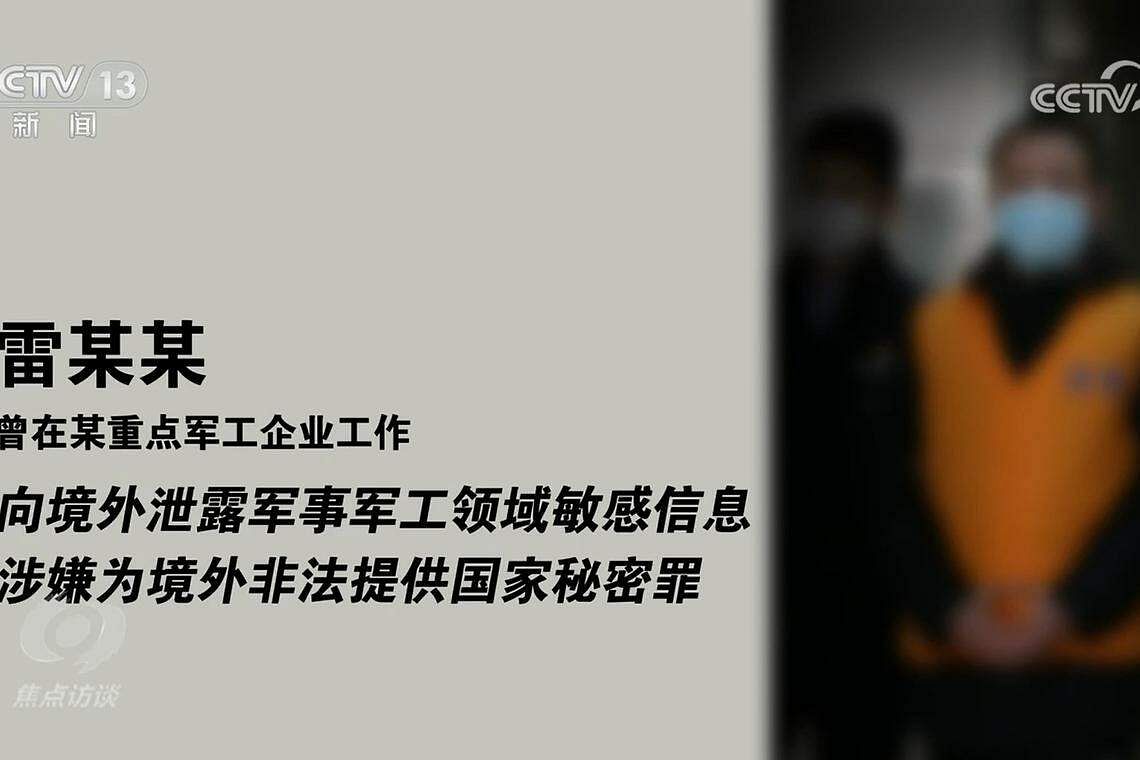

CCTV reported that the experts include a former state -owned enterprise employee who had been sentenced to six years of imprisonment and an expert engaged in national defense work.The report also pointed out that some of Kaisheng's overseas customers are closely related to foreign governments, military, and intelligence agencies.

/>

/>

Kaisheng's prospectus states that the company has more than 1,400 customers, more than half of which is the financial industry customers.The remaining customers include consulting companies and companies covering many industries such as technology, medical care and automobiles.

The Wall Street Journal reports that Kaisheng usually hosts the call meeting to pull experts and customers, but neither the participating parties know the identity of the other party.

Expert interviews are the most common and conventional operations in the consulting industry.The official ban on Chinese officials has caused concerns of some market participants. Without the targets, industries, and contents of those experts, the scope of impact will be very large.

Customer demand to the consulting company walks in the gray area

But it is not easy to designate standards. During the consultation, the original commercial consultation may also be mixed with other sensitive information.

一位熟悉科技股权投资的人对联合早报说,“一般来讲,纯商业的发展不会涉及敏感信息。但随着政府对一些行业的监管变得严格,更多投资人觉得,You should learn more about the policy direction as much as possible, especially when it involves popular investment areas, such as semiconductors, autonomous driving, robots, etc., which is "easy to touch sensitive information".

Shen Meng, director of Chan Song Capital, told the Shanghai Securities Journal that the paid consultation model itself is fine, but if the information that the expert is located or the information that can be contacted has confidential attributes, it may touch security issues."After all, in the online or offline communication, it is easy to leak confidential information with non -confidential information."

Reuters reports that some customers have blurred legal and illegal boundaries in order to strive for some information that may violate confidentiality regulations.

Another investor who once participated in the Kaisheng conference with experts said that customers will not pay high prices for those public information that are easy to get.It is destined that the consulting company must swim between legal and illegal. "

Another netizen who claims to have worked in PricewaterhouseCoopers said that in order to reduce the risks in conventional consulting services, the consulting company should conduct detailed investigations on customers to understand who the customers are.

"Sometimes the new customers who require us to provide us with market research services can last for six months for customer background surveys, otherwise it is impossible to know who the client is really beneficial."

The information supply chain that foreign dependence relies on is threatened

China's consulting industry has increased significantly in recent years. Data from the China Commercial Industry Research Institute showed that the scale of the consulting industry has increased from US $ 10.8 trillion in 2016 to US $ 21.3 trillion, with a compound annual growth rate of 18.5%.

As a consulting company with China's largest expert network, Kaisheng has become the survey goal of the Chinese government, which will lead to threats to the information supply chain that overseas investors, the banking of China and foreign companies.

On the second day after the public law enforcement news was disclosed, CICC Capital, a subsidiary of CICC, announced that the company's service was discontinued by the company.According to Reuters, the other two large private equity funds also temporarily stopped cooperating with Kaisheng.

In addition, experts, as the most important "source supplier" in this type of service, will also be more cautious to participate in consultation as third parties.

Raffaello Pantucci, a senior researcher at Nanyang University of Science and Technology in Singapore, told the South China Morning Post that the Cai Sheng expert's consultation of leaks may affect the entire consulting industry."This incident may cause real and direct damage to the entire due diligence industry, because people will be cautiously involved in it."

The affected are very affected, I am afraid that the foreign companies that can't understand the Chinese economy and can't figure out the routine. The consulting company has long provided them with services to understand the Chinese market and solve information poor.The New York Times described that this industry "helps the outside world understand the economy that is rich in profits but often opaque."

The Wall Street Journal reports that multinational companies usually hire due diligence companies to analyze the business field, including ensuring that related businesses meet US regulations.

In addition to multinational enterprises, foreign -funded consulting companies serving multinational enterprises, such as McKinsey, also requires expert network companies such as KaishengEssenceIn a listing prospectus, Kaisheng revealed that customers include not only investment institutions and technology companies in China, but also a number of foreign -funded consulting companies with global heads, such as McKinsey, Boston Consultation, Bain, Pricewater YongTao, Eisenzhe and so on.

TheKaisheng incident involved the wide range of factories, and this year has been superimposed this year. Although the official media reported in detail the Kaisheng incident, it was impossible to completely eliminate foreign companies' concerns about the Chinese business environment.

In March, five Chinese employees of the Beijing Office of Mintz Group, a due duty company in the United States, were detained.In April, the Chinese police raided Bain's consultation in Shanghai and asked employees.

However, although the tools that foreign companies have relying on the poor information are being regulated, it does not mean that it will disappear.The latest report of the McKinsey Global Research Institute said that the Chinese market is still the first choice for multinational companies.

If the representatives of the Shanghai American Chamber of Commerce appealed: clearly define the areas where enterprises conduct due diligence, or can help foreign companies and investors eat a reassinual pill.