When President last month limiting U.S. investment in critical technologies in China, the .

That's because many U.S. startup investors have already retreated from China, after years of political mudslinging between the world's two largest economies led to increased sanctions and trade restrictions.

But with the door to the Chinese tech market closing, VCs are seeing new opportunities on their home turf. The U.S. government is actively promoting investments in semiconductors and broader industrial development, and investors are finding a widening talent pool invigorated to take on tough challenges in light of world events, with an explicit focus on protecting U.S. values.

"VCs are saying, 'Where's the most stable places to invest? And quite frankly, where's the talent?'" said Gilman Louie, co-founder of venture firm Alsop-Louie Partners. He's also CEO of America's Frontier Fund, which says in its that it's "committed to reinvigorating our nation's innovation and manufacturing prowess in critical frontier technology sectors."

"In uncertain times, when there's unpredictability and global stress, whether you're a U.S. investor or a foreign investor, you want to come to America to invest," Louie said.

Once seen as a vast market of opportunity for U.S. tech companies and investors, China is now filled with more risk than reward and is increasingly viewed as a rival in developing key technologies, including advanced artificial intelligence and quantum computing, that will drive global markets in the decades to come.

Last year, the U.S. aimed at limiting Beijing's ability to produce advanced military systems, and more recently the Biden administration restricted the ability for U.S. investors to back critical tech in China.

Meanwhile, lawmakers passed the , which promised to pump tens of billions of dollars into semiconductor manufacturing in the U.S. The goal is to reduce international dependence on chips that are key to development of electronics, cars and medical equipment and are becoming more important to national security with the rapid evolution of AI.

Lindsay Gorman, senior fellow for emerging technologies at the German Marshall Fund's Alliance for Securing Democracy, said she's seen a "new crop of venture capitalists" in the last few years that prioritize U.S. tech competition with China and U.S. national security.

"Ten, 15 years ago, these geopolitical lines were not part of the equation," Gorman said.

Louie added that he doesn't "know of a single major fund out there that isn't thinking about disruptive tech investing in the U.S., investing in defense tech, investing in microelectronics and AI in the next generation and next iteration."

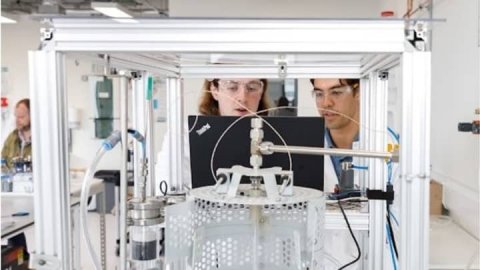

In Torrance, California, just south of Los Angeles, Hadrian Automation is building efficient factories to help space and defense companies get parts faster and cheaper. CEO Chris Power, who started the company in 2020, said he's seeing increased interest from large growth funds that have typically invested in software.

"Everyone's kind of standing up their own practices to support the market," Power said. Hadrian's early backers include Lux Capital and Founders Fund, which have longer histories of investing in manufacturing and deep science.

VC funding in aerospace and defense tech has shot up in recent years, according to data compiled by PitchBook for CNBC. In 2019, 69 companies in the sector raised a total of $1.7 billion in value. In 2021, that jumped to 119 deals worth $6.4 billion. Last year, which was the since 2008, saw a slight slippage in the space to $5.6 billion, though the number of deals was the same as 2022, according to PitchBook.

The poster child for U.S.-focused defense tech is Anduril Industries, co-founded in 2017 by Oculus Rift designer Palmer Luckey. The company, which ranked seventh on the latest and has been valued at $8.4 billion by private investors, develops autonomous technology for national security and warfare.

On Thursday, Anduril the acquisition of Blue Force Technologies, which develops autonomous aircraft for defense and commercial customers.

While Anduril started with a focus on military contracts, other startups have navigated their way there.

Saildrone, which makes unmanned ships, was originally focused on monitoring environmental data for fisheries and agencies like the National Oceanic and Atmospheric Administration.

It later became clear to CEO Richard Jenkins that the company needed to expand its aperture to bring in more revenue, since the government wasn't spending enough on science to make the business work. Bilal Zuberi, a partner at early investor Lux, asked the company if it would consider selling its products to the Navy or Coast Guard.

Zuberi said Jenkins came to him with a key concern. He was unsure how his team would react if the environmental company they joined began selling to the defense sector. Zuberi talked about how he sees the opportunity differently. Saildrone's technology can help prevent greater human casualty by, for example, learning of certain precise moves by the Chinese government in advance so the U.S. could send a warning signal and avoid a greater conflict.

Jenkins decided to make the pitch to his team. He told staffers he had a "pretty firm line on not weaponizing the platforms," and keeping the focus on data collection tools. He also said the company wasn't forgoing its climate work.

Saildrone didn't lose any employees as a result of the shift.

"There was a perception that the technology industry doesn't understand the importance of national security and what it takes to protect our democracy," Zuberi said. "And then the military doesn't care about the technology that we're developing. I think that perception has somewhat been shattered."

Zuberi said that for industry leaders it doesn't have to be about patriotism. They can just look at the untapped potential in defense tech.

"It's not like the last five years, suddenly investors woke up more patriotic than they used to be," Zuberi said. "I think they just realized that there's a big business opportunity here that they want to access."

Paul Kwan, managing director of venture firm General Catalyst, had a similar observation.

"What's changed around tech the last few years is people want to work on stuff that makes a difference and has a bigger impact on the world," said Kwan, who has on "modern defense and intelligence."

While tech workers at companies including and have made headlines in the past their employers' defense contracts, the topic is more nuanced now in the startup world.

"As a technologist, to work in defense was certainly taboo," said Kyle Harrison, general partner of Contrary Capital. "I think the conversation has been more open. I think there's still people that feel very strongly about it, for and against. But it used to be nobody really talked about it, where now people are acknowledging that it's really difficult to protect a lot of the values that you think are important if your defense apparatus is from the '80s."

Part of the movement is driven by an awareness of , several VCs said, which has highlighted the role defense can play in protecting values of democracy.

"You have an aggressor nation, taking land and causing death and destruction to civilians," said Raj Shah, managing partner of Shield Capital, adding that tech workers "want to do something to help and they want to have meaning in their lives. And photo-sharing apps are only so important."

As Lux co-founder Josh Wolfe said, "Do you want to build software that has people clicking on ads, or do you want to do things that have a lasting impact on the safety and security of the American people and helping to reduce human suffering around the world?"

It's not just shifting sentiment within the tech community. There's also a growing openness from the U.S. defense community to procuring technology from newer players.

"The government's becoming a better customer," said Shah, who previously served as managing partner of the Defense Department's Defense Innovation Unit, which seeks to accelerate the use of emerging technologies. "It actually makes business sense to solve important security problems."

Power, CEO of Hadrian, said the narrative of "Silicon Valley hates the government and the government hates Silicon Valley" is gone, even though he says "I don't think it was ever true."

"People are viewing selling software to the government as a real market opportunity versus something that may or may not happen or would take them 10 years," Power said.

One area where the shift in mindset has become abundantly clear in the past year or two, Power said, is in recruiting. In the past, some potential prospects expressed little interest in manufacturing, but now Power said he finds many more people who are compelled to solve these problems.

Wolfe said that trend permeates throughout his portfolio.

"Money follows talent," Wolfe said. "And talent is going into hard tech."

WATCH: