has struck a deal with Arm through 2040 and "beyond," Arm said in Tuesday.

The news indicates that Apple has secured access to a core piece of intellectual property, the Arm architecture, used in its iPhone and Mac chips, for the foreseeable future.

Arm, owned by SoftBank, is set to debut on the Nasdaq stock exchange in the coming weeks at a total valuation that could be , which would be the biggest technology initial public offering this year.

For Arm, its note about the Apple deal indicates that at least one of its most important partners will continue to use the company's technology for years, quelling some fears that the change in Arm's corporate structure could prompt some of its customers into looking for technological alternatives.

"Further, we have entered into a new long-term agreement with Apple that extends beyond 2040, continuing our longstanding relationship of collaboration with Apple and Apple's access to the Arm architecture," Arm said in its updated SEC filing.

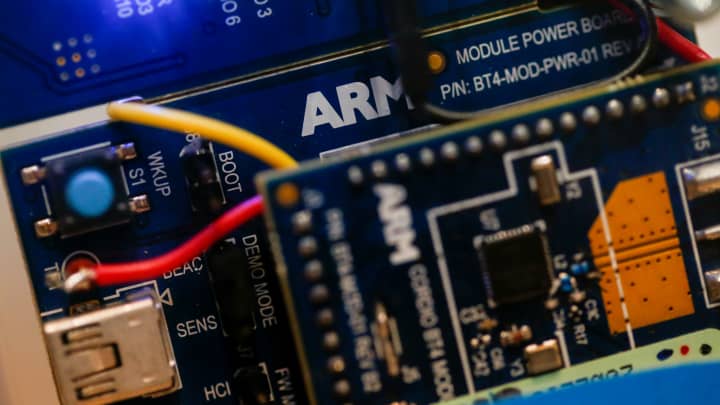

Arm's architecture is used in nearly every smartphone chip, including Apple's A-series for iPhones. Arm's instruction set outlines how a central processor works at its most basic level, such as how to do arithmetic or access computer memory. Switching large software projects to other instruction sets is expensive, difficult and time consuming.

Arm, originally founded in 1990, started growing fiercely after the iPhone came out in 2007 and smartphone makers needed chips that were geared for low-power usage, especially compared with the x86 architecture used in PC and server chips by Intel and AMD.

One reason firms such as Apple use Arm's architecture is because it has not been owned by a competitor. Arm, a British company, licensed its technology to all comers, and its customers could plan to invest billions in developing Arm chips without worrying that their access to the technology could be curtailed.

The company said 250 billion chips have shipped using Arm's architecture, although about half the company's royalties revenue comes from products released between 1990 and 2012, according to the filing.

Concerns over access to Arm technology is one of the main reasons regulators Nvidia's bid to buy Arm early last year, leading to this fall's IPO.

Apple, , , Samsung, , , , Synopsis, Samsung and Taiwan Semiconductor Manufacturing Company have expressed interest in buying some Arm shares as part of the offering, as much as $735 million in total according to the filing, which would give those companies a stake in Arm's ownership and some say in how it is managed. They're referred to as "cornerstone investors."

An Arm representative declined to comment and referred to the SEC filing. Apple representatives didn't immediately respond to CNBC's request for comment.